If you aren’t capturing website leads right now, you’re missing precious opportunities

We’re in a recession and lending is down, which means your credit union has fewer opportunities to earn revenue. People are still applying for loans and opening accounts, just not as many. And now, they’re even more likely than before to apply through your website since all your lobbies are closed.

With fewer opportunities, you can’t afford to miss any of them. And if you aren’t capturing leads on your website, then you’re definitely missing out.

Social distancing has put a lot of people out of work, and they may need personal loans to get through these tough times. Other people are taking advantage of lower interest rates and refinancing their loans. And, of course, applications for SBA loans are through the roof. So, even now, there are opportunities to grow that you can take advantage of by capturing leads.

When I say “capturing leads”, I mean asking each applicant for their name, email, and phone number before you ask for anything else.

This is an example of a lead capture form on VoyageFCU.org.

Once you have someone’s contact information, you can email, call, or text them—manually or automatically; but without the lead, you’re out of luck. So, if you’re sending people straight to a big, hairy application before capturing the lead, then you’re missing lots of opportunities simply because most people who start applications don’t finish them.

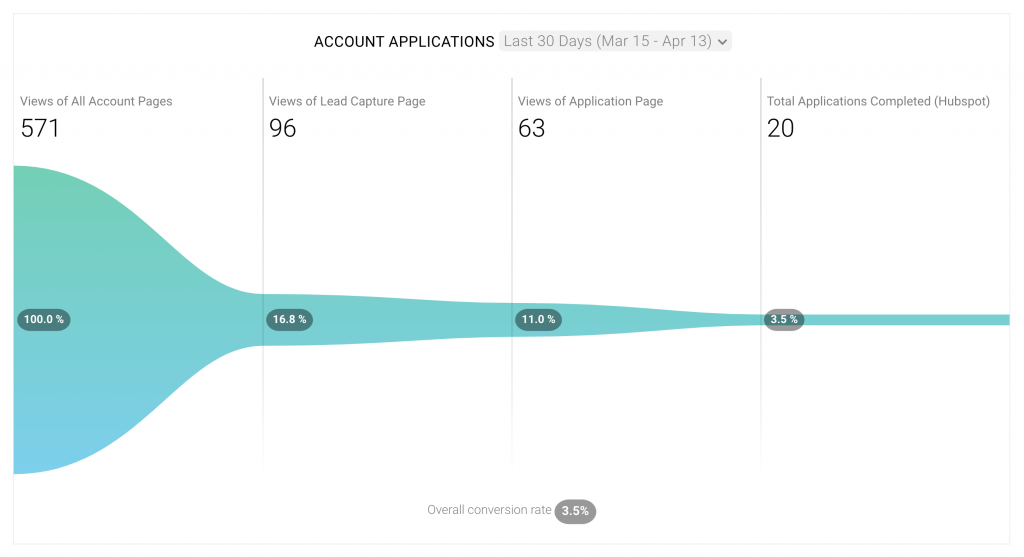

Take a look at this conversion funnel my company set up for Voyage FCU, a small credit union in South Dakota with $105M in assets:

Over the last 30 days, the account pages on VoyageFCU.org had 571 unique pageviews. From those 571 pageviews, 63 people became leads (11%) and 20 people (3.5%) completed applications. That means 43 people started the application but didn’t finish it. Fortunately, Voyage FCU captured the leads first, so they can contact those people to help them complete the account opening process. They’re making sure they don’t miss opportunities.

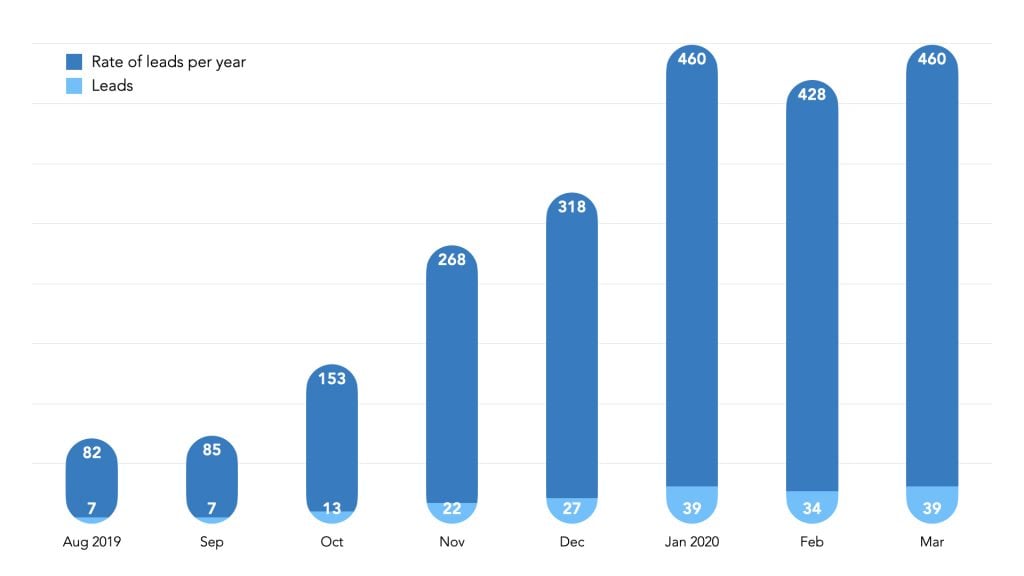

Last autumn, we helped Voyage set up a lead capture system for all of their account pages. Before the setup, they had some long online applications that only a few people completed each month. After the setup, their leads skyrocketed from 82 to 460 per year. That’s 5.6 times more leads, which would help any credit union grow.

Since putting lead capture forms on every account page of their website, Voyage FCU is getting 5.6 times more leads.

How to set up a lead capture system

You can set up a lead capture system in just a few steps.

- Create a lead capture form

Your lead capture form should have these fields and nothing more:

-

- First Name

- Last Name

- Phone (I suggest “Mobile Phone”, so you can text them)

- Product (the product they’re interested in; I suggest using a “hidden” form field that automatically collects the URL of the product page so the user doesn’t have to select the product)

Once you’ve created the form, make it the first step of the application process for all of your products. Meaning, your call to action should be something like “Apply Now”, and it should open the lead capture form.

- Put the leads into a CRM

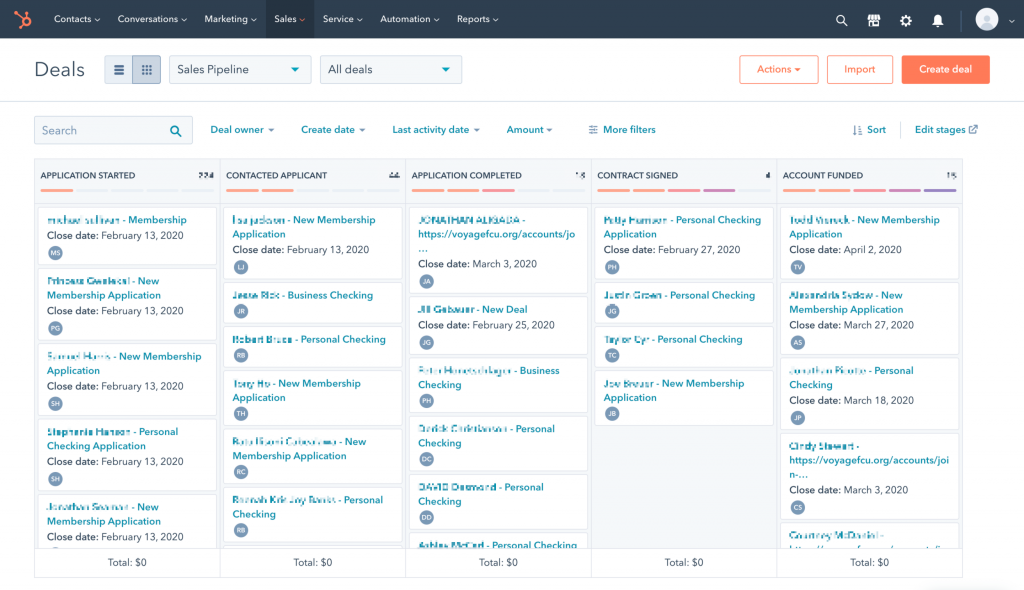

You don’t want leads to get lost in your email inbox. So, instead of just sending them to an email address, put them in a CRM, which is a much better way to track leads through the application process.

For Voyage FCU, we set up a free Hubspot CRM account.

Voyage uses Hubspot to manage hundreds of leads generated by their website.

Note: Your form system may not have a direct integration with the CRM you want to use, in which case Zapier might be able to help you connect the two.

- Redirect the user to the remainder of your application

After you’ve captured the lead, you need a bit more info from the applicant before you can give them a loan or account. So, your lead capture form should redirect them to the remainder of the application, if it’s online.

Note: If you use an origination system like MeridianLink, SymApp, Originate, etc, you might be able to pass the lead data (name, email, phone) to the origination system via API or using URL parameters. (For instance, I know LoansPQ accepts URL parameters.) That way, your applicant won’t have to fill in this info twice. However, if passing the data isn’t possible, I would still recommend capturing the lead on your website before anything else: Again, if you don’t capture the lead, you’ll never know about most applicants because they’ll drop out of the application process before completing it.

- Notify your response team

Someone at your credit union should receive a notification when a new lead is generated. Whoever that person or team is, send them an automated email so they can follow up. (Most form systems give you the ability to send email notifications automatically.) But don’t put all the lead info in the email. Instead, share just the name of the lead and the product they are applying for, with instructions to log in to the CRM to get the lead’s email and phone number. Again, you don’t want leads lost in someone’s email inbox; you want to organize them in a CRM where you can see statuses and analytics.

- Set up funnel analytics

Without analytics, you’re flying blind. You need to know how many leads your website is generating and how to improve. So, create a conversion funnel like the one I shared above. Databox is a great tool for this.

That’s all you need to start capturing leads! Get set up as soon as possible so you don’t miss any of the precious few opportunities available to your credit union during this recession. Good luck and stay healthy!