How to personalize your credit union website & increase member engagement

The hottest trend in credit union website design is mobile responsiveness, but personalization will soon impact engagement just as much as mobile devices. Website personalization will go mainstream in the next five years because personalizing content is the best way to engage users of your credit union website.

What is Website Personalization?

Personalization is when website content adapts to individuals. These adaptations are made dynamically based on user data. User data, collected through website analytics, might include page views, clicks, referring websites, and other browsing behaviors. Even data as simple as page views can be used to create personalized experiences for members.

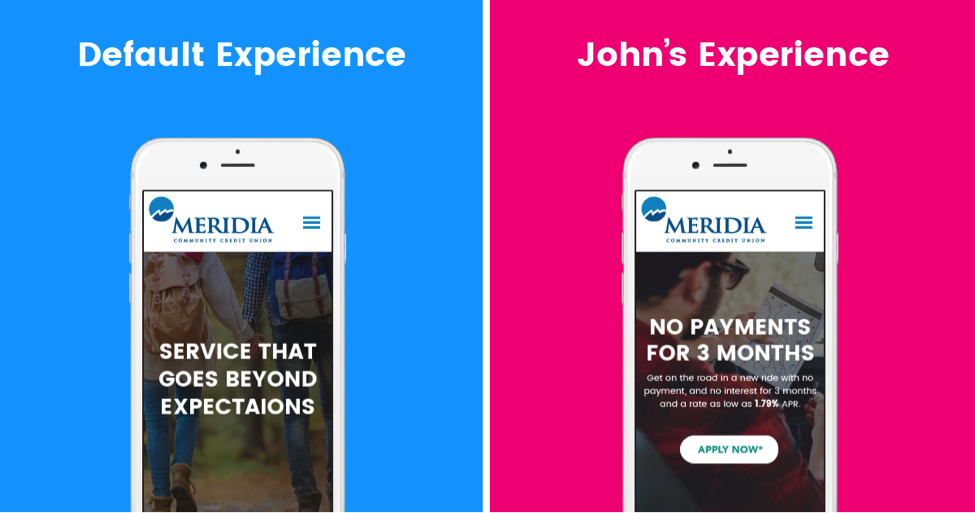

Example of Personalization:

John visits the auto loan page of your credit union website. That’s a good hint John wants to buy a new car. Based on this data, personalization software adapts your website’s content to show John an auto loan promotion. Since the auto loan promotion is relevant to John’s interest in buying a new car, he’s more likely to click the promotion and take action.

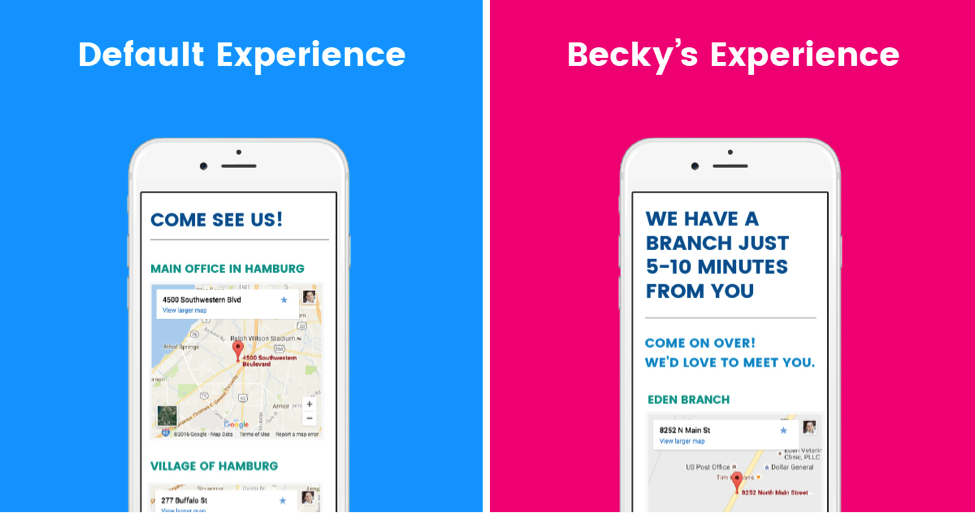

Another Example of Personalization:

Becky is not a member of your credit union, but she’s interested in joining. She visits the “Locations” page on your website to find the branch nearest her. Personalization software on your website detects Becky’s location based on her IP address. Using her location, your website displays a message saying, “We have a branch just 5-10 minutes from you. The address is . . .. Come on over! We’d love to meet you.”

Usually, the best way to really understand something is to experience it. So, check out this automated demo which demonstrates one example of personalization. (Disclaimer: my company built the demo.)

Why Should You Care About Personalization?

In 1776, the economist Adam Smith published a book called “The Wealth of Nations,” which became the the foundation of modern economics. One of Smith’s most fundamental insights is that people act based on their individual interests (he referred to this as “self-interest”, which should not be misinterpreted to mean “selfish interest”). In other words, people act only when they care. This insight may seem obvious and intuitive, but it’s extremely useful when applied to marketing.

Personalization is a way to show users content they care about. If you show people content they care about, they are more likely to interact with it. That’s why personalization just makes sense. Ultimately, personalization can help credit unions get more members and borrowers and make marketers look like rockstars.

I know this marketer and she use personalization on her credit union website. Hence, she’s a rockstar 😉

Currently, credit union marketers come to me saying, “We need to redesign our website because it’s not responsive.” Mobile responsiveness is the hottest trend in credit union website design because straggling credit unions realize they must either go mobile or die. The same thing is going to happen with website personalization. In five years, I predict credit union marketers will say, “We need to redesign our website because it doesn’t personalize content.” I could be wrong, but I bet Adam Smith would wager on my prediction.

Consider implementing personalization before it goes mainstream and you find yourself behind the ever-advancing trends of credit union website design.

How Can You Implement Personalization on Your Credit Union Website?

We’ve talked what personalization is and why it matters. Now, let’s talk about how to implement it on your credit union website. This section is divided into two parts.

- First, you have to install personalization software on your website, otherwise personalization is not possible. I’ll give you some options for software.

- Second, I’ll give you three steps to run a personalization campaign.

How to Install Personalization Software

You can either buy personalization software from a vendor or build your own. For 99.9% of credit unions, I recommend buying rather than building.

For 99.9% of credit unions, implementing personalization through existing software is the best option. You could build your own personalization solution in-house (see info below), but that’s not practical or necessary for the supermajority of credit unions. So, here are some existing personalization softwares you can buy:

Optimizely is a big name is A/B testing software and they added personalization capabilities within the past year. They have a fairly easy, do-it-yourself solution. Pricing is $49 – 1,000 per month for small- to medium-sized businesses ($49 per 1,000 monthly unique visitors). That buys you basic personalization, targeting, and segmentation. If you want advanced implementations for lots of traffic, “Enterprise” pricing starts at $100,000 per year.

BlueConic seems pretty legit. They have some big clients. Also, they have a free plan, so you can try out their software before buying. However, if you have more than 1,000 credit union members, you’ll end up paying $500 – 2,000+ per month.

BrightInfo appears to have a good solution, though I haven’t used it. Their prices start at $500 / mo.

Marketo is a well-known marketing software company. I don’t have prices for Marketo’s personalization software, but you can expect it to be expensive (I’m guessing Marketo’s personalization software is expensive because their other softwares are expensive).

Disclaimer: BloomCU is my company, but here’s my best attempt at an unbiased overview of Persona: BloomCU built its personalization software, Persona, specifically for credit union websites. Pricing is customized for clients based on how the credit union uses Persona, but I can tell you it’s less expensive than most options listed above. If your website gets fewer than 1,000 visitors per month, then BlueConic and Optimizely are cheaper.

Build personalization software in-house

At some point in every marketer’s career, they will find themselves in the alluring shadow of a very hairy question, “Should I build this tool myself?” After all, the problem you need to solve is simple, right? It couldn’t take more than a couple days to build it yourself, right?

My company has built lots of things in-house: websites, payment calculators for credit union websites, landing pages, chat bots, personalization software, etc. In our experience, writing new software often costs twice as much and takes four times longer than what you estimate at the outset. But sometimes building in-house is the only option (or the only option that makes sense). When you do build in-house, there is one major upside: whatever you make is yours. You own it and you can do whatever you want with it.

Most credit unions should buy personalization software rather than build it, but if you have some extenuating circumstance that necessitates an in-house solution, here’s how you can build your own personalization software: How to Build Your Own Personalization Software.

How to Run a Personalization Campaign

At this point, you might be itching to get personalization running on your site because it’s cool and will take your marketing to the next level. Indeed, personalization is very cool stuff, but let’s be smart about implementing it. First, define your objectives.

Step 1: Define Your Objectives

Before you start a personalization campaign, determine why you’re doing it. You may want to increase membership or the number of auto loan applications. Whatever your purpose, defining your objectives is crucial. The following steps are useless if you don’t know why you’re personalizing your website.

Step 2: Create a Hypothesis

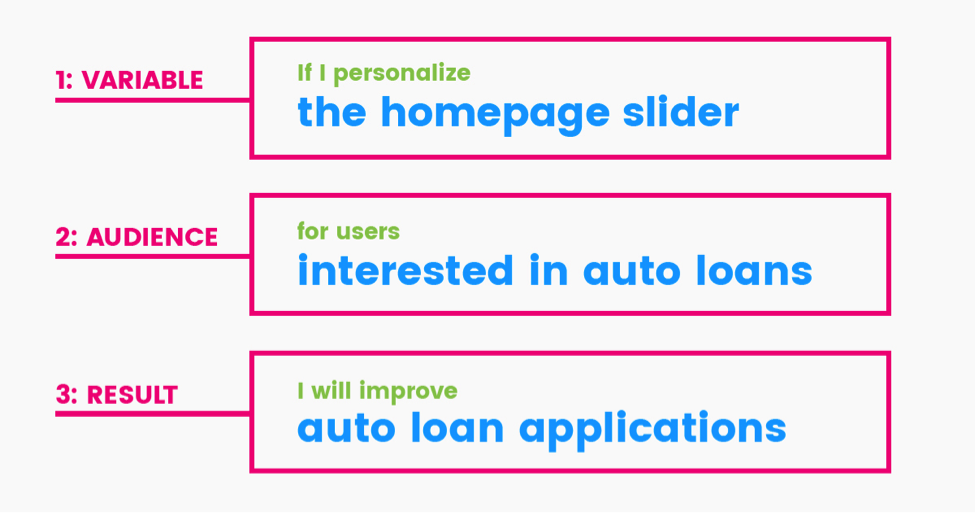

A personalization campaign is an experiment. You are now a marketing scientist. Therefore, you must have a hypothesis to define what you are testing.

Creating hypotheses for your personalizations is easy!

Creating a hypothesis is like making a sandwich with three ingredients:

(1) Choose a Variable

Which element of your website will you personalize? This could be a homepage banner, sidebar promotion, page heading, pop-up, log-in area, etc.–the possibilities are endless. I recommend starting with a variable on your site that gets a lot of traffic (at least 5,000 visits per month), like the homepage banner.

(2) Craft a Message

Who will see the personalization? Pick an audience based on an interest. For example, your audience could be, “People interested in auto loans.” Start by choosing an interest that drives growth for your credit union–like people interested in loans or membership–or whatever will impress your CEO the most 😉 .

What message is relevant to your audience? After you choose an audience, craft and design a message that’s relevant to their interests. For example, if your audience is “People interested in auto loans,” then you could design a homepage personalization that features your best auto loan promotion (e.g., a low rate).

(3) Predict the Result

What outcome do you predict? The outcome could be more leads for membership, loans, or any other measurable metric.

Here’s an example of a hypothesis sandwich:

Step 3: Improve Performance

As you run personalization campaigns and test hypotheses, collect data to compare actual results with predicted results. Your hypotheses might be correct, incorrect, or somewhere inbetween. In any case, you’ll learn valuable information that can be used in future personalization campaigns.

Conclusion

Personalization is the future of credit union website design because showing relevant content just makes sense. All that’s left to determine is which credit unions will be lead and lag when it comes to implementing personalization.