September spending trends: Inflation, supply issues push up holiday season

CO-OP Solutions Payments Trends Report (Spending Data from September 1-30)

RANCHO CUCAMONGA, CA (October 19, 2022) —

As the leaves begin to turn, the economy is chugging along. Unfortunately, it’s chugging too fast for the Federal Reserve’s comfort.

Employers have continued to add jobs at a strong clip, with non-farm payrolls growing by 263,000 in September, edging the unemployment rate down to 3.5%. The biggest gains were found in the leisure and hospitality sectors, along with healthcare.

Meanwhile, inflation continues its year-long hot streak. The producer price index, a measure of wholesale prices, posted a 0.4% gain for September, doubling consensus estimates of 0.2%. This doesn’t bode well for a relaxing of consumer prices and is likely to keep the Federal Reserve committed to its strategy of raising rates in an effort to cool what it sees as a too-hot economy.

Indeed, the Fed raised its benchmark rate by 75 basis points at its September 21 meeting, and Chairman Jerome Powell has signaled plans to bump it another 1.25% by the end of 2022. The stock and bond markets have not reacted well to these aggressive measures, with major indexes down by nearly 25% for the year.

Co-op Solutions’ September credit union card portfolio data showed generally flat to declining month-over-month results in both credit and debit. The Campers & Camping and Sport/Recreation categories were particularly hard hit this month with Entertainment (movie theaters, tourist attractions, museums, etc.), Lodging, Auto Rental, Airlines and Retail also showing moderate declines.

No need to hit the panic button yet, as categories displaying small to moderate declines are in line with prior years’ MoM trends from August to September as transaction counts tend to decline as summer travel ends, back-to-school shopping declines, and consumers start pulling back spend in preparation for the holidays.

Here are some of the key spending trends Co-op’s SmartGrowth consulting team are watching closely this month:

#1: Early Holiday Shopping Begins Now

The combination of continued supply chain issues and rising inflation is pushing the holiday shopping season up in the calendar cycle. Major retailers including Amazon, Target and Kohl’s are all promoting major sales in October, as a way to manage supply concerns and ensure they hit their holiday sales targets amid significant uncertainty.

“With inflation at the top of consumers’ minds, we anticipate many will do their holiday shopping a bit earlier and put their gifts away in their closets for a few months,” said John Patton, Senior Payments Advisor, for Co-op. “I do think that retailers are doing a better job of managing their stock levels than they did a few months ago. They are better prepared.”

#2: Entertainment, Travel Spending are Softening

While the Entertainment and Travel spending categories have shown strong increases throughout the year, as inflation has continued its sharp rise, consumers have begun pulling back on such discretionary spending.

Year over year, the Entertainment category is up a massive 40% in debit and nearly 62% in credit. Travel spending has shown similar growth of 18% in debit and nearly 50% in credit. But in September, Entertainment fell in both debit and credit by 11%, while Travel was down a few percentage points, led by double-digit declines in debit spending on Lodging.

#3: Shift to Credit is Slowing Down

Over the past year there has been a broad shift in spending from debit to credit. Credit is up by 12.4% year over year, while debit has remained virtually flat over the same period. But in recent months that narrative has begun to change. In September, debit was down by -4.0% and credit was down by -3.6% month over month. Households are carefully choosing to use debit or credit based on the context of the individual purchase and their own financial circumstances.

“Part of the reason why credit transaction volume is so inflated over the past year is that consumers are using credit more for everyday purchases,” says Beth Phillips, Director, Coop Solutions. “Consumers have traditionally used debit for such purchases, so a relatively small increase in such usage on the credit side can have an outsized impact on the relative percentage change.”

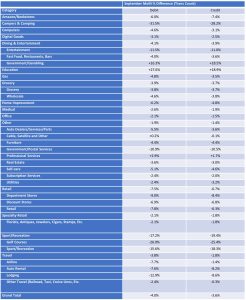

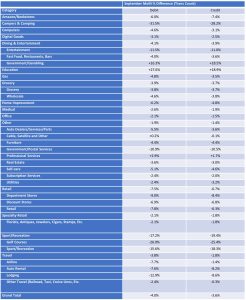

Month-Over-Month Category-Level Spending (Comparing September 2022 to August 2022)

Please note that the category spending below reflects month-over-month comparisons (rather than year-over-year) – i.e., compares September 2022 with August 2022, rather than September 2022 to September 2021.

|

September MoM % Difference (Trans Count) |

| Category |

Debit |

Credit |

| Amazon/Bookstores |

-6.0% |

-7.4% |

| Campers & Camping |

-31.5% |

-28.2% |

| Computers |

-4.6% |

-3.1% |

| Digital Goods |

-3.1% |

-2.5% |

| Dining & Entertainment |

-4.1% |

-3.9% |

| Entertainment |

-11.5% |

-11.0% |

| Fast Food, Restaurants, Bars |

-4.0% |

-3.6% |

| Government/Gambling |

+16.3% |

+18.5% |

| Education |

+27.6% |

+18.9% |

| Gas |

-4.8% |

-3.5% |

| Grocery |

-3.9% |

-3.7% |

| Grocery |

-3.8% |

-3.7% |

| Wholesale |

-4.6% |

-3.8% |

| Home Improvement |

-6.2% |

-4.8% |

| Medical |

-2.6% |

-1.9% |

| Office |

-2.1% |

-1.5% |

| Other |

-1.9% |

-1.4% |

| Auto Dealers/Services/Parts |

-5.5% |

-3.6% |

| Cable, Satellite and Other |

+0.2% |

-0.1% |

| Furniture |

-4.4% |

-4.4% |

| Government/Postal Services |

-10.9% |

-10.5% |

| Professional Services |

+2.9% |

+1.7% |

| Real Estate |

-3.6% |

-3.0% |

| Self-care |

-5.1% |

-4.6% |

| Subscription Services |

-2.4% |

-2.0% |

| Utilities |

-2.4% |

-3.2% |

| Retail |

-7.5% |

-6.7% |

| Department Stores |

-9.0% |

-8.4% |

| Discount Stores |

-6.9% |

-6.8% |

| Retail |

-7.8% |

-6.3% |

| Specialty Retail |

-2.1% |

-1.8% |

| Florists, Antiques, Jewelers, Cigars, Stamps, Etc. |

-2.1% |

-1.8% |

| Sport/Recreation |

-17.2% |

-19.4% |

| Golf Courses |

-26.0% |

-25.4% |

| Sport/Recreation |

-15.6% |

-18.3% |

| Travel |

-3.8% |

-1.8% |

| Airline |

-7.7% |

-1.4% |

| Auto Rental |

-7.6% |

-8.2% |

| Lodging |

-12.9% |

-8.6% |

| Other Travel (Railroad, Taxi, Cruise Lines, Etc. |

-2.4% |

-0.3% |

| Grand Total |

-4.0% |

-3.6% |

What CUs Should Do Now

With the holiday shopping season upon us, it’s a great time for credit unions to activate “spend and get” campaigns to keep their cards top of wallet for spending in the hottest merchant categories, such as Department Stores, Discount Stores and Digital Goods. Also, make sure members can easily access their preferred forms of payment, whether shopping in-store or online.

Leading into the holidays, credit unions should focus on providing exceptional member experiences. With the spirit of the holidays, this time of year can also bring financial stressors to members. Hosting lunch-and-learns and staff trainings to acknowledge the challenges this time of year may bring members can be a hugely beneficial opportunity to encourage (or better yet – incentivize) employees to keep their credit union values top of mind in trying situations to provide exceptional member experiences. Experience that will exceed client expectations and assist members with their financial journey.

More information on the Co-op SmartGrowth Consulting Team can be found here.

About Co-op Solutions

Co-op Solutions is a credit union-owned financial technology platform built using an industry-leading ecosystem, and whose mission is to connect credit unions to the technology, strategic partnership and scale they need to best serve their members and grow now and into the future. Co-op Solutions partners with credit unions to unlock their potential so they can compete; does the hard work of innovation, creating a one-stop opportunity to help credit unions grow; and offers knowledge and expertise in a world where everything must be integrated. Founded in 1981, Co-op Solutions services 2,650 credit union clients, processes eight billion transactions annually, and manages a nationwide ATM network of more than 30,000 and a 5,700-location shared branch network. For more information, visit www.coop.org.