Press

Prepared remarks of Vice Chairman Metsger

(April 30, 2015)

Association Common Bond

”I support the adoption of this final rule as a first, and very important step forward in modernizing federal Field of Membership rules. It represents the beginning of a new era.

This rule accomplishes several important goals:

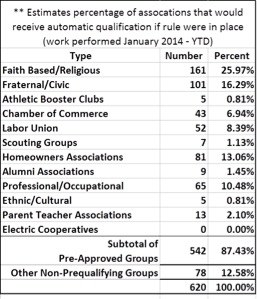

- First, it streamlines the processing of 87% of the association Field of Membership applications the agency receives – nearly nine out of every ten applications – by defining 12 types of associations that qualify for automatic approval. This will expedite access to credit union membership and services for many associations and consumers.

- Second, it reduces the cost of processing applications for both credit unions and the NCUA.

- Third, by freeing-up time and resources it will enable the agency to more quickly and thoroughly process the less than 20% of applications that do not qualify for automatic approval.

- Fourth, it protects the integrity of the process by establishing a clear threshold that associations which are created primarily to facilitate membership in a credit union cannot be approved.

- Fifth, it establishes a new “corporate separateness” factor as part of the test for determining whether associations that do not qualify for automatic approval meet the “totality of the circumstances test.” This gives credit unions an additional new way to demonstrate that an association meets the “totality of the circumstances” test.

When the board considered a proposed rule, it contained a much shorter list of only seven types of associations that would qualify for automatic approval. At my request, and with the support of Chairman Matz and Board Member Fryzel, we specifically asked for comment on what other types of groups should be added to the automatic approval list because their applications are routinely approved. As a result of the comments we have received, and analysis done by staff, the automatic approval list has grown from ZERO groups today, to seven in the proposed rule, and 12 in the final rule.

Even more importantly, these 12 categories of associations made up 87% of the association applications NCUA received last year.

In one swoop we’re cutting red tape by almost 90%. I cannot think of another regulatory relief initiative by any federal agency that has been that dramatic.

At the same time we are strengthening the principle that an association must not be created for the purpose of enabling credit union membership.

This is the right balance of cracking down on the very small number of people who would violate the letter and the spirit of the law, while expediting consideration for the vast majority.

It is also important to note that these changes do not threaten the safety or soundness of any credit union or the share insurance fund. In fact, by diversifying credit union membership these changers are likely to enhance the safety and soundness of both individual credit unions and the share insurance fund.

I also want to reiterate that this is only the first step in our efforts to modernize federal field of membership rules that have not been significantly modernized in more than fifteen years – a time period where state FOM rules have undergone significant revision, as has the financial services industry. Credit unions have many more tools, and more sophisticated tools, to serve members today than they had at the end of the 20th Century. Reasonable proximity has a very different meaning in a world where consumers can access a wide range of financial services on their cell phones, tablets, or personal computers.

Chairman Matz has created an internal Field of Membership working group that is consulting with external stakeholders to evaluate how federal FOM rules should be modernized – within our statutory authority – to keep up with changes in state laws, technology, and the financial services industry. The working group will recommend both changes in NCUA policies and procedures, and in NCUA rules; with a goal of acting on policy and procedure changes, or initiating rules changes, by the end of 2015. In addition, the working group will make recommendations to the board on statutory changes that should be transmitted to the Congress.

I know that my office, and the working group, have received many thoughtful suggestions for modernization of our field of membership policies, procedures, and rules. I encourage all interested parties to continue sending us their suggestions by e-mailing: FOMSuggestions@ncua.gov.

I want to thank the Office of Consumer Protection and General Counsel staff who have worked so hard developing this final rule. Working together, we have developed a rule which provides meaningful regulatory relief, while at the same time maintaining the integrity of the process.

This is a win for credit unions, because it makes it easier for them to serve associations. It is a win for the agency because it enables us to reduce our workload. And most importantly it is a win for consumers because it facilitates their access to affordable financial services.

I look forward to working with my colleagues and other interest parties to continue to provide regulatory relief by modernizing federal FOM rules.”