Northwest Community Credit Union short-term loans, powered by QCash Financial’s platform, are meeting member needs

Headquartered in Eugene, Oregon, Northwest Community Credit Union (NWCU) launched two new products earlier this year called Northwest Cash and Northwest Cash Plus, offering short-term loans from $150 to $700 and $701 to $4,000, respectively. Both products are designed to help their members deal with unexpected cash needs with an easy to use application process.

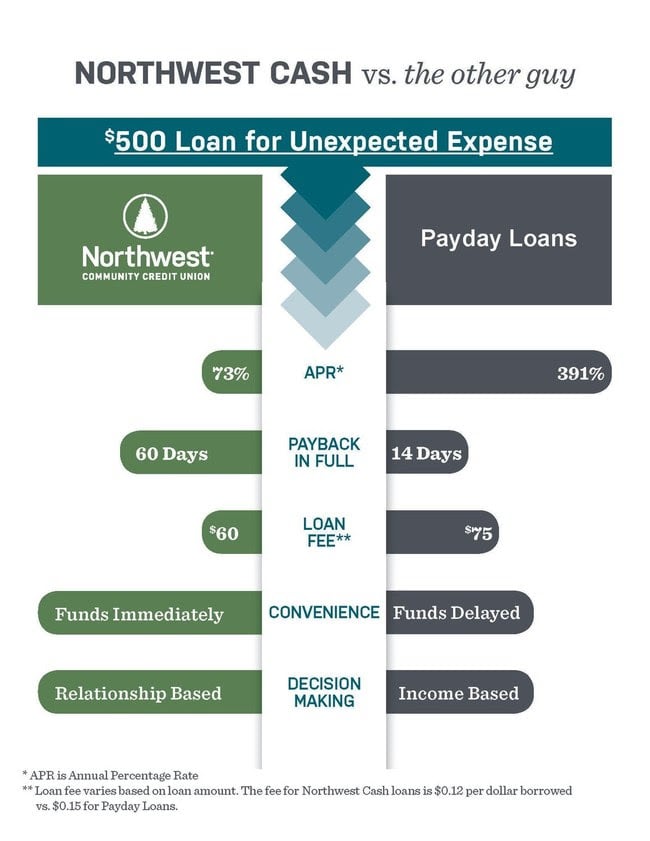

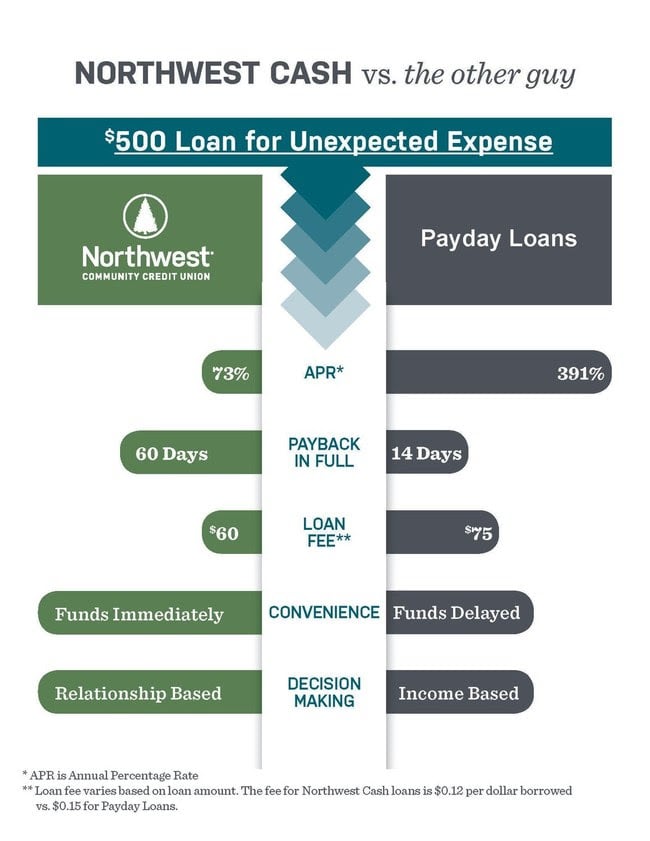

Using QCash Financial’s white-label, digital lending platform, NWCU automated the loan process using the member’s credit union relationship to make the lending decision rather than credit history. Members learn immediately what they qualify for and the funds are deposited into the account right away. The fees and rates are configurable by each financial institution and are substantially lower than traditional short-term lenders.

“I was initially skeptical of the credit risk and the potential member cost associated with these loans,” said NWCU Business Intelligence Manager, Sam Stratton.

“After viewing a Pew Charitable Trust webinar on small dollar lending, I changed my thinking. Pew described the scenarios that lead to consumers using high-cost, short-term loans. Those without access to traditional credit often turn to payday loans and overdrafts with triple digit APRs.”

NWCU studied its membership and found a significant portion of members did, in fact, use traditional payday lending.

“Since we launched the products in January, we’ve funded more than 1,000 loans and have heard several touching stories from members which underscore the critical need for this type of loan product,” said Teri Scott, NWCU Director of Support Services.

“One member took out two NW Cash loans to help make ends meet during his paternity leave. Another member had been out of work for two weeks and was struggling to pay bills. A NWCU phone center agent recommended he apply and he cried tears of joy when he was approved.”

“We have the great privilege of hearing stories like this all the time,” said Ben Morales, QCash Financial CEO. “The Northwest Community Credit Union team understands how important access to cash is as a first step in breaking the debt cycle. Our platform is an easy way for credit unions to make a tremendous difference in the lives of their members,” noted Morales.

Loan approval is immediate and based on the history with Northwest Community Credit Union, not a credit score.

About Northwest Community Credit Union

Northwest Community Credit Union (NWCU) is headquartered in Eugene, Oregon. Originally founded by six members of a wood products corporation in 1949, NWCU has grown to serve a diversified membership of 115,000 and over $1.1 billionin member-owned assets, with locations in 11 Oregon cities.