Perspectives on the credit union market

Credit Union Performance Metrics

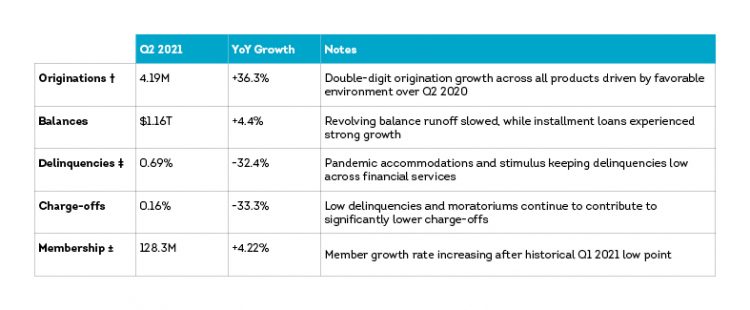

Q2 was encouraging for credit unions in a number of categories. Originations soared with 36.3% YoY growth; perhaps unsurprising given the state of the nation one year ago in Q2 2020. Balances also saw growth, now above $1.16T. The 4.4% YoY growth can be attributed to strong performance in installment loan products and a slowing in revolving loan balance runoff. Delinquency and charge-offs are at record low rates across financial services, with credit unions leading the way across many product types. Lastly, credit unions saw over 4% growth in new members, an encouraging sign after consecutive quarters of slowing growth. There are 128.3 million credit union members in the USA as of Q2.

Summary of Credit Union Performance Metrics

Source: TransUnion US consumer credit database

† – Originations measured in number of new accounts; Q4 2020

‡ – 60 days past due or greater, number of accounts

± – Sourced from Callahan & Associates