Press

Credit unions resolve to be heard on second RBC Proposal

Credit Union Voices sponsors successful in-person “raise-your voice” event at CUNA GAC

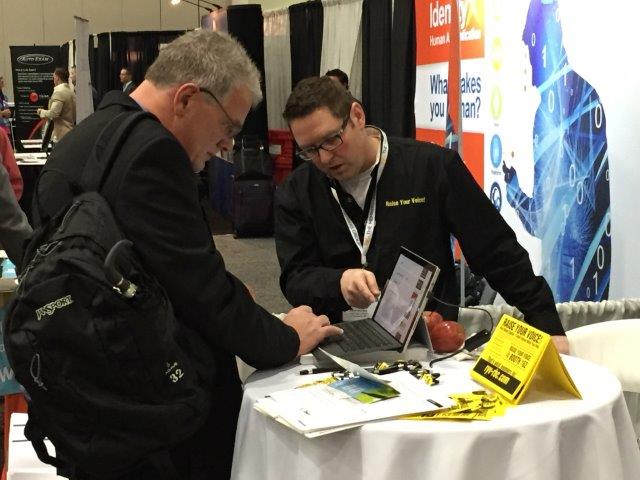

WASHINGTON, DC (March 17, 2015) — Numerous credit union volunteers, leaders and staff stopped by the Credit Union Voices booth at CUNA’s Governmental Affairs Conference to express concerns about NCUA’s revised proposed risk-based capital rule.

“We saw a lot of activity in the Credit Union Voices booth,” said David Damstra, Vice President of Marketing Services and Creative Director for CU*Answers. “We spoke with a lot of credit union members, who are enthusiastic not only about raising their voices on the RBC issue, but also the easy process Credit Union Voices has developed for commenting. ”

Moreover, while many had already submitted letters, nearly 50 additional attendees filed comments with NCUA on the spot via Credit Union Voices’ online terminals. The consensus: The latest version of the RBC regulation continues to be unnecessary and potentially harmful.

“To say that NCUA’s revised RBC rule is a ‘problem looking for a solution’ is too kind, since it presumes that if there were an actual problem, RBC II would be a reasonable solution,” said Doug Fecher, President/CEO of Wright-Patt Credit Union in Beaver Creek, Ohio. “I prefer to say it this way … ‘NCUA’s revised RBC rule is a solution that won’t work for a problem that doesn’t exist.’ ”

Fecher isn’t alone in his observation.

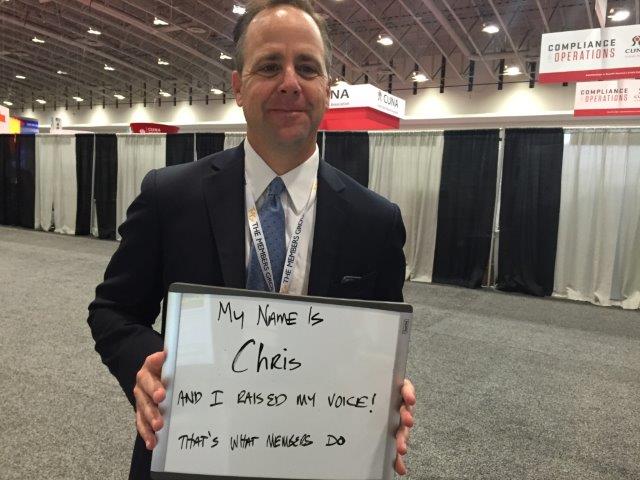

“The rule undermines the core of credit union effectiveness by having government rules, not the member-owner’s wellbeing, be the focus of business strategy,” wrote Chris Otey, Chief Revenue Officer at Woodland Hills, Calif.-based CU Wallet, and Vice Chairman of South Bay Credit Union in Redondo Beach, Calif.

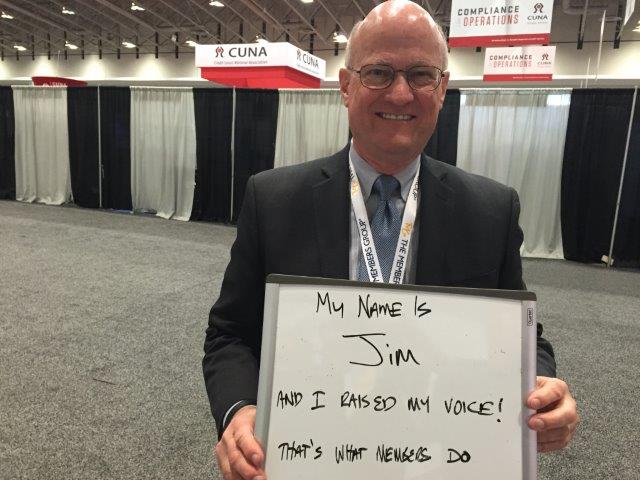

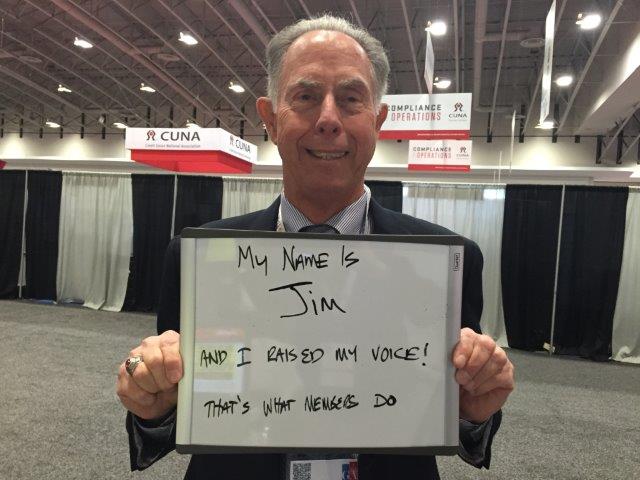

Another commenter, Jim Jordan, President/CEO of Schools Financial Credit Union in Sacramento, Calif., stated, “The revised RBC rule penalizes credit unions for specific activities such as real estate lending, member business lending, and credit unions chartered to assist the un-bankable by placing a capital tax on the resulting assets of low income or poor credit lending.”

Some commenters didn’t mince words: “This is the worst rule since the Stamp Act,” wrote Melissa Hunt, Chief Operating Officer and SVP, Credit Union Student Choice.

And Michael Wettrich, President/CEO of Education First Credit Union in Westerville, Ohio, stated NCUA should not “force my credit union to institute changes both potentially drastic and unwarranted in our balance sheet to meet arbitrary weights.”

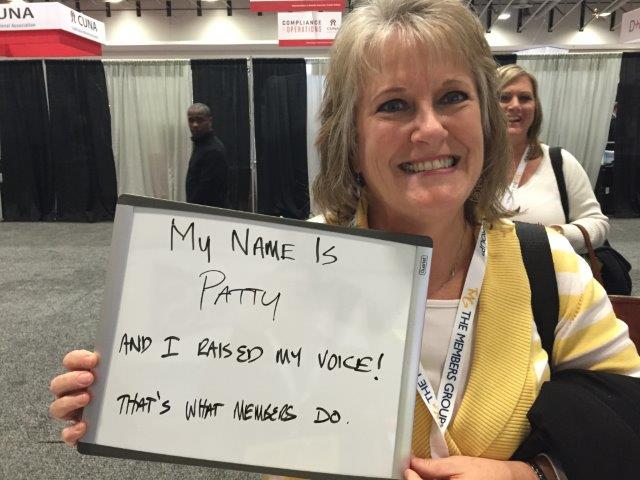

Another commenter, Patty Sarne, COO/SVP of San Antonio Citizens Federal Credit Union wrote, “We believe NCUA again focused on the potential risk to the insurance fund rather than those they regulate and their members.”

Credit unions and their service partners weren’t the only ones stating concerns about RBC II at the GAC.

Geoff Bacino, former NCUA Board Member and Principal with Bacino & Associates, wrote, “As NCUA continues to work on the RBC regulation, I would urge the agency to recognize the unique nature of credit unions with regard to how capital is considered. Bank regulations should not be less burdensome and onerous than those confronting credit unions.”

And speaking before GAC attendees March 10, current NCUA Board Member J. Mark McWatters said, “The credit union cooperative, not-for-profit structure is radically different from the shareholder, for-profit model.” In January, McWatters voted against releasing the revised proposed RBC rule.

Callahan & Associates Chairman Chip Filson emphasized that having a comment process at the GAC is not a one-time event.

“Credit Union Voices will be a continuing effort to alert credit unions to the importance of weighing in on any regulatory issue or other area of concern to the industry,” he said. “For RBC this time around, it comes down to the simple question: Is this good public policy or not? All the data suggests the ratios can never be done right; so the issue is not about the details, but about whether RBC works, and is appropriate for the cooperative model.”

Filson says commenting on RBC II is even more vital than before because while “battle fatigue” may be keeping some from responding, it could be mistakenly interpreted as an endorsement of the revised rule.

Credit Union Voices is an informal alliance of credit unions, service providers and business partners that use a “crowdsourcing” process to provide information and support on regulatory issues important to the industry. The alliance first launched its efforts in response to the initial proposed risk-based capital rule, helping to facilitate the submission of comment letters to the NCUA. For more information, visit Credit Union Voices online.

About Credit Union Voices

Credit Union Voices is an alliance comprised of credit union organizations that are bringing attention to critical issues affecting the industry. Their mission is to provide information and education that encourage the credit union community to speak up on behalf of the 100 million-plus people who rely on their credit unions for financial services and support.

Credit Unions Resolve to Be Heard On Second RBC Proposal. Numerous credit union volunteers, leaders and staff stopped by the Credit Union Voices booth at CUNA’s Governmental Affairs Conference to express concerns about NCUA’s revised proposed risk-based capital rule.

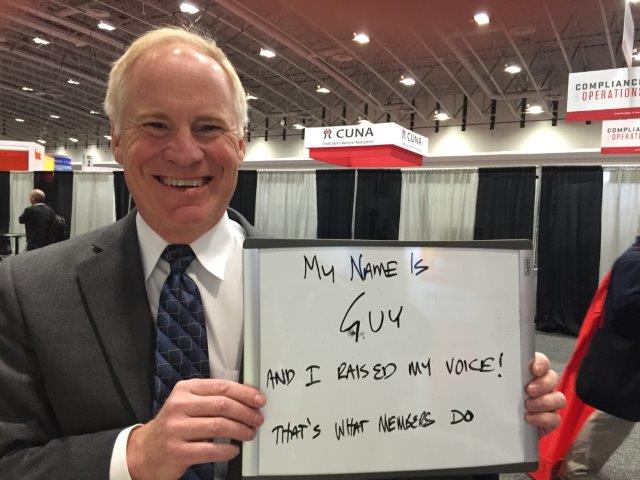

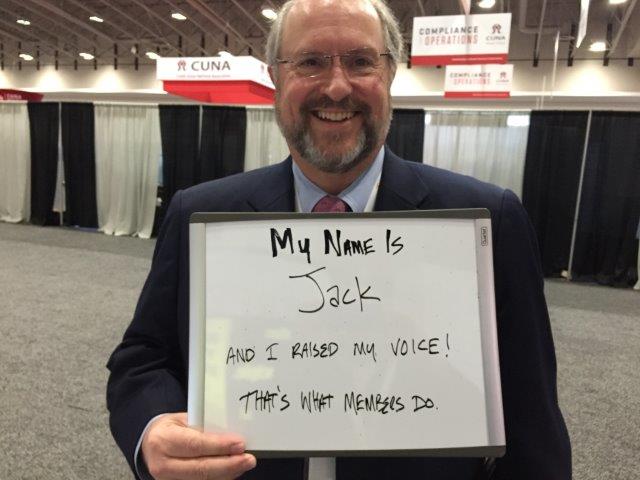

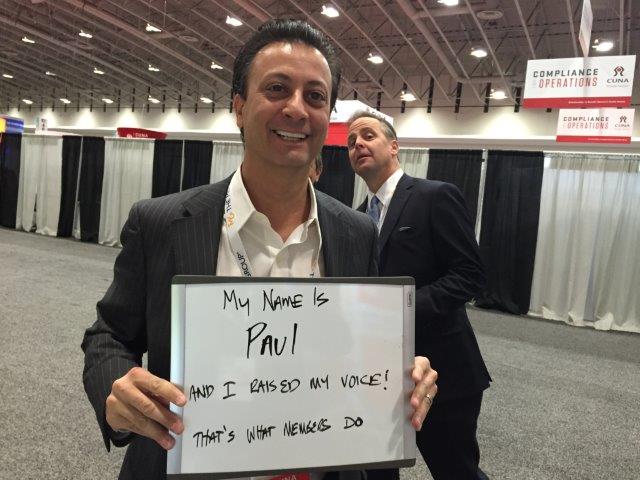

Photos: Jack Antonini, CEO at NACUSO; Samantha Betts, Account Management Coordinator at Callahan & Associates; Jim Cardwell, Principal at Cardwell Leadership;

David Damstra, VP, Marketing with Jim Vilker, VP, Professional Services at CU*Answers; Paul Fiore, CEO and Founder at CU Wallet; Melissa Hunt, COO/SVP at CU Student Choice; Jim Jordan, President/CEO at Schools Financial CU; Kevin Lytle, Vice President, Business Partnerships at True North Custom; Guy Messick, Esq., Partner at Messick & Lauer; Chris Otey, Chief Revenue Officer at CU Wallet/Vice Chairman, South Bay Credit Union; Rick Rice, Chairman at Indiana Department of Financial Institutions; Patty Sarne, COO/SVP at San Antonio Citizens FCU; Michael Wettrich, President/CEO at Education First CU