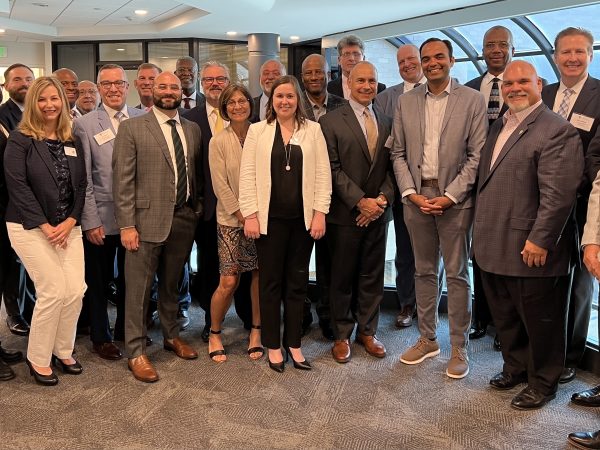

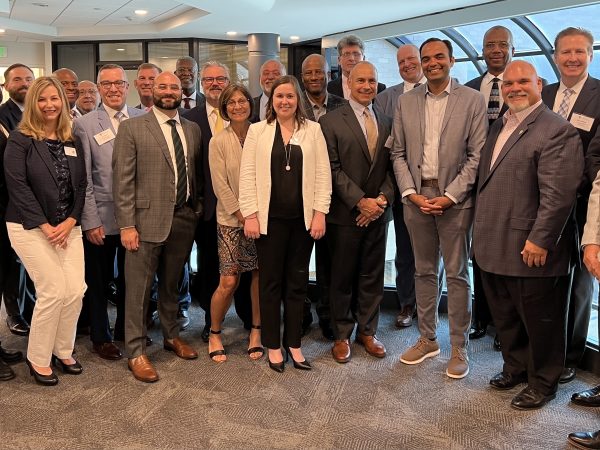

MD|DC Credit Union Association hosts roundtable with CFPB Director

COLUMBIA, MD (July 18, 2022) — The MD|DC Credit Union Association hosted the first industry in-person roundtable discussion with Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra and local credit union executives on Friday. Director Chopra has called it a key priority to engage with small banks and credit unions that are not directly supervised by the CFPB.

“We appreciate CFPB Director Chopra taking the time to meet in-person with our members and the opportunity to share credit unions’ consumer-focused approach to financial services,” said John Bratsakis, president/CEO of the MD|DC Credit Union Association. “It was a productive discussion that touched on a wide range of issues impacting area credit unions and the 2.2 million members they serve. We look forward to continued engagement and further opportunities to weigh in on bureau initiatives as they are being developed.”

During the hour-long discussion, credit union executives shared how diverting resources to keep up with overly burdensome regulations designed for big banks can have an adverse effect on consumers.

Director Chopra outlined key areas of focus for the bureau, which included:

- Examining fees such as overdraft, non-sufficient fund fees, and credit card late fees to understand the impact on consumers. Director Chopra was clear that the focus is on encouraging financial institutions to review fee policies to make sure they work in the best interest of consumers.

- Addressing challenges with the heavily consolidated core services provider market to ensure fair and market-driven services that are adaptable and flexible.

- Preserving Relationship Banking in an era of consolidation and digitization by giving consumers the right to timely information about their accounts from banks and credit unions with over $10 billion in assets.

- Supervision of nonbank entities and fintechs to protect consumers and level the playing field between banks and nonbanks.

- Establish a framework for giving consumers access rights to their financial data per section 1033 of the Dodd-Frank Act.

- Small business lending data collection rulemaking related to data collection for women-owned, minority-owned, and small-business loans under the Equal Credit Opportunity Act. Credit unions expressed concern about several required data points not regularly collected during the loan process.

Credit unions executives are encouraged to submit an application to serve on the CFPB’s Credit Union Advisory Council which advises the bureau on regulating products and services from the unique perspective of credit unions. The deadline to apply is July 24.

About MD|DC Credit Union Association

MD|DC Credit Union Association President/CEO John Bratsakis, congratulated Noll on his recognition: “Congratulations Brett! Your leadership and dedication have not only advanced FedChoice Federal Credit Union but also enhanced the lives of its members and the broader community. Your recognition as the 2024 Professional of the Year is a testament to your outstanding contributions and unwavering commitment to financial empowerment.”