Costa Rican CU professionals learn about new innovations in California

World Council Immersion Learning Program leads San Diego exchange

MADISON, WI (December 17, 2019) — Credit union leaders and volunteers from Costa Rica-based CoopeAnde No. 1 recently visited four San Diego area credit unions as part of the World Council of Credit Unions’ Immersion Learning Program.

Through visits to East County Schools FCU, Frontwave CU, MyPoint CU and USE CU, the group learned how these credit unions are innovatively serving their members and the community.

The program is one of several immersion learning exchanges coordinated through World Council’s Global Classroom—an initiative that provides credit union professionals from around the world the opportunity to network and exchange perspectives on the shared challenges they face.

The nine-person delegation—in San Diego from Dec. 10-12—consisted of CEO Alexandra Márquez Massino Rojas, Board Chairman Gerardo Marín Arias, Board Vice Chairman Alberto Camacho Pereira, Board Secretary María López Porras, and Board members Nydia Durán Rodríguez, Mario Leal López, Milton Varela Villegas and Edgar Villalobos Morales, as well as Internal Auditor Karolina Vargas Arguedas. The group was joined by World Council Program Manager for Member Services Thomas Belekevich.

CoopeAnde—one of the largest credit unions in Latin America with assets of more than $900 million—was established in 1965 to serve members of the National Association of Educators (Ande), providing a financial solution to professionals within the education sector. It serves more than 70,000 members—from public, private, semi-private educational institutions and universities throughout the country—at 23 branch locations.

“Our exchange this week was a perfect example of credit unions’ local service with a global reach,” Belekevich said. “As technology changes the way we do business, it was enlightening for our colleagues from Costa Rica to see credit unions continued commitment to personalized service. The new perspectives shared by our hosts this week will be used by CoopeAnde to improve financial educational tools for members in communities throughout Costa Rica.”

EAST COUNTY SCHOOLS FCU AND FRONTWAVE CU

The round of visits began Dec. 10 at East County Schools FCU in El Cajon and Frontwave CU in Oceanside.

The Costa Rican group was able to speak with Bill Hale, a teacher with the La Mesa-Spring Valley School District and a member of the credit union, as well as with Board Chair Patty Floyd in addition to staff from the $123-million-asset-sized East County Schools FCU.

East County Schools provides a variety of programs for its 4,438 members, including an advanced payroll loan program for newly hired employees (who may have to wait up to a month to receive their first paychecks); loans to East County school districts for equipment; and loans of up to $500 at 0% interest for educators to help pay for school supplies and other materials. Hale, the science and math teacher, said he has zero budget for materials, so he frequently must solicit donations from parents.

As CEO Steve Devan quipped to the group: “Education is the only profession in the U.S. where people steal from home to bring to work.”

East County Schools also has what it calls its “CU2U” Service, which “brings” the credit union to school sites by appointment so members can open new accounts, apply for loans, and set up bill pay services, for example.

“Because we run as an employee benefit model, we’re allowed on campus to be very present in front of our members on a regular basis,” said Business Development Officer Karen Fleck.

For nearly 12 years, the credit union has sponsored and led the East County Chamber of Commerce’s Educators Tour to various countries as well as paid for one its members’ trip. In 2013, the Educators Tour went to Costa Rica. Due to the overwhelming success of the program, it has added an Educators Tour 2.0 with a return trip to Costa Rica in 2020. To the delight of the East County staff, the Costa Rican delegation said they wish to serve as a resource for the upcoming trip.

“The great care you have for your members, especially those dealing with difficult financial situations, is impressive,” said Coope Ande Board member Leal López. “It shows the great relationship you have with your members—that you’re always looking for better opportunities to help your members.”

In the afternoon, the group trekked to the headquarters of Frontwave CU, which has 109,000 members, 14 branches and $900 million in assets. The average age of its members is 34.

CEO Bill Birnie provided a brief history of the credit union, formed in 1952 as Camp Pendleton FCU. In 2001, the credit union changed to a state charter and a community field of membership and got a new name: Pacific Marine CU.

Chief Marketing Officer Todd Kern detailed the credit union’s successful 2018 name and brand change. The credit union changed its name from Pacific Marine CU, in part, because it was looking for something that would distinguish it from other financial institutions as well as other companies with similar sounding names. In a survey of non-members, it found two in three believed the name hurt it; among members, one in three believed the same.

One of the key objectives for the name and brand change was to build a brand that would resonate with its key audiences and better position the credit union for future success, Kern said. It also wanted a fun, fresh and modern brand that also conveyed a sense of openness to the broader community. Frontwave’s four new branches feature the new branding and it has remodeled two branches so far with the new look. All six have a Frontwave CU store in which members can buy branded items such as t-shirts and caps. All the proceeds go to local charities, Kern said.

The Costa Rican delegation—who also went on tours of the call center and IT department—were impressed by the Frontwave CU video that spotlighted its new eye-catching and bold branding.

MyPoint CU

On Dec. 11, the group visited the newly opened North Park branch of MyPoint CU. There, Vice President of Marketing Heather Dueitt along with CEO Dave Brooke, Vice President of Retail Operations Christopher Crockett and Business Development Manager Adriana Brunner (who frequently served as an interpreter) showcased the credit union’s prototype branch experience and new branding.

Like Frontwave CU, MyPoint was seeking a brand that would stand out in a very competitive market. The credit union was chartered more than 70 years ago to serve the Point Loma neighborhood of San Diego. In 1998, it changed to state as well as a community charter. “There were too many people that associated us with that community (Point Loma), so it was time to make a change,” Brooke said.

The end result was a new name and branding for the $550-million-asset-sized credit union that just debuted nearly 50 days ago. The color scheme of the credit union changed from blue to orange—and everything within the credit union features that color accent. You can even smell a citrusy scent as you walk into the branches.

The North Park branch is the prototype for how the credit union envisions to remake the rest of its branches. Just two months old, the branch reflects the local community. Residents love their dogs and can often be seen walking them around the area, so the branch even has a dog water bowl in front. It also features decorations and furniture from local stores and photos of members, Dueitt said.

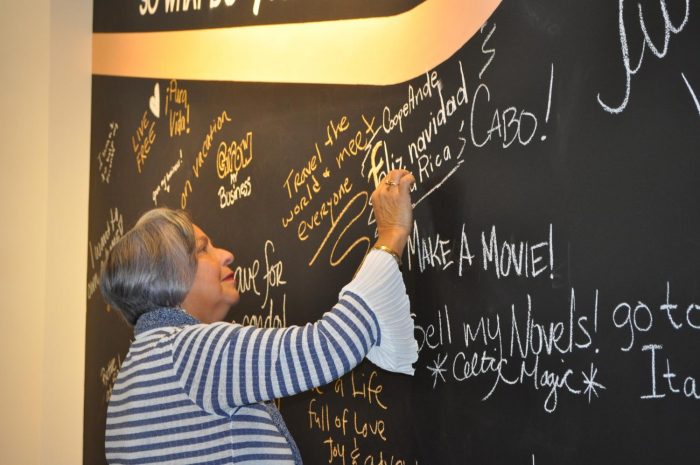

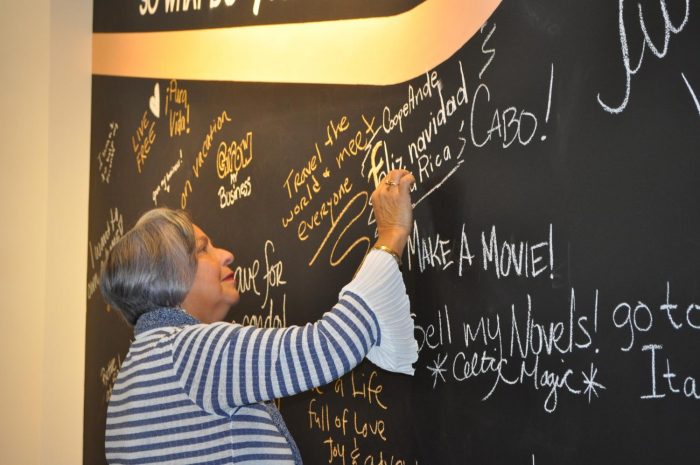

A key visual element of the branch is the “Wish Wall”, a giant black chalkboard in which members can write their financial wishes or goals. The wall has been such a huge success, staff had to erase the board to make room for more wishes, Dueitt said. It’s a small space but one that provides multifunctionality. There are no teller lines, but there’s a station in which members can come in and use their computers to look at emails, for example. It also has a conference room that can be converted into office space.

“We never want to stop improving,” Brooke added. “We’re always looking to make it easier for our members to do business with us.”

CoopeAnde Board Chairman Marín Arias said it is also looking at doing the same thing as MyPoint. “Your example has generated a lot of ideas, which will be useful for us,” he said.

USE CU

On Dec. 11, the delegation visited both the University & State Employees Credit Union (USE CU) La Mesa Branch as well as its corporate office in San Diego.

Unlike the other visits, this one featured more of a roundtable question and answer session, which provided the Costa Ricans the opportunity to follow up on any questions they might have from earlier meetings or touch on things they hadn’t yet explored.

USE CU—founded in 1936 and considered one of the oldest credit unions in California—has more than $950 million in assets and serves more than 60,000 members throughout the state. It has eight branches.

The group and USE CU staff, including Chief Experience Officer Paris Chevalier and Vice President of Marketing Amber Fielder, discussed the differences in board governance. The visitors were also very interested to hear how the credit union handled the transition from being focused on serving solely university and state employees to a community charter.

East County FCU staff with the delegation from CoopAnde #1 in Costa Rica.

Frontwave CU staff, including CEO Bill Birnie (center in black suit), with the delegation from CoopeAnde #1.

MyPoint CU and CoopeAnde staff in front of MyPoint’s North Park Branch’s popular Wish Wall.

USE CU staff show the Costa Rican group its

CoopeAnde Board member Nydia Durán Rodríguez puts her wishes on the MyPoint CU Wish Wall.

About World Council of Credit Unions

World Council of Credit Unions is the global trade association and development platform for credit unions. World Council promotes the sustainable development of credit unions and other financial cooperatives around the world to empower people through access to high quality and affordable financial services. World Council advocates on behalf of the global credit union system before international organizations and works with national governments to improve legislation and regulation. Its technical assistance programs introduce new tools and technologies to strengthen credit unions' financial performance and increase their outreach.

World Council has implemented 300+ technical assistance programs in 90 countries. Worldwide, 82,758 credit unions in 97 countries serve 404 million people. Learn more about World Council's impact around the world at www.woccu.org.

About CCUL

The California Credit Union League and the Nevada Credit Union League are the trade associations for credit unions in both states. They serve 249 credit unions in California and Nevada with more than 11.3 million members with more than $187 billion in assets. For more information contact Tina Ramos-Ingold, 909-212-6050, tinar@ccul.org.