One simple change to get more out of loyalty surveys

The increased use of loyalty based surveys like the Net Promoter Score (NPS) is a positive trend. However, the real value of asking one simple question to all of your credit union’s membership isn’t necessarily the aggregate score you receive at the end of the process. Credit Unions that actively engage with each respondent in dynamic ways have been able to identify problems they need to address and get the most value out of their biggest fans.

Here is one simple change your credit union can make to get the most value out of loyalty surveys:

Build logic into your surveys to instantly react to member ratings

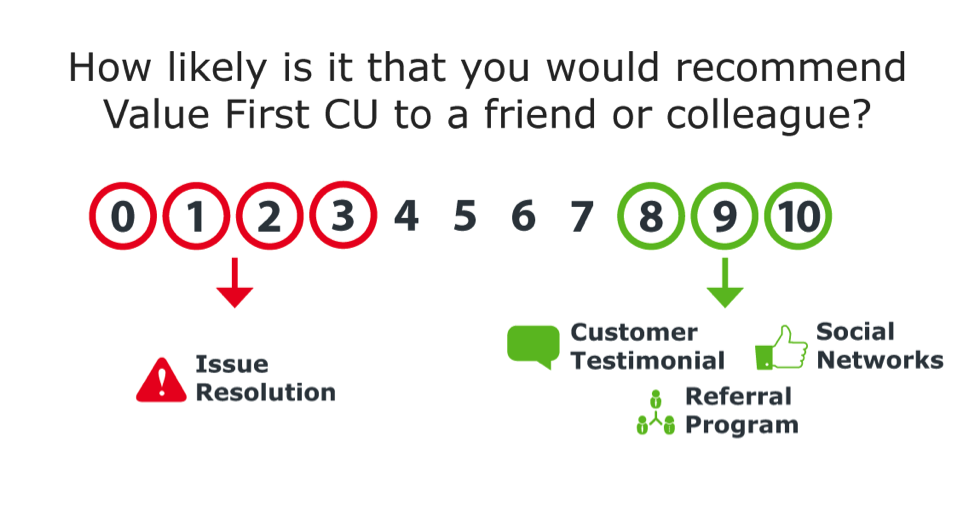

Modern survey software will allow you to instantly present different questions to respondents based on their response to one question. If you haven’t utilized this type of logic within your surveys, now is the time to start. General survey platforms like Survey Monkey have this functionality to some extent. Survey platforms that focus on the financial space, like our Base iQ survey software, often have the ability to solicit customer testimonials and incorporate referral programs directly.

We find that the most value is gained by prompting members that rate your credit union lower on the scale with a question that asks them how your organization can improve. If you keep your survey short, ideally 1-3 questions, members are more than happy to spend a moment to tell you where your credit union is falling short. This insight can be instantly turned into process improvements, training opportunities, and fee structure re-alignments. We also recommend reaching out to each member personally to let them know that you are listening and even better, are adjusting the way your organization functions.

At the other end of the rating spectrum, fans of your brand can be leveraged right away into direct referrals or even customer testimonials. The financial institutions that we have worked with have gained hundreds of extremely valuable customer testimonials simply by asking for them from the right people at the right time. This is a great way to add social proof to your marketing and sales cycle. Members can create some of the most compelling marketing copy since it sources from genuine feelings and emotions.

If you aren’t conducting any type of simple survey on your credit union’s membership, now is the time to start. Tracking a metric like NPS over time can provide some value in identifying high-level trends and how your credit union compares to other institutions. But, the most important benefit is using it as a tool to ask for the right feedback from members who think you have some areas to improve, and others that couldn’t be happier with calling your credit union home.