April spending trends: Consumers grow cautious as recession looms

CO-OP Payments Trends Report (Spending Data from April 1-30)

RANCHO CUCAMONGA, CA (May 18, 2022) — Several months of consumer price pressures, stock market volatility, geopolitical threats and rising interest rates are beginning to take their toll on consumer spending. Co-op’s April credit union card portfolio data showed weak month-over-month results across most categories as cardholders grew concerned with the potential of recession later this year.

Underlying economic data was mixed in April, as non-farm payrolls grew by 428,000 in April and the unemployment rate remained steady at 3.6%. Wages rose by 0.3% for the month – an increase of 5.5% from a year ago. Despite these strong labor figures, however, gross domestic product fell by 1.4% in the first quarter – the first decline in GDP since the early days of the pandemic.

And inflation is still a significant worry for shoppers, as the consumer price index hit an annual growth rate of 8.5% in March, the fastest pace in 40 years. In a bid to curb rising prices, the Federal Reserve Bank raised its benchmark bank lending rate by 50 basis points at its May 4 meeting, the largest increase since 2000. The Fed’s recent moves are beginning to impact consumer borrowing rates, as the 30-year fixed-rate mortgage rate reached 5% for the first time since 2011.

These events are fueling widespread concern of an economic downturn later this year or in early 2023, with Deutsche Bank recently warning of a “major recession.” Consumers seem to be taking note as they begin to scale back their spending in anticipation of further instability and belt-tightening in the months ahead.

Here are some of the key spending trends Co-op’s SmartGrowth consultants are watching closely:

#1: Grocery Stays Strong as Consumers Shift to Essentials

Grocery emerged as one of the few highlights in Co-op’s April credit union spending data, with modest upticks in amount and count across both the credit and debit portfolios. Consumers have begun curbing their spending on luxury and non-essential goods and services in the Travel, Lodging, Digital Goods, Dining and Sports/Recreation categories, conserving their dollars to spend on staples.

“Shoppers are shifting to private label brands, which are making a comeback in the grocery stores,” said John Patton, Co-op Senior Payments Advisor. “For example, people are buying generic rather than Jif brand peanut butter, in order to stretch the value of their dollar.”

According to a report from PYMNTS, 61% of consumers are shopping primarily for “essential” goods, including gas, health products, food and beverages. This is leading to a stagnation in eCommerce purchases, as 17% fewer of these “stick to essentials” consumers made online purchases in March as compared with January 2022.

“Because of the unique nature of the health and economic challenges we have faced over the past couple of years, the federal government had been more cautious in raising rates than they were during previous inflationary periods,” said Beth Phillips, Director at Co-op Solutions. “This means the government is now forced to play catch-up, and the combination of high prices, supply shortages and rising interest rates is driving the consumer perception that prices are truly out of control.”

#2: High Housing Costs Leads to Home Improvement Growth

According to a new Gallup poll, only 30% of U.S. consumers believe it is a good time to buy a home. This is the lowest level recorded since 1978, and comes as the median home sales price hits a record $428,000 and 30-year mortgage rates continue to rise.

According to Patton, these concerns are leading a growing number of homeowners to stay put and invest in their current home, providing yet another boost to the Home Improvement merchant category.

“The rising costs of purchasing and financing a home are going to start impacting the home sales model,” said Patton. “People are getting to the point where they would rather stay in their current home instead of buying a new house. We’re already seeing some data showing that the average purchase price – even though still elevated – is beginning to soften, indicating that people are starting to buy smaller residences.”

Home improvement projects were already on the rise due to months of stay-at-home practices and quarantines during the pandemic, and now that is morphing into projects driven by astronomical home prices.

“Home improvement spend is very high on debit, which tells us that consumers still have cash on hand, and they’re willing to spend it to improve their current home and ride out this current housing cycle,” said Patton.

“With home prices at record levels and consumers equipped more than ever to update their homes themselves or with the help of a professional, implementing a special pricing promotion on home improvement merchants this summer will align perfectly with consumer demand,” said Phillips. “Now is also a great opportunity to consider your credit card product as a small loan vehicle for consumers to make home improvement purchases. For a consumer, using your card is much easier than applying for a small home loan.”

#3: The Return of the “Staycation”?

In April, one of the biggest growth categories across both the credit and debit portfolios was Campers and Camping, which showed double-digit increases in count and amount. This came while the Travel, Lodging and Sport/Recreation categories were all down for the month.

Co-op’s SmartGrowth experts expect this trend to continue, as consumers look to vacation closer to home and on a budget as a way to stave off inflation while also remaining safe in light of continued COVID variant outbreaks.

What Credit Unions Should Do Now

Despite inflation, credit balances are continuing to rise. Co-op member credit portfolio balances were 7% higher in April 2022 than a year prior, continuing a recent trend. Instituting a low introductory rate balance transfer campaign now can help credit union members save as interest rates rise, while reinforcing the primary financial relationship. In addition, applying engagement strategies can help ensure new card holders utilize a credit union’s card as their main option.

As balances increase and the economy wavers, it’s also important to analyze members’ credit lines usage and adjust as necessary to meet cardholders’ needs while protecting the credit union.

Supply chain issues continue to severely impact chip shortages, which means it’s getting more expensive to reissue credit and debit cards. Some major issuers are pushing out their reissue dates from the typical three years to five. This approach can save a credit union money in the long run, while also improving member convenience and helping to keep a credit union’s card at the top of their members’ digital wallets.

Lastly, the importance of analyzing payments data to optimize the member experience is more critical to current and future success than ever. “Your credit union has access to behavioral data, and you’re in a prime position to help your member by cross-selling auto loans, home improvement loans and other credit facilities,” said Patton.

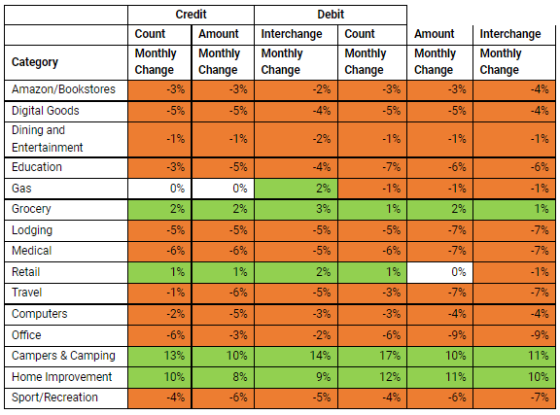

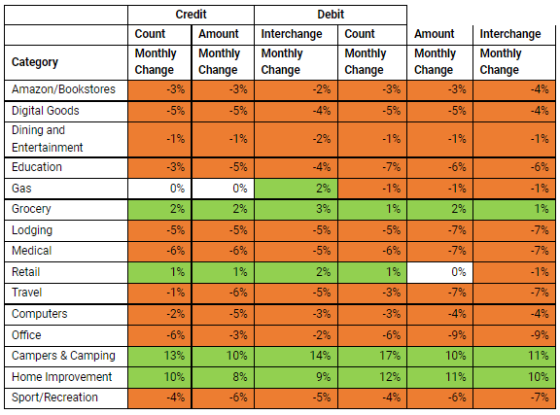

Month-Over-Month Category-Level Spending (Comparing April 2022 to March 2022)

Please note that the category spending below reflects month-over-month comparisons (rather than year-over-year) – i.e., compares April 2022 with March 2022, rather than April 2022 to April 2021.

About Co-op Solutions

Co-op Solutions is a credit union-owned financial technology platform built using an industry-leading ecosystem, and whose mission is to connect credit unions to the technology, strategic partnership and scale they need to best serve their members and grow now and into the future. Co-op Solutions partners with credit unions to unlock their potential so they can compete; does the hard work of innovation, creating a one-stop opportunity to help credit unions grow; and offers knowledge and expertise in a world where everything must be integrated. Founded in 1981, Co-op Solutions services 2,650 credit union clients, processes eight billion transactions annually, and manages a nationwide ATM network of more than 30,000 and a 5,700-location shared branch network. For more information, visit www.coop.org.