Outstanding loan growth slows at CUs in November

Credit union loans outstanding grew 0.05% in November, compared to a 0.11% increase in October and a 1.54% increase in November of 2019, according to CUNA’s Monthly Credit Union Estimates.

“November is often a strong month for credit union loan growth, as members increase spending during the holiday season,” said CUNA Senior Economist, Jordan van Rijn. “However, this year was different as the pandemic depressed travel and spending, and many consumers used savings instead of credit for their holiday shopping.”

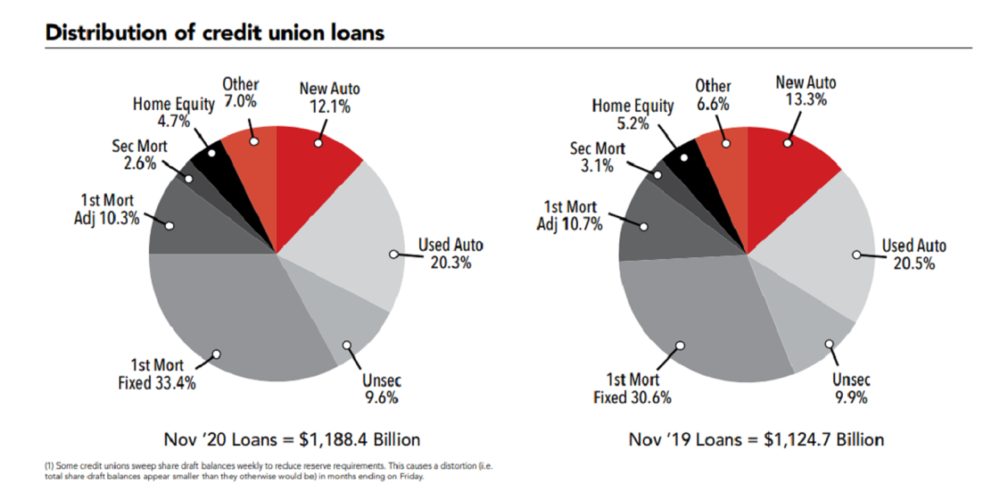

Other mortgage loans led loan growth during the month, rising 0.92%, followed by fixed-rate mortgages (0.88%), and credit card loans (0.85%). On the decline during the month were used auto loans (-0.04%), new auto loans (-0.17%), adjustable-rate mortgages (-0.84%), unsecured personal loans (-0.91%), and home equity loans (-2.09%).

Credit union savings balances increased 0.20% in November, compared to a 1.83% increase in October and a 1.54% increase in November of 2019. Money market accounts led savings growth during the month, rising 1.96%, followed by regular share (0.65%). On the decline during November were certificates of deposit (CDs) (-0.31%), individual retirement accounts (-1.59%), and Share drafts (-1.90%).

continue reading »