Biz2Credit small business recovery ranking measures ability of industries to rebound from pandemic hardship; finance and insurance on top

NEW YORK, NY (November 18, 2021) — In an examination of small business funding trends, the new Biz2Credit Recovery Ranking for 2021 found that businesses in the Financial Services and Insurance industry recovered the fastest from the COVID-19 pandemic compared to other industries. These companies experienced the greatest strength of recovery from COVID-19 lockdowns because businesses in financial services and insurance had a high demand for expansion capital, but a low level of distress.

The new Biz2Credit Recovery Ranking identified top recovering industries based on the number of loans approved in PPP Round 1 and PPP Round 2 (Draw 1 only), as well as overall demand for growth capital from small businesses in different economic sectors. The proprietary research examined the industries that experienced a greater degree of recovery from the pandemic and were in a stronger financial position in 2021 relative to 2020.

This new ranking matrix measures the resiliency of businesses across different industries based on their ability to bounce back from the economic shock of the pandemic. The Biz2Credit Recovery Ranking was created to assess the extent of recovery from the COVID-19 pandemic across industries.

- A high percentage means that businesses in a particular industry are recovering well from the pandemic.

- A low percentage means that businesses in a particular industry are recovering poorly from the pandemic

The ranking is a proprietary measure of demand for financing and an industry’s need for government-provided relief.

| Biz2Credit Recovery Ranking: Top 10 Industries Ranked |

|

| Rank |

|

Industry |

|

Recovery Rate (index) |

|

| 1 |

|

Finance and Insurance |

|

67% |

|

| 2 |

|

Retail Trade |

|

56% |

|

| 3 |

|

Real Estate and Rental Leasing |

|

53% |

|

| 4 |

|

Wholesale Trade |

|

49% |

|

| 5 |

|

Manufacturing |

|

48% |

|

| 6 |

|

Construction |

|

48% |

|

| 7 |

|

Professional, Scientific, and Technical Services |

|

46% |

|

| 8 |

|

Health Care and Social Assistance |

|

46% |

|

| 9 |

|

Information Technology |

|

45% |

|

| 10 |

|

Administrative, Support, Waste Management, Remediation Services |

|

44% |

|

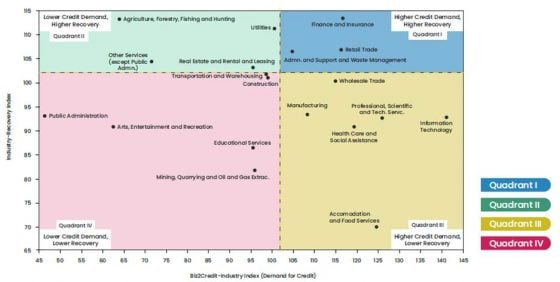

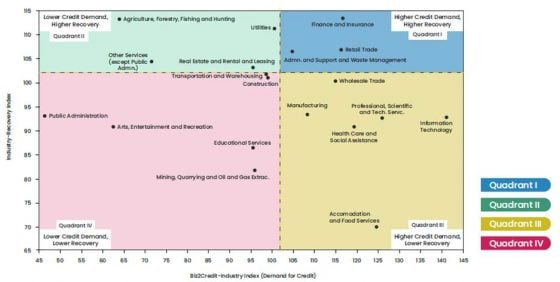

Biz2Credit Recovery Ranking Matrix

Higher Credit Demand, Higher Recovery (Quadrant I)

Industries in this quadrant had a high demand for credit and are better positioned to benefit from access to additional capital. These industries include Finance and Insurance; Retail Trade; Administrative and Support; and Waste Management and Remediation Services.

Lower Credit Demand, Higher Recovery (Quadrant II)

Industries in this quadrant have been relatively less impacted by the pandemic and are anticipating a recovery without exhibiting high demands for growth capital. Such industries include Real Estate and Rental and Leasing and Services (except Public Administration).

Higher Credit Demand, Lower Recovery (Quadrant III)

Industries in this quadrant had a high demand for credit but also required considerable assistance from government lending programs, especially PPP. These industries include Information Technology (IT); Professional, Scientific, and Technical Services; Accommodation and Food Services; Health Care and Social Assistance; Wholesale Trade; and Manufacturing.

Lower Credit Demand, Lower Recovery (Quadrant IV)

Industries in this quadrant have been severely impacted by the pandemic and are experiencing a slow recovery, aided in most cases by significant government relief financing. These industries include Construction; Transportation and Warehousing; Educational Services; Arts, Entertainment and Recreation; and Public Administration.

“In this report, our data scientists have found that small businesses in particular industries experienced a greater level of recovery from the impacts of the pandemic. Financial and real estate businesses did exceptionally well at recovering from the pandemic,” said Rohit Arora, CEO of Biz2Credit and one of the leading experts on small business finance. “Retail also rebounded financially. Their challenges now are related to the supply chain, rather than consumer demand.”

Biz2Credit Top Small Business Industries Study Methodology

The Biz2Credit Recovery Ranking is featured in the newly released 2021 Top Small Business Industries Report. In this study, Biz2Credit, a leading online funding provider to small businesses, analyzed the financial performance of over 200,000 companies that submitted funding requests through the company’s online funding platform. The objective of the study is to identify the top industries for small businesses during the preceding year and to measure the performance of businesses based on their industry affiliation. All companies included in the analysis have less than 250 employees and less than $10 million in annual revenues. The report covered small businesses across the country, from start-ups to established companies.

About Biz2Credit

Founded in 2007, Biz2Credit has arranged more than $8 billion in small business financing. The company is expanding its industry leading Biz2X technology in custom digital platform solutions for banks and other financial institutions, investors, and service providers. Visit www.biz2credit.com or Twitter @Biz2Credit, Facebook, and LinkedIn.