CO-OP Solutions Payments Trends Report (Spending Data from January 1-31)

RANCHO CUCAMONGA, CA (February 23, 2023) — With a strong holiday shopping season in the rear-view mirror, January spending results were muted as consumer confidence dipped in response to mixed economic signals.

January’s surprisingly resilient jobs report bucked expectations of a coming recession, with employers adding 517,000 new jobs to the payroll, pushing unemployment down to just 3.4%. Inflation has been slowly trending downward in recent months, to a rate of 6.2% in January, but investors fear the combination of strong job growth and stubbornly resistant inflation figures will persuade the Federal Reserve to continue its year-long strategy of raising interest rates well into 2023.

Indeed, the Fed raised its benchmark lending rate by another 25 basis points at its February 1 meeting, while signaling more hikes to come, noting that inflation “has eased somewhat but remains elevated.”

Another major area of focus for the industry continues to be credit risk. According to NCUA’s Q3 2022 data, loss rates were historically low at 1.93%. However, in light of the Fed’s continued interest rate hikes and escalating economic stressors, charge-off rates are once again rising from the historic lows of the past few years – with predicted loss rates on par with those seen before the pandemic.

When combined with rising credit balances, stubborn inflation and higher interest rates, these rising loss rates are leading industry professionals to speculate that economic disruptions are ahead, although they are likely to be relatively mild as the economy resets from the widespread impacts of a worldwide pandemic.

Co-op’s SmartGrowth team members are closely watching the following key spending trends this month:

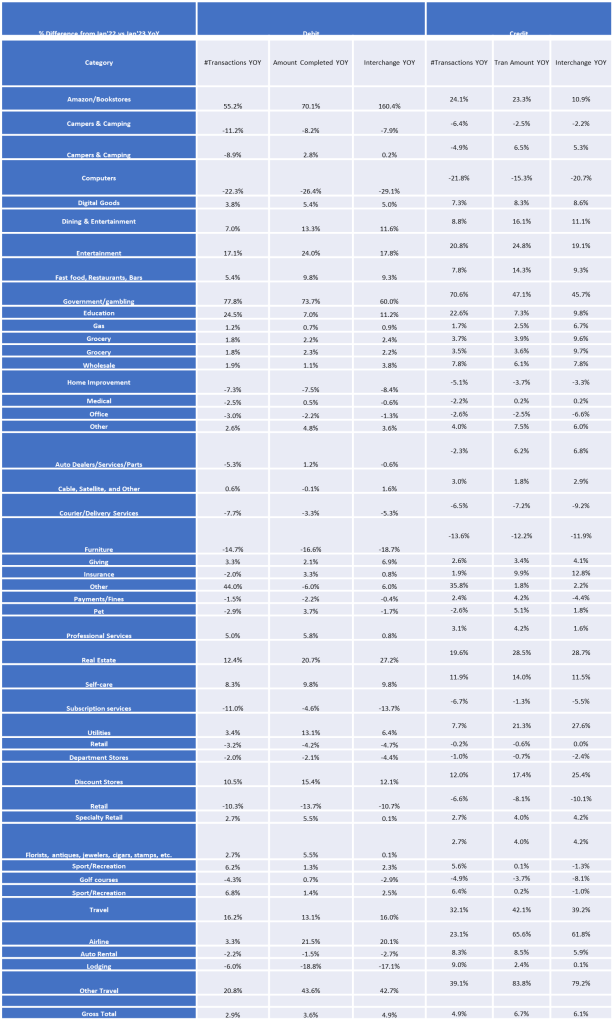

- Retail, Amazon post-holiday volumes up over prior year: Following strong holiday sales season numbers, retailers posted big declines in January, as is typical for this time of year. However, debit cardholders spent at much higher rates as compared with January 2022, increasing their Amazon transactions by over 50%. In comparison, credit cardholders increased their spend by 25% over the same period.

Other retail merchants, including department stores, did not fare as well – posting moderate declines on purchase transactions.

Amazon transactions declined by 29.3% in credit and 27.5% in debit from December 2022 to January 2023. These results, while expected after the holidays, come as Amazon warns of slower growth ahead in both its eCommerce and web services businesses, citing the challenging economic outlook

2. Travel ticks up: Travel purchases increased year-over-year by 16% on debit and 32% on credit. While some consumers prefer the travel protection of a credit card, the steady growth in both portfolios since January 2022 provides a continued positive outlook for the travel segment as we move into 2023.

“Travel has been one of the strongest categories over the past couple of years, particularly on credit,” said Beth Phillips, Director of Strategic Portfolio Growth, Co-op Solutions. “Travel is up by 28% in transaction count since January 2021, and by 8% since January 2022. This trend indicates the travel industry is poised for continued strong growth.

- Economic worries spur shift to debit: Although we have seen higher rates of credit spending – and ballooning credit card balances – as economic uncertainty grows, consumers have indicated they are focused on their own household budgets and may start shifting their spending behavior to debit.

Co-op’s January 2023 data showed an increase in debit transactions of 3% over January 2022, a rate of growth only 2% lower than credit. This represents a significant jump from January 2021, when transaction volumes fell by 8% on debit and 7% on credit.

According to The Conference Board’s Consumer Confidence Index, consumer confidence fell from 109.0 in December to 107.1 in January, with greater pessimism among lower-income and younger households. Consumers are concerned about the direction of the economy over the next six months, as many have already exhausted much of their savings reserves since the pandemic.

This economic uncertainty led to declines in January month-over-month credit transaction volume of -10.2%, while debit spending fell over the same period by a comparatively smaller -8.7%.

“Higher income households – including those professionals that receive a regular salary – are still faring better than lower-income, paycheck to paycheck households,” said John Patton, Senior Payments Advisor, Co-op Solutions. “But the latest surge in job growth has skewed toward lower-wage jobs in the leisure, hospitality and healthcare sectors, indicating that the professional ranks may begin feeling the pain soon as consumer confidence continues to decline.”

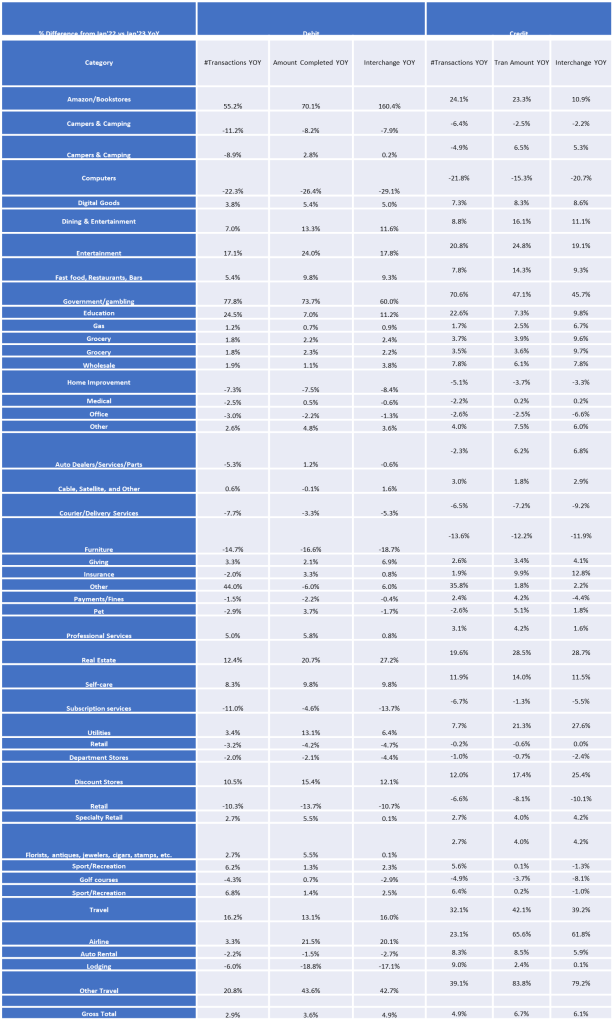

Month-Over-Month Category-Level Spending (Comparing January 2023 to December 2022)

Please note that the category spending below reflects month-over-month comparisons (rather than year-over-year) – i.e., compares January 2023 with December 2022, rather than January 2023 to January 2022.

What Credit Unions Should Do Now

Use Fed Increases to propel your program: As the Fed continues to raise interest rates, consumers who have been enticed by rich rewards programs are now starting to pay attention to their credit card rates. This shift in focus provides credit unions the opportunity to re-assert their value propositions – particularly their comparatively low rate and fee structures.

Credit unions should leverage this momentum to create new account rate and balance transfer promotions. While it is critical to be mindful of audience segmentation and risk exposure, it is just as important for credit unions to use this opportunity to optimize their portfolio.

Update pricing strategies for your program(s) – if you haven’t already: If credit card program pricing strategies have not been reviewed or updated in recent years, a repricing effort is critical to regain lost ground. While this effort may seem overwhelming, it is a critical step to ensure future program success. In addition, for most credit unions a modest increase in pricing will still keep their rates well under industry averages and will be a strength for the institution’s value proposition to their members.

Keep an eye on fraud trends: Economic uncertainty is also a fertile breeding ground for card fraud. Be sure to activate a fraud prevention strategy.

More information on the Co-op SmartGrowth Consulting Team can be found here.

About Co-op Solutions

Co-op Solutions is a credit union-owned financial technology platform built using an industry-leading ecosystem, and whose mission is to connect credit unions to the technology, strategic partnership and scale they need to best serve their members and grow now and into the future. Co-op Solutions partners with credit unions to unlock their potential so they can compete; does the hard work of innovation, creating a one-stop opportunity to help credit unions grow; and offers knowledge and expertise in a world where everything must be integrated. Founded in 1981, Co-op Solutions services 2,650 credit union clients, processes eight billion transactions annually, and manages a nationwide ATM network of more than 30,000 and a 5,700-location shared branch network. For more information, visit www.coop.org.