Military service members keep finding financial peace with credit unions

For much of the last century, the proud credit union movement has played a vital role in supporting the financial interests of our United States military service members, veterans, and their families, in addition to providing education to their military communities.

And the credit union difference continues to lift them up today. A large number of military service members come from economic backgrounds that never gave them the financial literacy and education opportunities to succeed. Many learned the hard way.

According to the Brookings Institution, over 60 percent of 2016 military enlistments came from neighborhoods with a median household income between $38,345 and $80,912. Additionally, of the estimated 19,000 veterans surveyed, more than 12,000, or 64 percent, claimed they “couldn’t make ends meet at some point in the past 12 months,” according to the Military Times.

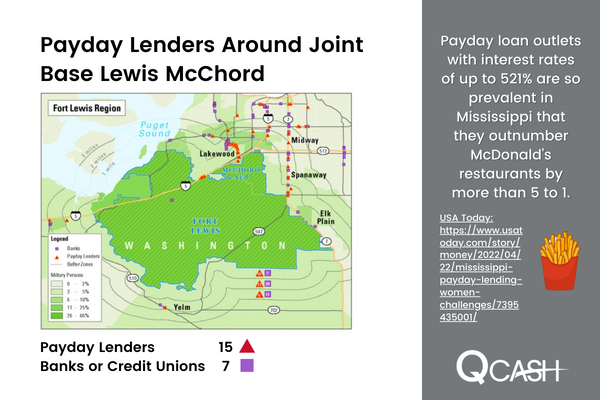

The frustrating reality is that, while faithfully serving their country, those same military members have to deal with serious economic and costly barriers in the form of predatory payday lending outfits stationed right outside the gates of military bases or adjoining neighborhoods looking to take advantage of those members’ inexperience, vulnerability, and financial distress.

The battle to ward off predatory payday lenders is a daunting one. The numbers tell the story: According to a published study by Professors Steven Graves and Christopher Peterson at California State University Northridge, research found payday lenders intentionally open businesses as close as possible to military bases so they can target military soldiers who lenders believe may be more susceptible to their loans.

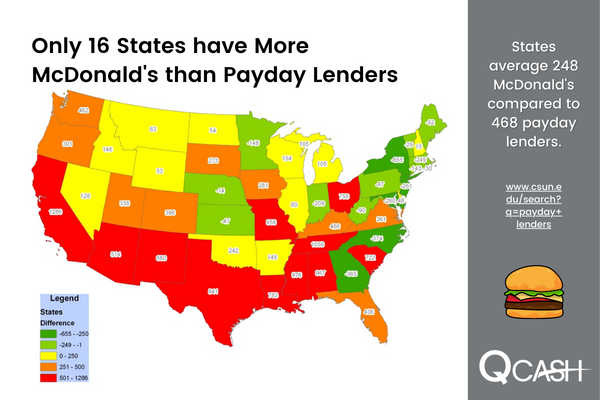

The prevalence of payday lending locations is striking in America. According to the study, U.S. states average 248 McDonald’s franchise locations, compared to 468 payday lending outfits. In fact, as late November 2014 there were more than 20,000 lenders spread out across the country compared to 14,267 McDonald’s locations, according to the St. Louis Reserve.

Even further, payday lending outfits with interest rates up to 521 percent are so prevalent in Mississippi they outnumber McDonald’s locations 5-to-1.

Fortunately, you won’t find a better counterpart to predatory payday lenders than the financially inclusive credit union movement, particularly for young and financially-inexperienced service personnel. In fact, the credit union industry as a whole continually strives to help service members every day.

NCUA proposes yet another way to help military service members

Whether they’re individual credit unions’ community programs aiming to stave off payday lenders creeping around our nation’s military bases or national organizations working to make military service members’ lives more comfortable, the industry is always on the side of what’s best for those who lay it on the line for us.

During its fifth open meeting in late May, the NCUA Board unanimously approved a proposed rule that would add “war veterans organizations” to the definition of a “qualified charity” that a federal credit union may contribute to through the use of a charitable donation account. The proposal also asked attending commentators if there were any other groups, entities, or organizations the NCUA Board should consider adding to the definition of a ‘qualified charity” to inform potential future rulemaking in this area.

Are you attending DCUC’s 60th Annual “Conference with a Purpose” in August?

As stated, the support never ceases in bringing attention, support, and financial accommodations to building up our military service members as they establish their financial profile, their career, and their families.

And there is no other event that epitomizes this endeavor more than the annual Defense Credit Union Conference. This year will mark the DCUC’s 60th anniversary of the event, to be held August 7-11 at the Broadmoor Resort in Colorado Springs. There is simply no other conference like it; the only one that brings the Department of Defense and military perspective to credit union industry issues in an environment where one can network directly with other credit union DCUC members, CEOs, executives, and other top decision-makers who have faced the same challenges in serving the military community.

If you wish to register for the event, click here, and begin learning how your credit union can support your local military service members and their families.

4 tips to connect with your credit union’s local service members and vets

We have discussed industry legislation and large, influential industry events that bring top executives and decision-makers together to affect real financial literacy principles for military service members. But nothing replaces the day-in, day-out work our nation’s individual credit unions do to create life-changing financial initiatives for the military service members in neighborhoods and communities across the nation.

Here are some tips to help your cooperative communicate and connect with your local military and service veterans:

Realize and act on service members’ specific needs

Stay updated on military service members’ culture, various pain points, military acronyms, frequent relocation arrangements, deployment itineraries, transition processes to civilian life, and benefits specific to them.

Coordinate your credit union’s products and services to parallel their financial objectives and prepare for them in advance solutions to financial education, home lending and mortgage info, and career planning and search resources.

Keep credit union staff educated

Include regular consistent training that keeps your credit union staff updated with, at minimum, a knowledgeable understanding that keeps them apprised of the unique needs and challenges your local military community encounters. They must also recognize the importance of espousing understanding, sensitivity, and respect with member interactions.

Provide individual and focused assistance

Always offer one-on-one support for your credit union’s military service members, veterans, and their loved ones in order to internalize and recognize their specific financial goals and create distinct solutions. Such products and services may include low-interest lending, waiving of fees, and flexible payment options in the middle of deployments or during moments of financial difficulties.

Partner with military institutions

Reach out and set up official collaborations and partnerships with military organizations like military bases, veterans organizations, and various military support groups to enhance your credit union’s understanding and service objectives of these specific communities’ needs and requirements. Create and engage in local events and outreach initiatives to cultivate relationships and also enhance your cooperative’s presence, visibility, and brand profile.

Additionally, the more military service members and veterans learn and remain top-of-mind about the benefits of the credit union movement, the more they may steer away from predatory payday lenders who are buzzing around their military bases.

Whether it’s member-centric legislation out of Washington, annual in-person events within the credit union industry, or good ol’ fashioned in-house initiatives to lift them up and into the sense of security they continue to provide for us, our military service members deserve the absolute best services we can give them.