In today’s online world, your credit union website design can’t be one-size-fits-all. Every visitor is unique, and they expect an experience that reflects that—which is why personalization is a highly impactful trend. Did you know that in 2019, 72% of consumers only engage with marketing messages that are customized to their individual interests? With stats like that, it’s no wonder that 88% of digital businesses are investing in personalization.

It’s also why we ran our own experiment with personalization on one of our client’s credit union websites, and our results may convince you to hop on the bandwagon—we’re talking about a 213% increase in clicks on calls to action.

What is personalization?

Personalization is software that uses data to adapt your website for each visitor. Here are a few examples of personalization: Amazon recommends products based on what you’ve already viewed; Netflix recommends shows based on others you’ve watched; travel sites offer promotions based on the weather; and news outlets serve up specific videos based on your location.

Why put in the effort?

Setting up personalization on your credit union website design takes time and brainpower, but there are compelling payoffs. According to Evergage’s 2018 Trends in Personalization report, the top five benefits of personalization include increased visitor engagement (55%), improved customer experience (55%), improved brand perception (39%), increased conversion rates (51%) and increased lead generation and customer acquisition (46%).

How do I do it?

There are many different ways to go about implementing personalization, but here’s how we do it at BloomCU. A while back, we created Persona, personalization software built just for credit union websites. Our solution adapts website content on the fly for individuals based on their interests. When people visit your site, Persona tracks data like page views and clicks to determine their needs and interests.

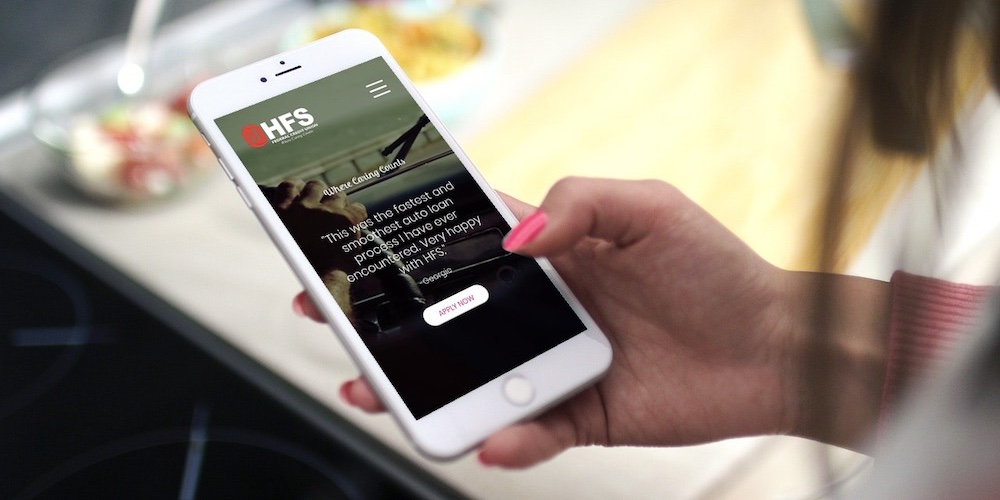

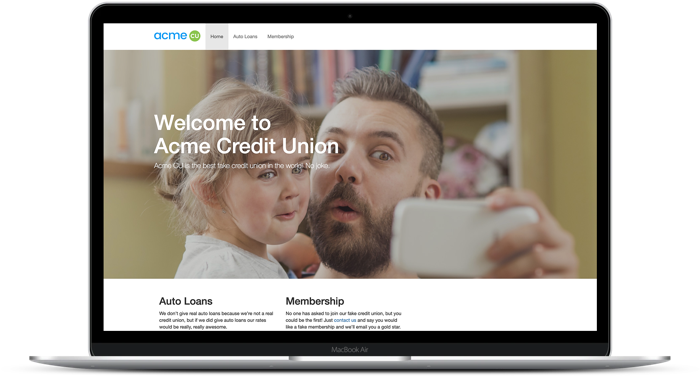

For example, say a visitor lands on this homepage:

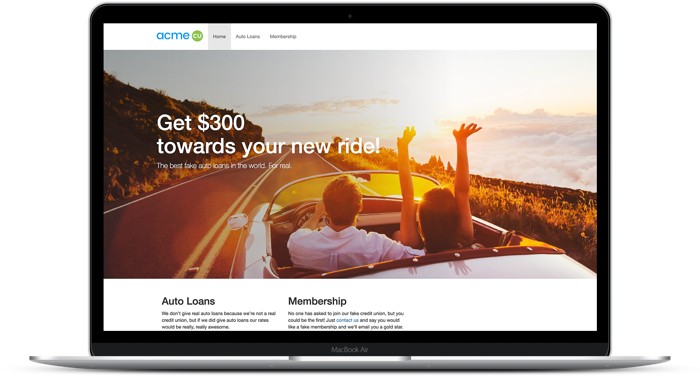

Then they visit the auto loans page. When they return to the homepage, the content is personalized based on their interest in auto loans.

Persona provides a tailored experience that increases the chances of the visitor engaging and becoming a borrower.

If you want to see personalization in action, check out this live demo.

What results will I see?

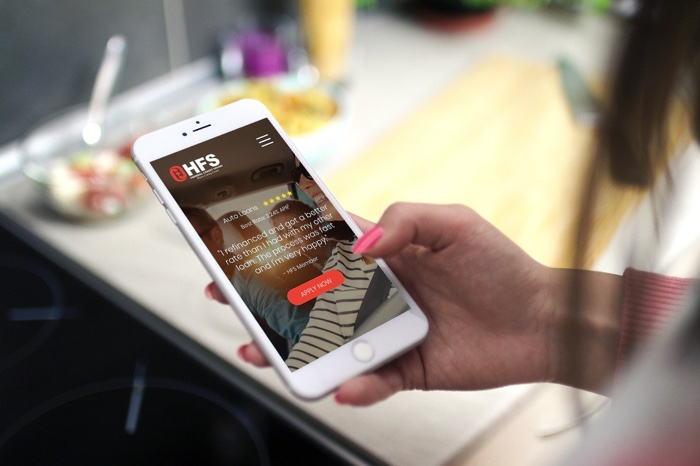

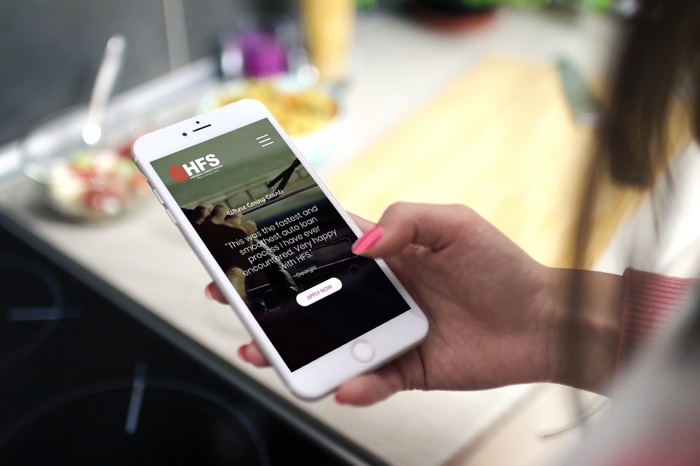

We put personalization to the test for our client HFS Federal Credit Union. In this case study, we ran an A/B test and decided to target people interested in auto loans, credit cards, personal loans, personal lines of credit, and autos for sale.

For the sake of the study, only half of the website visitors were shown a personalized experience. The other half experienced no personalization and saw the same homepage regardless of their previous browsing behavior.

Here’s how the personalized experience worked:

Let’s say a young woman named Liz visits the auto loan page.

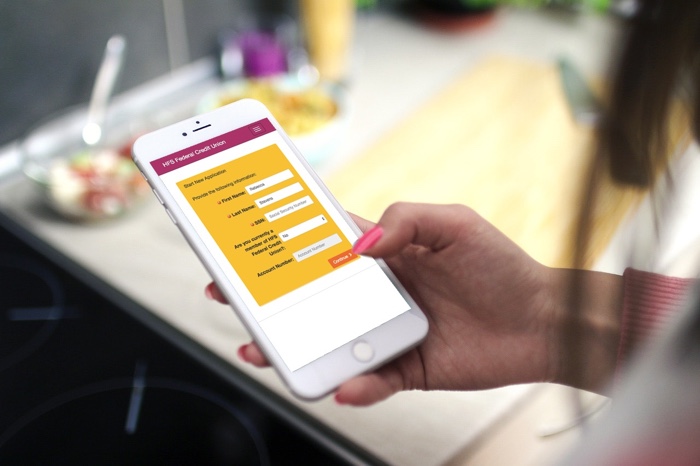

Persona tags her interest as “auto loan.” As a result, the next time she visits the homepage, Persona shows her an auto loan promotion.

Based on our study results, Liz is about 200% more likely to click “apply now” when shown the personalized promotion.

The results made our jaws drop—they were even better than we anticipated. We tracked 296,000 page viewsand saw 200%+ more clickson calls to action for all of the personalizations we ran:

- Personal Loans personalization: 218%more clicks

- Auto Loans personalization: 200%more clicks

- Credit Cards personalization: 200%more clicks

- Personal Lines of Credit personalization: 300%more clicks

- Autos for Sale personalization: 233%more clicks

In total, HFS Federal Credit Union got 213% more clicks—and that many more clicks can translate into significant growth.

Check out our personalization case study with HFSFCU.

With AdWeek reporting that personalization can reduce acquisition costs by as much as 50%, lift revenues by 5–15%, and increase marketing spend efficiency by 10–30%, personalization is one trend you can’t afford to ignore. Take the time to tailor the website experience and you’ll win more business for your credit union.

Want more design insights that win big? Get access to some of our best insights.