August spending trends: Inflation dampens consumer spending

CO-OP Solutions Payments Trends Report (Spending Data from August 1-31)

RANCHO CUCAMONGA, CA (September 20, 2022) — With regards to the economy, it continues to be a “Tale of Two Cities.”

Job growth remained strong in August, with non-farm payrolls rising 315,000, near consensus estimates. The unemployment rate climbed slightly to 3.7% for the month.

Yet the biggest economic concern for consumers remained a stubbornly high inflation rate, which rose by 8.3% in August despite falling gas prices. This unexpectedly high increase drove markets down, with the S&P 500 falling by 4.3% on Tuesday, September 13.

Co-op Solutions’ August credit union card portfolio data showed generally flat month over month results across most categories in both credit and debit. The exceptions included strong growth in the Education and Giving/Political merchant classifications, and sharp declines in the Campers & Camping, Entertainment, Government/Gambling, Home Improvement and Real Estate categories.

Here are some of the key spending trends Co-op’s SmartGrowth team is watching closely this month:

#1: Education Spending Jumps as Students Hit the Books

According to Co-op’s month-over-month credit union portfolio data, education spending posted a huge increase in August, rising 70% in debit and 71% in credit.

“This is not surprising,” said John Patton, Senior Payments Advisor for Co-op. “A big lift in the education category is expected as students prepare to go back to school in late August and early September. Families are purchasing books and supplies and paying their college tuition bills during this time.”

#2: Spending Behaviors Shift Based on Household Needs

Whereas the year-long trend has been a sharp shift in spending from debit to credit, that narrative may be changing as U.S. consumers emerge fitfully from the pandemic period, just to face rapidly rising prices and a potential recession. Households are now starting to make pragmatic decisions on whether to use debit or credit based on their own unique circumstances.

Based on Co-op credit union portfolio data, overall credit transaction volume is up by 13.5% year over year, whereas for debit it has basically remained flat at just 0.6% growth. But in both July and August, credit and debit spending volumes behaved in lockstep from the prior month. It may be that many households are shifting to debit for their everyday spending needs while reserving credit for larger purchases, as a way to more effectively manage budgets.

“Consumers are making choices based upon their individual financial situations,” said Patton. “Households are deciding whether to pay with debit or credit depending on their unique circumstances, whether it’s for education, medical or everyday spending on groceries and gas. These are choices being made at the household level, and it’s reflected in our transactional data.”

#3: Spending on Computers and Electronics Expected to Fall

According to Co-op’s August month-to-month credit union transactional data, the Computers merchant classification was flat in debit and fell roughly 2% in credit, but some expect a sharper fall-off in the coming months.

According to the Wall Street Journal, PC and printer manufacturer HP’s revenues fell by more than 4% in the second quarter, a trend the company expects to continue as consumer demand for electronics remains soft, and business demand begins to dry up amid budget cutbacks and more rounds of corporate layoffs this fall.

According to Co-op forecast projections, spending in the Computer category is expected to increase in credit through the fall, while falling off in debit.

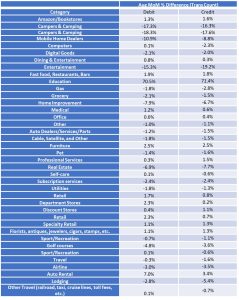

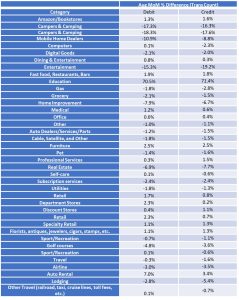

Month-Over-Month Category-Level Spending (Comparing August 2022 to July 2022)

Please note that the category spending below reflects month-over-month comparisons (rather than year-over-year) – i.e., compares August 2022 with July 2022, rather than August 2022 to August 2021.

What Credit Unions Should Do Now

As the economy continues to remain in upheaval, reviewing lines and pricing strategies is critical to ensure that credit unions are well positioned to address what’s happening in the marketplace and continue to meet member needs.

With everything from rent, groceries and healthcare becoming more expensive, members are looking to save anywhere they can. This is one reason why cash back reward programs continue to remain the most popular type of card benefit. In fact, a December 2021 survey found that 41% of U.S. adults named cash back as their favorite credit feature.

Credit unions have a unique competitive differentiator when it comes to cash back rewards: they have their members’ deposit relationship. Cash back should naturally be a part of any credit union loyalty rewards program.

“It makes perfect sense to offer your members a cash back reward, and allow them to periodically redeem those rewards with a deposit right into their credit union account,” said Patton. “Especially if you can offer them a seamless digital redemption experience in your online banking platform. This is a unique, flexible experience credit unions can offer because you have that relationship. Most issuing banks don’t have this opportunity.”

Patton also recommends credit unions activate their “spend and get” campaigns as the holiday shopping season approaches. It’s another way to reward members with much-needed cash as an incentive for using their debit or credit cards at particular merchants or within specific spending categories.

More information on the Co-op SmartGrowth Consulting Team can be found here.

About Co-op Solutions

Co-op Solutions is a credit union-owned financial technology platform built using an industry-leading ecosystem, and whose mission is to connect credit unions to the technology, strategic partnership and scale they need to best serve their members and grow now and into the future. Co-op Solutions partners with credit unions to unlock their potential so they can compete; does the hard work of innovation, creating a one-stop opportunity to help credit unions grow; and offers knowledge and expertise in a world where everything must be integrated. Founded in 1981, Co-op Solutions services 2,650 credit union clients, processes eight billion transactions annually, and manages a nationwide ATM network of more than 30,000 and a 5,700-location shared branch network. For more information, visit www.coop.org.