Press

SNL Financial: credit unions add employees, keep compensation expenses in check

A new SNL analysis shows that even as the credit union industry adds more employees, average compensation expenses have trended downward.

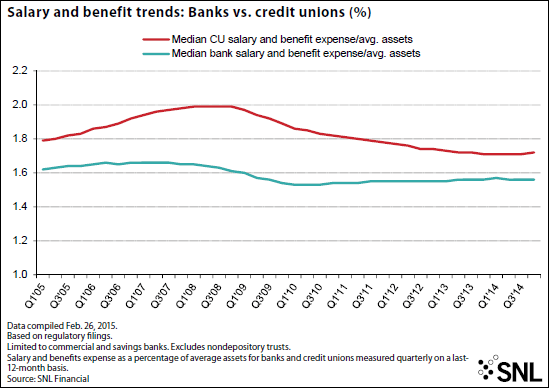

Compensation expenses relative to assets at credit unions trended gradually downward in the wake of the financial crisis, even as the aggregate number of full-time employees in the sector continues to increase.

SNL looked at quarterly salary and benefit expense as a percentage of average assets on a last-12-months basis to avoid seasonal spikes in payroll expenses that often occur in the fourth quarter. Salary and benefit expenses include gross salaries, wages, overtime, bonuses, Social Security, state and federal unemployment taxes paid, and retirement plan contributions.

The median salary and benefit expense as a percentage of average assets for U.S. credit unions was 1.72% at the end of 2014, down from nearly 2% in late 2008.

By comparison, that same metric for U.S.commercial and savings bankswas 1.56% at year-end 2014, down from 1.61% at the end of 2008.

Yet the credit union industry continues to add employees. In the last quarter of 2014, there were nearly 246,000 full-time employees at credit unions, a 23% increase since the first quarter of 2005.