‘Information Governance’ is new 2020 wildcard for credit unions

Industry unaware of importance in growth, risk management, data value, competition

FAIRFIELD, CA (December 2, 2019) — As credit unions balance evolving data practices, compliance risks, economic unknowns and other issues in the consumer banking landscape, the year 2020 could be the beginning of a new era within “information governance” for the entire industry.

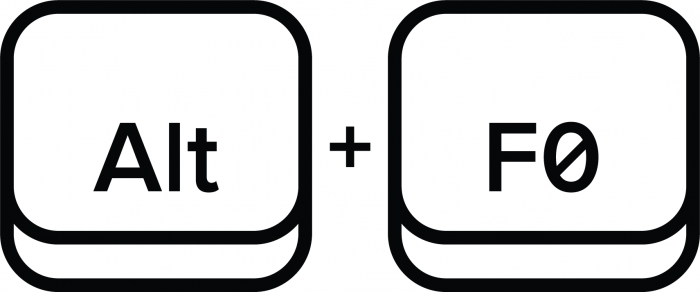

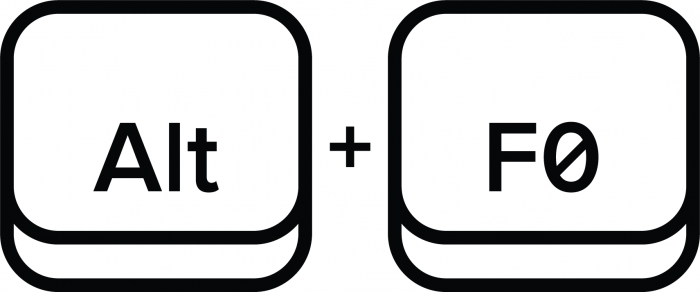

According to the latest findings and analysis by Alt + F0:

- Very few credit unions nationwide — especially small to medium asset-size institutions — are just now beginning to open the door to what information governance is and how it relates to their members. Credit unions will have to “play catch up” to other industries already applying information governance.

- A small handful of credit union executives who manage member-technology engagement are finally starting to recognize that information governance goes far beyond the traditional records-administration era that’s proliferated since businesses started accelerating collection of consumer data in the early 2000s.

- Only a modest share of credit union industry leaders have recognized that information governance holds the key to leveraging future membership growth, risk management, data asset-value, and competition within financial services.

- Maria Martinez-Carey, founder and principal of Alt + F0 (materials attached), is available to discuss the member, data, risk and other information governance implications and issues facing credit unions in 2020: info@altf0.com

Are CUs Connecting 5 Core Areas?

“Today, we’re at the very early stages of ‘information governance’ capturing the attention of key decisionmakers within the credit union industry as we transition into a new year and a new decade,” Martinez-Carey said. “Anchored by the industry’s ‘people helping people’ philosophy, credit unions will want to begin using information governance to their advantage as they face competition from fintechs, banks, and scrutiny of data management and security by regulators and auditors.”

When harnessed in conjunction with a credit union’s data and records-retention efforts, Alt + F0’s credit union information governance platform draws together unique connections between five core operational areas to paint an ongoing, interconnected visual of credit union members’ data, lives, and current and future needs. These five universal core areas can be overlaid across each other to discover and lock-in higher data-and-records efficiencies. They include: 1) records and information; 2) business operations; 3) privacy and security; 4) information technology; and 5) legal holds.

Alt + F0’s LOCK audit readiness platform tool helps credit unions and organizations in other industries scale and mature their management of data. While implementing information governance starts with being “audit ready” for internal management and external third parties, this initial process is far from complete. Eventually, linking all five core operational components increases a credit union’s total data-value on all members while simultaneously decreasing regulatory examination liabilities, privacy risk, and scrutiny on the backend.

Industry Should Study Patterns and Relationships

Some credit union CIOs, operation risk managers, records-retention specialists and others are beginning to pay more attention to information governance while others are just now stepping into the awareness and learning phase. They realize that credit union information governance is a forward-looking and holistic way to leverage members’ data, distinctively comply with regulations, and approach long-term product lifecycles at the highest level.

“The traditional ‘records management’ and ‘data management’ seen in our industry over the past several years won’t cut it for addressing credit unions’ increasingly sophisticated compliance needs, regulatory demands, and the urgency to retain members and innovate with the future,” said Martinez-Carey, who developed LOCK. “A new era in banking stands in front of us that requires information governance for credit unions.”

Unlike other approaches to reaping value within data and records in the banking arena today, credit unions choosing information governance will begin extracting a network of integrated relationships on members from the very beginning of their memberships to current-day activities. Today’s rapidly changing banking environment requires a higher-profile perspective of existing and future credit union members.

‘At the Heart’ of CUs’ Member-Owner Philosophy

Credit unions can choose to make information governance a priority.

“They have the opportunity to enter a new decade with their special member-owner philosophy — all while continuing to do what’s right for their institutions and members,” Martinez-Carey added. “Information governance is at the heart of these principles and stands ready to help credit unions and their members going forward.”

Maria Martinez-Carey.

About Alt + F0

Alt + F0, (Fairfield, CA) an Information Governance (IG) solutions provider dedicated to helping credit unions build and utilize Information Governance systems to manage and leverage the lifecycle of member data through its LOCK software service (SaaS) and other solutions. Maria Martinez-Carey is the founder and principal of Alt + F0.