Mobile P2P is growing, but credit unions are losing the race

The percentage of smartphone owners making mobile P2P payments grew 30% in the last nine months, but traditional financial institutions are slipping up.

by. Rob Rubin

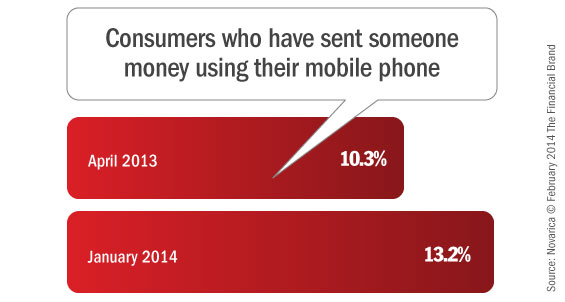

In January 2014, a survey on FindABetterBank asked smartphone owners whether they used their phone to make and P2P payments within the last 30 days. Overall, the percentage of smartphone owners who have made a mobile P2P payment grew by 30% from April 2013 to January 2014.

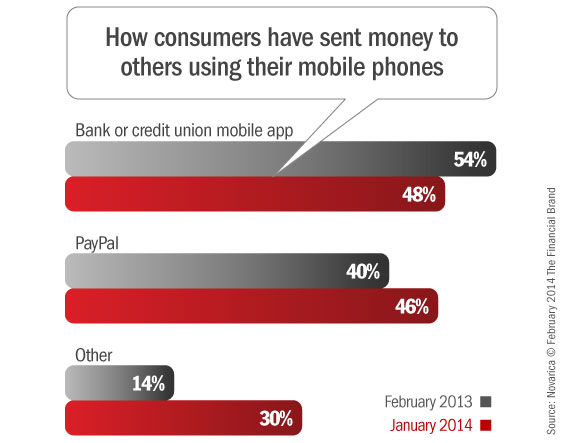

Banks and credit unions are losing the initiative. Most banks and credit unions treat P2P as a “bolted on” feature and it doesn’t receive a tremendous amount of marketing attention or promotion. As a result, the percentage of mobile P2P users using their banks’ or credit unions’ mobile P2P feature has declined, while competitors like PayPal and Google Wallet have grown.

continue reading »