Personalized lending for the digital consumer

Financial institutions are ready to lend and consumers are ready to borrow, creating a perfect storm of lending opportunity. But, traditional loan acquisition programs often miss the mark due to lack of alignment with consumer needs, consumer fear of rejection and outdated marketing techniques. New, data-driven lending solutions break down these barriers with substantially better results.

The loan marketplace is finally gaining steam after years of low demand. According to American Banker, loan portfolios at financial institutions with less than $40 billion in assets increased an average of 15% in third quarter 2014 from the previous year, and net interest income rose 11%. The loan-to-deposit ratio for these banks averaged 85.3% for the period, an improvement from 82.4% two years earlier.

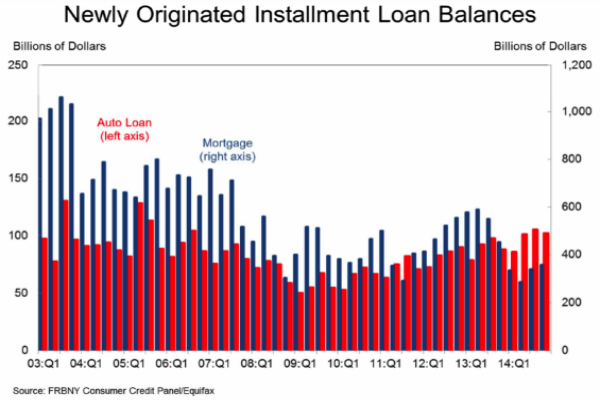

An analysis of the market from the consumer side shows aggregate household debt balances up one percent from third quarter to fourth quarter 2014, with increases in mortgage, auto loan, student loan and credit card balances. Credit card limits, mortgage originations and home equity line of credit (HELOC) limits all increased, while overall delinquency rates were down. The number of credit inquiries in six months, which indicates consumer credit demand, rose four million during the period.

continue reading »