Southeastern Credit Union proves it is possible to grow loans despite anemic macro trends with the help of Kasasa

Asking one question leads to increased loan volumes and balances

AUSTIN, TX (November 4, 2020) — Georgia-based Southeastern Credit Union recently achieved rapid growth in loan volume and balances amid the pandemic with the assistance of Kasasa®, an award-winning financial technology and marketing provider. Kasasa helped Southeastern strategically position its loan offerings to increase consumer debt wallet-share by reframing how consumers think about their debt and asking one pivotal question.

With the lowest interest rates in history and the threat of an economic recession due to the pandemic, Southeastern needed to increase loan volume and accomplish it in a way that helped offset shrinking interest margins. The community credit union worked with Kasasa to discover a new way to offer the Kasasa Loan®, the first and only loan on the market today that features a new concept called Take-Backs™, enabling borrowers to pay ahead on their loan but take extra payments back if they need it.

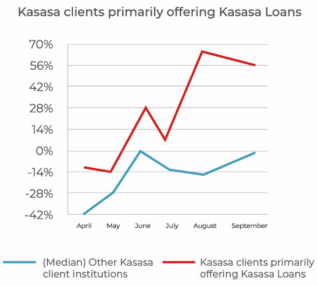

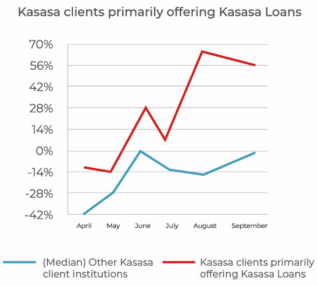

Compared to loan data from the rest of the Kasasa Loan client base, Southeastern rose above the trends with 38% increase in total loan balances originated. They also saw 24% more loans per borrower and a 10% higher average balance per loan.

The increase in lending volume enabled Southeastern to offset the market drop in rates and still drive positive yield growth, without the historically common assistance of increasing marketing expenses or broadening credit tolerances. Additionally, Southeastern had a 100% net promoter score during this time period, with more borrowers likely to recommend the Kasasa Loan to a friend, and borrowers were on average four years younger than other Kasasa financial institutions.

“To see 38% growth in loan originations at a time when the industry is down 11% is incredible,” said Gabe Krajicek, CEO of Kasasa. “To do it without spending any money on marketing, but instead offering a better, more consumer-centric loan and asking the consumer ‘Do you have any other loans you wish worked this way?’ is nothing short of the most impressive innovation in lending since credit cards. Southeastern Credit Union committed to actively selling the Kasasa Loan, making every new loan a Kasasa Loan, and the results were outstanding despite the slump in loan demand across the industry.”

With a dashboard that provides unprecedented transparency and control, the Kasasa Loan does not force borrowers to choose between saving for unexpected expenses or paying off debt. Instead, borrowers can still access those extra funds should something unexpected happen. Kasasa Loans are preferred by nine out of 10 consumers over comparably priced loans, according to a 2017 Kasasa consumer study, and 98% of consumers said they would refinance existing debt at the same rate in order to get a Kasasa Loan with the Take-Back feature.

“Community banks and credit unions are already the best sources for consumer-friendly lending and financial products,” Krajicek added. “By implementing this simple change in strategy that is more or less future proof, the financial institution will be able to secure a strong foothold among competitors in the market

To learn more about how Southeastern Credit Union bucked the trend of shrinking loan growth click here.

About Kasasa

Based in Austin, Texas, Kasasa® is a financial technology and marketing provider committed to driving results for over 900 community financial institutions by attracting, engaging, and retaining consumers. Kasasa does this through branded retail products, including reward accounts, referral programs, and the only loan with Take-Backs™, world class marketing, and expert consulting services. For more information, please visit www.kasasa.com, or visit them on Twitter or LinkedIn.