Mirror, mirror, on the wall

This October, I’m thrilled to be joining the incredibly talented team of Mitchell Stankovic & Associates for The Underground Collision, “Grimm Fairy Tales or Happily Ever After” on October 21st in Vegas. So, it’s fully appropriate that this article refers to the infamous quote from Snow White & the Seven Dwarves.

In looking at our own reflection as credit unions, are we really considering the financial well-being of our own? Our employees? Recent data from the Financial Health Network’s Financial Health Pulse® 2023 U.S. Trends Report, suggests that there is a lot of opportunity to “start at home” by focusing on our employee’s financial health.

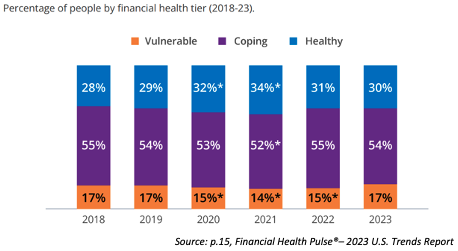

As a refresher, the Financial Health Network’s methodology uses Financial Health Survey responses from consumers to report out their financial health in three categories: Vulnerable, Coping, and Healthy. As you can see from the graph below, from 2022 to 2023, there is an uptick in the percentage of folks who are financially vulnerable.

New in the report this year was a look at how financial health and well-being are related and connected to a person’s employment experiences. Specifically, two out of 5 (40%) unemployed Americans were Financially Vulnerable, compared with 14% of those who were employed and 15% of those who were not in the labor force.

More concerning from a credit union perspective was this: Those working at smaller businesses were more frequently Financially Vulnerable than those working for larger businesses. Workers at businesses with fewer than 100 employees were Financially Vulnerable twice as often as those working at businesses with 500 or more employees (18% versus 9%, respectively). (Source: p.37-38, Financial Health Pulse®– 2023 U.S. Trends Report).

Currently, over 84.9% of credit unions have less than 100 employees. Only 2.7 % have more than 500 employees. (Sources: CUNA and NCUA Call Reports).

Credit unions, as employers, need to think beyond 401k benefits to really understand the financial challenges their employees face. Do employees know about the resources of the credit union to help them be financially healthier? Are they aware of credit union products, services, and even coaching that can boost their financial wellness?

In 2021-22, the Foundation worked with six credit unions to provide them the demographic and financial health information on members and employees. The “Mirror, mirror” moment? Learning that employees are really struggling financially. Larry Ellifritz, CEO of Consolidated Community Credit Union in Portland, OR — one of the credit unions who participated in the grant – summed it up this way:

“My team told me how uncomfortable it is to share with your employer that you’re in financial difficulties. I’m incredibly grateful my employees trusted the process because their response changed our strategy dramatically. Now we’re expanding the survey to encourage direct feedback. We can’t just ask about an individual’s financial situation, we need to ask, ‘And how can we help?’”

For more information on what you can do to help employees with their financial health, check out the Foundation’s full grant report. Also, check out this great resource from Filene Research Institute.

“Mirror, mirror on the wall – who’s the fairest of them all?”

Financially healthy credit union employees and members! Take some time to focus on your employees’ financial well-being and it will pay dividends on talent retention, culture, and member service far into the future.