PenFed welcomes Chairman of National Credit Union Administration at Board Education Conference

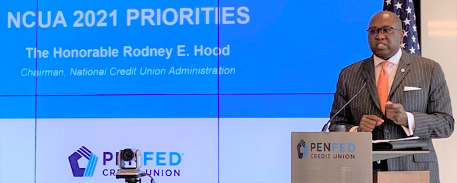

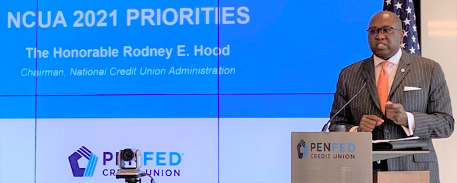

SAN ANTONIO, VA (January 19, 2021) — PenFed Credit Union, the nation’s second largest federal credit union, hosted its Board Education Conference on Saturday Jan. 16 with five expert speakers—including the first in-person event by National Credit Union Administration (NCUA) Chairman Rodney E. Hood since March 2020.

Speaking to the 11 members of PenFed’s volunteer Board of Directors, five members of PenFed’s volunteer Supervisory Committee and nine members of PenFed’s Executive Team, Chairman Hood presented a positive outlook for the credit union industry. Chairman Hood asserted that on the strength of credit union share growth, the National Credit Union Share Insurance Fund is carrying sufficient equity to withstand the pandemic. Chairman Hood emphasized that he sees no need for the insurance fund to charge a premium at this time, and he assured that NCUA leaders are working to encourage credit unions’ growth while maintaining safety and soundness.

“PenFed is honored that Chairman Hood agreed to speak in person at PenFed and share his priorities for NCUA,” said PenFed President & CEO James Schenck. “Chairman Hood highlighted many NCUA regulatory and supervisory changes designed to provide credit unions more flexibility in serving our members. We strongly support Chairman Hood’s goal to ‘create a regulatory system that is effective, but not excessive.’”

Chairman Hood also answered questions from PenFed leaders. PenFed Chairman Ed Cody, who as a student worked as a teller at a church credit union, asked how larger credit unions can support smaller credit unions. Chairman Hood observed that many credit unions received record share growth in 2020 and are looking for opportunities to acquire assets.

Chairman Hood thanked PenFed for selling and participating in $5.3 billion worth of loans to other credit unions in 2020. He suggested NCUA could play a role in facilitating connections between credit unions seeking to sell assets and credit unions seeking to buy assets, in order to keep those assets within the credit union system.

Other insights from speakers at PenFed’s Board Education Conference:

- Stifel Chief Economist Lindsey M. Piegza, Ph.D., forecast that interest rates will remain near record lows through 2023.

- Global Workplace Analytics President Kate Lister shared best practices for facilitating remote workers.

- Independent Consultant Phillip Merrick recommended that the new cybersecurity perimeter in the cloud era must include three lines of defense: people, data, and automation.

- PwC Banking & Capital Markets Leader Peter Pollini predicted the future of mortgages will be a 100% digital experience—from pre-approvals to applications to electronic signatures.

“If we as credit union leaders think we have all the answers, we will fail miserably,” Schenck concluded. “That’s why PenFed is committed to bringing in outside experts to discuss timely topics that impact the future of financial services. We thank the PenFed Board Planning Committee for putting together an exceptional Education Conference that will shape our strategy to serve more members in the future.”

NCUA Chairman Rodney E. Hood Shares Positive Outlook for Credit Union Industry

About PenFed Credit Union

Established in 1935, Pentagon Federal Credit Union (PenFed) is America's second-largest federal credit union, serving 2.9 million members worldwide with over $34.6 billion in assets. PenFed Credit Union offers market-leading certificates, checking, credit cards, personal loans, mortgages, auto loans, and a wide range of other financial services with members' interests always in mind. PenFed Credit Union is federally insured by the NCUA and is an Equal Housing Lender. To learn more about PenFed Credit Union, visit PenFed.org, like us on Facebook and follow us @PenFed on X. Interested in working for PenFed? Check us out on LinkedIn. We are proud to be an Equal Employment Opportunity Employer.