Press

SilverCloud releases new consumer protection templates that prevent complaints

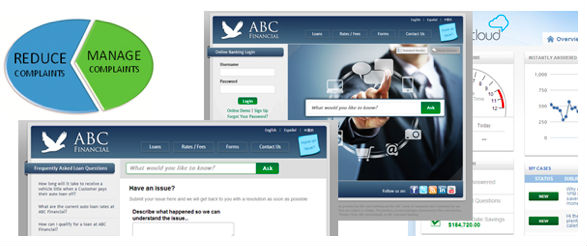

PORTSMOUTH, NH (October 30, 2013) — SilverCloud announces the release of new consumer protection knowledgebase templates to expand their comprehensive compliance solution – SilverCloud Tempest. Through analysis of the CFPB complaint database SilverCloud has developed direct answers to consumer questions, providing more education and transparency for banks, credit unions and other lenders. These templates will reduce complaints at the institution and will better position them from potential regulatory issues.

SilverCloud’s CFPB templates boast questions and answers that are delivered fully customized for the institution as part of the SilverCloud Tempest package, including custom calls-to-action to drive more self-service and revenue. The templates cover over 20 different topics ranging from general account inquiries to specifics on loans, mortgages, cards, collections, and more. Depending on the products and services offered at an institution, SilverCloud will tailor its CFPB templates to the needs of the institution.

“It is clearly essential for organizations to adopt a proactive approach to the CFPB” says Mark Burgess, Director of Product at SilverCloud. “We’ve spent a tremendous amount of time reviewing the complaint data and the CFPB’s recommendations to deliver our lenders with the information they must get out to their consumers – to better service them and to better educate them. SilverCloud will continually monitor the CFPB looking for new product complaints and new trends in an effort to better position and insulate our clients from regulatory action. No other vendor has taken such a common-sense approach or has gone to this extent for the bank and credit union industry as SilverCloud has.”

These new templates are part of SilverCloud Tempest, a unique solution that takes a twofold approach to the CFPB. First SilverCloud helps institutions minimize complaints through better self-service and self-education, instantly answering millions of consumer questions a month. Secondly, SilverCloud captures, centralizes, manages and analyzes any and all complaints that do occur.

About SilverCloud, Inc.

SilverCloud, Inc. is a SaaS company located in Portsmouth, NH and specializes in enhanced self-service solutions for the financial industry. SilverCloud delivers easy-to-launch solutions that unify channels with consistent and accurate information. SilverCloud’s Bank and Credit Union clients are more competitive, experience greater operational efficiency, and are more compliant – all through a simple monthly subscription. Find out more by visiting www.silvercloudinc.com.