Press

NAFCU: NCUA’s proposed two-tiered approach to risk-based capital would cost credit unions $760 million

WASHINGTON, DC (January 22, 2015) — National Association of Federal Credit Unions (NAFCU) Director of Research/Chief Economist Curt Long issued the following statement today regarding the astronomical costs of the National Credit Union Administration’s (NCUA) proposed two-tiered approach to risk-based capital ratio advanced in the agency’s second risk-based capital proposal.

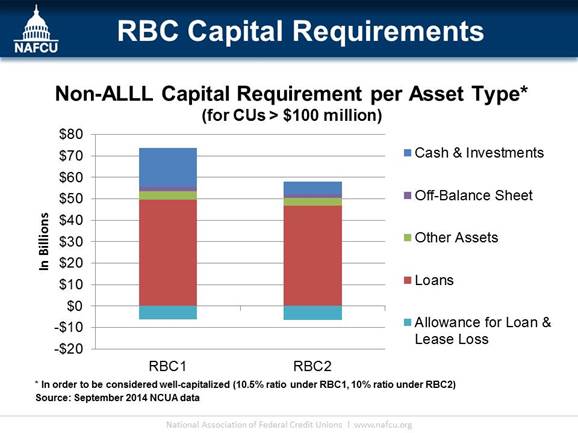

“Based on our financial analysis, credit unions’ capital cushions will suffer a $490 million hit if NCUA promulgates a two-tier approach to risk-based capital” said Long. “The specifics are even more astronomical. In order to satisfy the proposal’s ‘well-capitalized’ thresholds, today’s credit unions would need to raise an additional $760 million. On the other hand, to satisfy the proposal’s ‘adequately capitalized’ thresholds, today’s credit unions would need to raise an additional $270 million. NAFCU believes these shocking costs clearly demonstrate that the proposal misclassifies safe, sound credit unions and imposes the unnecessary burden to raise additional capital in order to maintain their current capital buffers or avoid prompt corrective action.”

“Even though this rule looks better on paper than the last one, almost all of the substantive changes to the risk weights were made to investments. So I think we’ll really have to look at this rule in tandem with the upcoming interest rate risk rule before we can know whether it is materially better than the initial risk-based capital proposal.”

“We continue to challenge the agency’s legal authority to implement this system, which based on our figures would clearly hinder credit unions’ viability and prosperity. NAFCU strongly believes this proposal is costly and unnecessary for an industry that is already extremely well-capitalized.”

The National Association of Federal Credit Unions is the only national trade association that exclusively represents the interests of federally chartered credit unions before the federal government and the public.