Press

SNL Financial: Credit union auto loan growth revs up in Q3

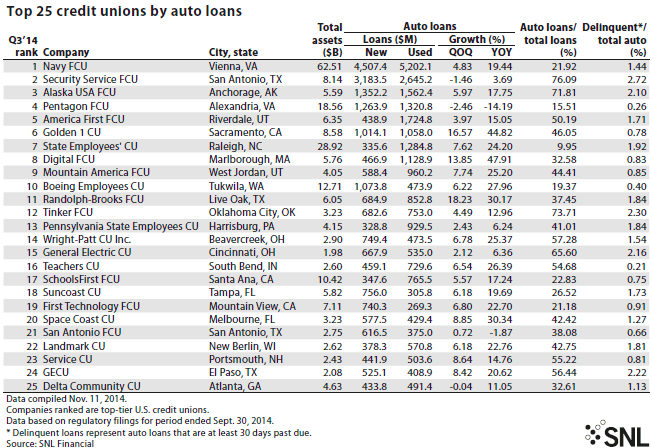

(November 17, 2014) — Auto loans at the top 25 auto lenders among credit unions hit $48.37 billion at Sept. 30, up 5.06% quarter over quarter and 15.97% year over year.

Used vehicle loans accounted for slightly more than half, 53.25%, of all auto loans held by the top 25 credit union auto lenders, the lowest ratio in the past five quarters for the group.

According to SNL data, rates for a direct five-year, new-car loan averaged 3.96% across the U.S. as of Nov. 7, while rates for a three-year, used-car loan averaged 4.18%.Both interest rates have fallen slightly more than 10 basis points over the last year.

The ratio of auto loans 30 days or more past due to total auto loans at the top 25 lenders was up 9 basis points from the third quarter of 2013, hitting 1.50% at Sept. 30.

In June, the NCUA released a proposal that would permit federal credit unions to securitize auto loans, which would allow the credit unions to obtain cash to fund more lending.

Navy Federal Credit Union, the nation’s largest credit union by assets, also held the largest amount of auto loans in the industry at $9.71 billion, split between $4.51 billion in new vehicle loans and $5.20 billion in used vehicle loans at Sept. 30. Navy grew its auto portfolio by 4.83% quarter over quarter and 19.44% year over year and auto loans accounted for 21.92% of the company’s total loans at Sept. 30.

Security Service Federal Credit Union was the No. 2 credit union by auto loans in the third-quarter, although its auto portfolio dropped 1.46% quarter over quarter. Security Service held $3.18 billion of new vehicle loans and $2.65 billion of used vehicle loans at Sept. 30 and auto loans made up 76.09% of the credit union’s total loans, the most of any credit union on the top 25 list. The company also had the highest delinquent auto loan rate among the top 25, with 2.72% of auto loans more than 30 days past due.

Alaska USA Federal Credit Union was the No. 3 auto lending credit union in the third quarter, with $1.35 billion in new vehicle loans and $1.56 billion in used vehicle loans on its books. Alaska USA had quarter-over-quarter auto loan growth of 5.97% and year-over-year auto loan growth of 17.75%.

Randolph-Brooks Federal Credit Union, No. 11, saw the largest quarter-over-quarter growth in its auto loan portfolio among the top 25 in the third quarter at 18.23%. On Sept. 16, it was reported that the credit union opened up two new branches in Frisco and Plano, Texas.

Digital Federal Credit Union, No. 8, had the largest auto loan portfolio growth between the third quarter of 2013 and the third quarter of 2014, at 47.91%. Despite the uptick in auto lending, auto loans still only account for 32.58% of total loans at the credit union. Since the end of the third quarter of 2013, Digital FCU has opened two new branches in Fitchburg and Lexington, Mass., and relocated its Burlington, Mass., branch to a new location offering expanded services.

Pentagon Federal Credit Union, No. 4, saw the largest quarter-over-quarter and year-over-year decrease in auto loans, shrinking by 2.46% and 14.19%, respectively. Pentagon FCU did have a low delinquency rate in relation to the other 24 top auto lending credit unions, with only 0.26% of its auto loans being delinquent.

State Employees’ Credit Union, No. 7, had the lowest ratio of auto loans to total loans at 9.95%. The credit union did show strong quarter-over-quarter and year-over-year auto loan growth though, up 7.62% and 24.20%, respectively. In May 2013, State Employees’ CU initiated the “Auto Power” program to enhance its vehicle loan pre-approval process. A press release on Sept. 30 said, “[State Employees’ CU] recently expanded Auto Power to include the purchase of used vehicles. In less than two months since the expansion, [State Employees’ CU] personnel statewide have assisted over 600 members with the financing of both new and used vehicles using the program.”