2020 community financial institution challenges with COVID research released

TUCSON, AZ (October 14, 2020) — An Arizona-based FinTech released a study of the top challenges to community financial institutions today on the University of Arizona’s Tech Parks website. The research was funded by the National Science Foundation through a grant and included information how COVID-19 affected the interviewees’ credit unions or banks.

“Originally, we set out to understand what the top challenges and what prevented community financial institutions from dealing with them, but the [COVID-19] pandemic was too much of an opportunity to not include,” said Ray K. Ragan, researcher and study co-author.

The study involved over 100 community financial institutions, which includes credit unions and banks and was done during the months of July and August. The final study sample size was reduced to 92, when the researchers limited the asset size of the community financial institutions to three billion or less. According to T. “Buck” Strasser, the study’s other co-author, said this reduction was necessary for a critical mass in the data analysis.

“When we looked at the data, we found we had a really good cohort when we limited the asset size, there simply were too many outliers when we went above three billion,” he said.

The study revealed that the top five challenges for the community financial institutions are: Regulation & Compliance, Technology, Data, Talent, and Customer or Member Service (as in providing). While the top five issues preventing these professionals are: Technology, Talent, Cost, Leadership, and Culture.

The researchers said the study was meant to inform regulatory policy decisions at the local, state, and federal levels and guide service providers where there is unmet need in the banking space. The research involved actual interviews with professionals at credit unions and community banks. This was a conscious decision to ensure the quality of the data collected was higher than using surveys to overcome bias in self-report surveys.

“There’s something magical that happens during an interview, people open up and get a lot more candid than they do in a survey, that’s when the hidden answers start to reveal themselves,” said Strasser.

The researchers used text analytics on the interviews to understand the relationships between each keyword. This was to understand how the keywords interrelated and provide policy makers with guidance where to influence for direct and indirect outcomes. The approach was available to the researchers because of the commonality of keywords found across so many interviews, said Ragan.

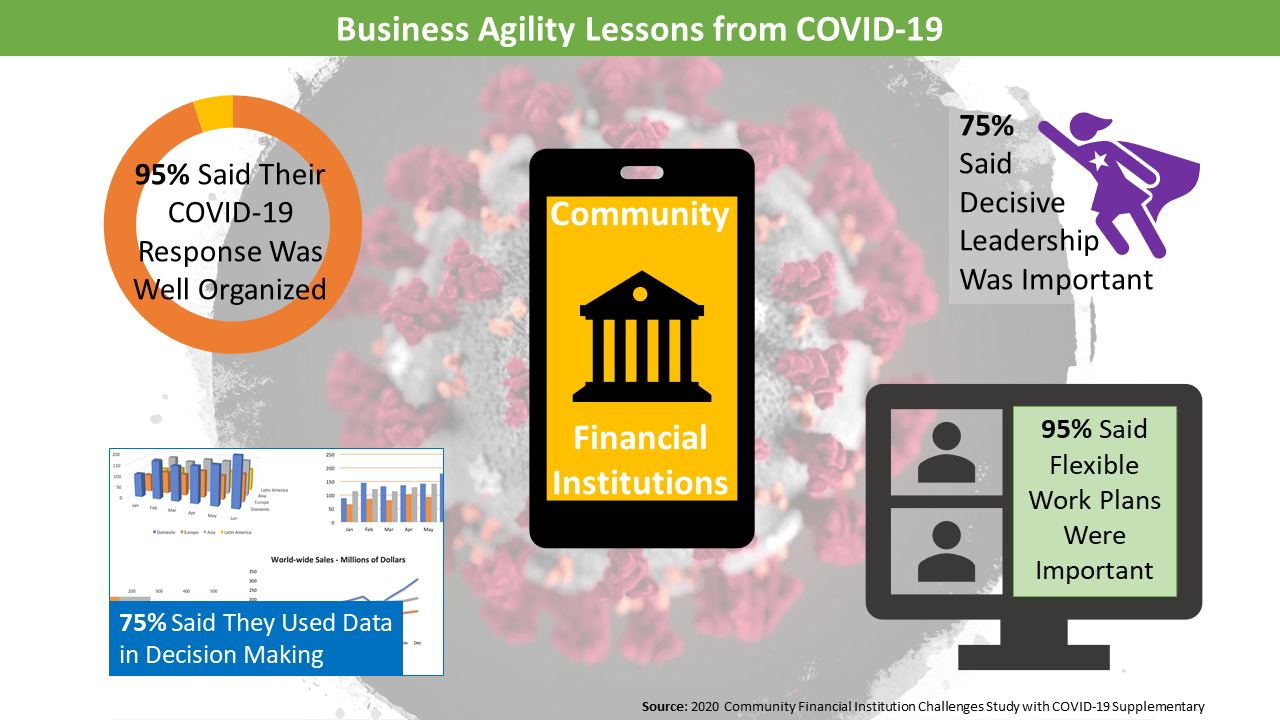

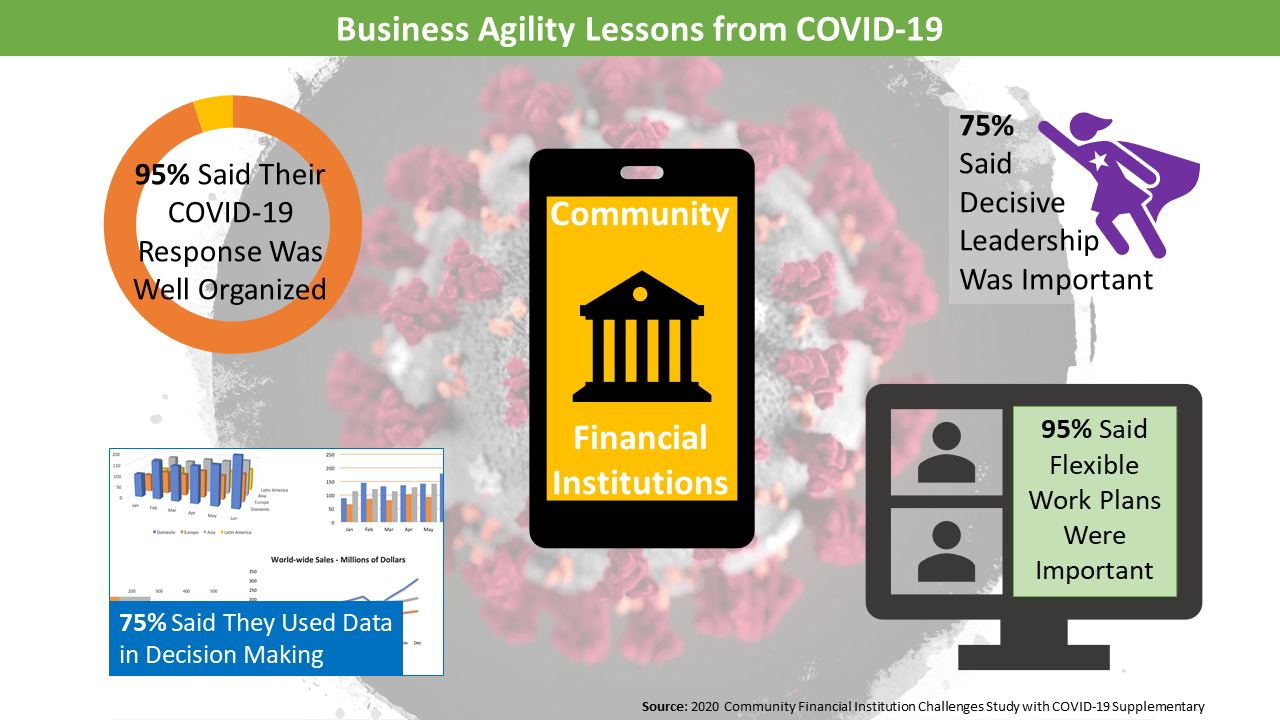

The study also captured how these credit unions and community banks handled the COVID-19 pandemic. Banking was and is considered an essential service, necessitating these institutions to directly respond with the pandemic, balancing safety and services. About 95 percent of the interviewees reported that their institution handled the response well, and most saw a dramatic up-turn in use of their digital services, according to the study.

Strasser said, “[t]here were a number of surprises in the COVID data, chief among them was the value of decisive leadership and data in a crisis.”

Link to the study:

2020 Community Financial Institution Challenges Study with COVID-19 Supplementary

Link to University of Arizona Tech Park Blog Post Analysis:

Business Agility Lessons from COVID-19

About Clear Core

Clear Core is a FinTech that specializes in data cleaning, augmentation, and visualization for financial institutions. Clear Core’s new technologies allow Credit Unions to have actionable data in under 90 days from contract signature. Clear Core was selected as the University of Arizona’s Center for Innovation FinTech of choice for 2020 and a National Science Foundation’s innovation corps grant for novel, high-impact technology.