Press

SECU publishes “stress testing” results for member-owners!

RALEIGH, NC (March 2, 2015) — In concert with new regulatory requirements mandated by the National Credit Union Administration (NCUA), North Carolina State Employees’ Credit Union has published both its Capital Plan and internal independent “Stress Test” results for SECU member-owners on its website. The move provides the members of the $30 billion Credit Union with access to independent reviews of the Credit Union’s capital adequacy under hypothetical national economic stress scenarios. SECU’s internal stress test results gauge the Credit Union’s ability to maintain sufficient capital while operating in “adverse” and “severely adverse” economic environments. NCUA, the deposit insurer of SECU, mandated last year that all federally insured credit unions with assets exceeding $10 billion must pass the same large bank “stress tests” on an annual basis, beginning in 2015. The NCUA stress test will be similar to the Dodd Frank Act Stress Test (DFAST) exercise and will use credit union data as of September 30, 2014.

The Comprehensive Capital Analysis and Review (CCAR) is an annual exercise required by the Federal Reserve to ensure that the largest banks (greater than $50 billion) have “robust,” forward-looking capital planning processes that account for their unique risks and that adequate capital remains under three stressed economic environments. Dodd Frank Annual Stress Testing (DFAST) is an analytical tool designed to evaluate whether banks between $10 billion and $50 billion retain sufficient capital under these same adverse economic circumstances. Tests are hypothetical and are to reflect the potential impacts on capital when the economy has high unemployment, low housing prices and unfavorable interest rates—as found in mild to severe recessions. Large banks are required to publish the results of their stress tests.

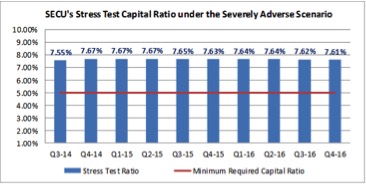

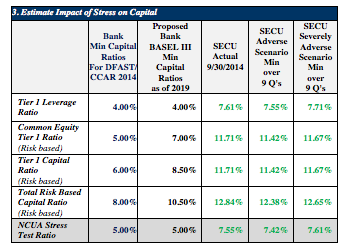

In its most recent tests, SECU used the Federal Reserve Bank stress test macro-economic model assumptions published in September 2014, as a guide to measure the effects of challenging environments on Credit Union capital. These same Federal Reserve economic scenarios are used by the largest U.S. Banks ($10 billion and greater in assets) and will be utilized by the NCUA in conducting formal credit union capital stress tests over the next few months. Under these hypothetical economic variables, capital must remain above a 5% target level over a 9 quarter projection, even under the severely adverse scenario.

Moody’s Analytics, an international economic modeling expert, created six unique “credit loss models” for SECU which calculated and correlated the stressed economic environments to potential changes in loan losses, earnings and capital at SECU. Results of these independent tests show that SECU is strongly capitalized and able to well withstand even the “severely adverse” economic environment imposed in the Federal Reserve stress test assumptions. Additionally, KPMG, a global accounting advisory firm, performed an extensive analysis to validate and confirm the results of the Moody’s credit loss model projections. KPMG found those model results to be sound and reasonable.

SECU Chief Financial Officer Mike Lord said, “Results of applying large bank ‘stress tests’ to SECU balance sheets reflect that our Credit Union’s capital levels currently exceed the capital requirements imposed on large banks. The voluntary publication of our internal stress test results provides assurance to the member-owners of SECU of our ability to withstand severe economic conditions similar to those experienced in our Country over the past 5+ years. SECU has also conducted capital level comparisons using the FDIC and BASEL standards applied to U.S. banks. As the illustration shows, SECU already exceeds the proposed capital requirements it must meet by 2019. A strong capital and liquidity foundation are key elements of a safe and sound financial institution. We are pleased with our positive results in these new capital/stress test exercises.”

About SECU

A not-for-profit financial cooperative owned by its members, SECU has been providing employees of the State of North Carolina and their families with consumer financial services for 77 years. The Credit Union also offers a diversified line of financial advisory services including retirement and education planning, tax preparation, insurance, trusts, estate planning and investments through its partners and affiliated entities. SECU serves nearly 2 million members through 254 branch offices, 1,100 ATMs, 24/7 Contact Centers and a website, www.ncsecu.org.