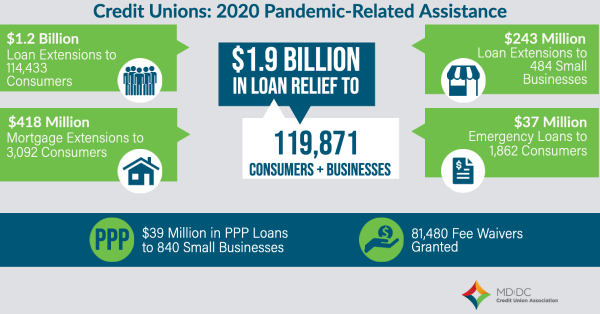

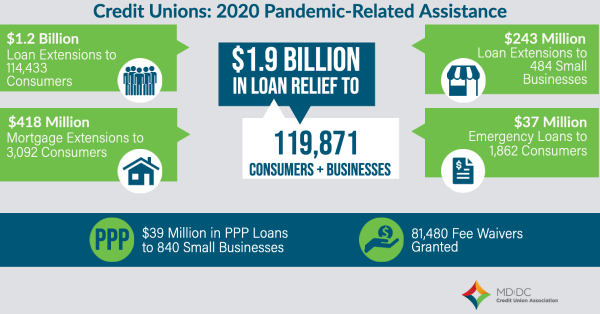

Maryland and DC Credit Unions provide $1.9 billion in loan relief to over 119,000 consumers and businesses

COLUMBIA, MD (February 22, 2021) —

Credit unions in the Maryland and DC region helped provide financial lifelines to members experiencing pandemic-related economic hardship. A survey recently conducted by the MD|DC Credit Union Association reveals that in 2020, more than 119,800 consumers and businesses received over $1.9 billion in loan relief from area credit unions.

“Recognizing the financial pressures caused by the pandemic, credit unions did what they have always done during times of crisis, serve their members’ changing needs,” said MD|DC Credit Union Association President/CEO John Bratsakis. “Credit unions responded by offering low- or no-interest hardship loans, fee waivers as well as mortgage deferments and forbearances and other assistance programs. As the pandemic unfolded credit unions also adjusted their operations to continue to provide access to essential financial services.”

The survey results highlight how, and to what extent, credit unions assisted members during the COVID-19 crisis in 2020:

- $1.9 billion in loan relief to 119,871 consumers and businesses

- $1.2 billion in loan extensions (deferment and forbearance) to 114,433 consumers

- $418 million in mortgage deferments/forbearances to 3,092 consumers

- $37 million in emergency low- or no-interest loans to 1,862 consumers

- $243 million in loan extensions to 484 small businesses

- $39 million in PPP loans to 840 small businesses

81,480 fee waivers granted

About MD|DC Credit Union Association

MD|DC Credit Union Association President/CEO John Bratsakis, congratulated Noll on his recognition: “Congratulations Brett! Your leadership and dedication have not only advanced FedChoice Federal Credit Union but also enhanced the lives of its members and the broader community. Your recognition as the 2024 Professional of the Year is a testament to your outstanding contributions and unwavering commitment to financial empowerment.”