Diversity, equity and inclusion take center stage at 2021 World Credit Union Conference

Day one afternoon session features keynote speech on DEI, breakout sessions on Open Banking

MADISON, WI (July 15, 2021) — Diversity, Equity and Inclusion (DEI) thought leader Raven Solomon helped credit union professionals get “future ready” in the second 2021 World Credit Union Conference (WCUC) keynote speech, which focused on generational equity.

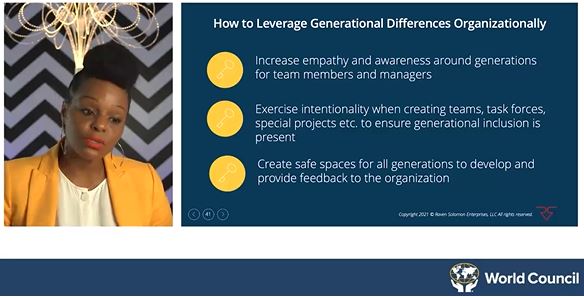

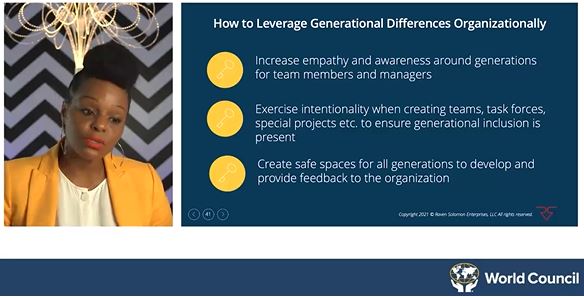

Solomon explained how the modern workplace is probably more complicated than any before it, with four or five generations of workers from different racial and cultural backgrounds working alongside one another each day. Solomon said failing to recognize the communication issues that result from those differences can cause problems in talent retention and recruitment for an organization. Solomon also provided credit union professionals with advice and guidelines they can follow to leverage those generational differences.

“Cross-generational employee resource groups, reverse-mentoring programs where not just the older person is mentoring the younger person—but it goes in reverse—and generational trainings just like this to really help us increase the awareness around the differences that exist amongst us,” said Solomon, who whose keynote address was sponsored by PSCU.

A Wednesday evening DEI breakout session conducted by Synergy Consulting LLC President Tracie Daniels focused on how credit unions can manage implicit bias.

Daniels explored common types of implicit biases and how they are developed, perpetuated and displayed in our workplaces. She also offered strategies for reducing our implicit biases and how reducing implicit bias leads to inclusion.

“People have to be internally motivated to be fair in every interaction in order to develop that self-awareness. It takes time, it takes patience and it takes learning, but it can be done,” said Daniels.

Open Banking

Attendees of two afternoon breakout sessions learned about the status of Open Banking in various regions of the world and what they need to know about it moving forward.

“Open Banking and Privacy: Emerging Regulatory Issues” focused on how worldwide changes to privacy regulations are shifting control of data to consumers and how those changes might impact credit unions.

Experts from the United States, Canada and Europe gave regional perspectives on the implications of open banking on retail financial products, such as loans and mortgages, to payments. These changes may require significant and expensive operational changes for credit unions, as well providing more access to member data (beyond payments) to third-party providers.

“The motivation is to foster competition and innovation in the retail financial services market, and also to increase efficiency and create a more inclusive environment for the unbanked or the newly-banked, without losing sight of financial system stability or consumer rights’ protection,” said Paloma Garcia, Senior Consultant and Head of Payments Practice at Afore Consulting, a Belgian firm that specializes in EU financial regulations.

Whether Open Banking is a threat to credit unions or a once-in-a-generation opportunity for them was the focus of a separate breakout session conducted by Rob Hale, Chief Digital Officer for Regional Australia Bank, a customer owned bank based in southeast Australia.

No country has made greater strides toward establishing a functional regulatory ecosystem for Open Banking than Australia—and Regional Australia Bank took an early and active role in that process. Hale advises all financial institutions do the same when Open Banking becomes a priority in their country or region.

“Get involved, get involved early,” said Hale. “Take some ownership of this and get involved on the ground floor and actually help inform and contribute to the evolution of the rules and how consumers are going to benefit from that.”

Still to come

The 2021 World Credit Union Conference continues Thursday with Worldwide Foundation for Credit Unions Day.

Worldwide Foundation Day features:

- International Credit Union Development Educators (I-CUDE) Class of 2021 Celebration.

- A Global Good Gathering – featuring an update on the Bridge the Gap campaign.

- Global Giving: What the Future Holds – featuring a panel of global credit union foundation leaders discussing the state of credit union philanthropy.

Follow conference activities on Facebook, Twitter and Instagram with #WCUC2021.

The 2021 World Credit Union Conference runs through Wednesday, July 21.

Raven Solomon

Tracie Daniels

Paloma Garcia

Rob Hale

About World Council of Credit Unions

World Council of Credit Unions is the global trade association and development platform for credit unions. World Council promotes the sustainable development of credit unions and other financial cooperatives around the world to empower people through access to high quality and affordable financial services. World Council advocates on behalf of the global credit union system before international organizations and works with national governments to improve legislation and regulation. Its technical assistance programs introduce new tools and technologies to strengthen credit unions' financial performance and increase their outreach.

World Council has implemented 300+ technical assistance programs in 90 countries. Worldwide, 82,758 credit unions in 97 countries serve 404 million people. Learn more about World Council's impact around the world at www.woccu.org.