Switch campaigns flip the stagecoach

In the wake of scandal credit unions are offering Wells Fargo customers incentives

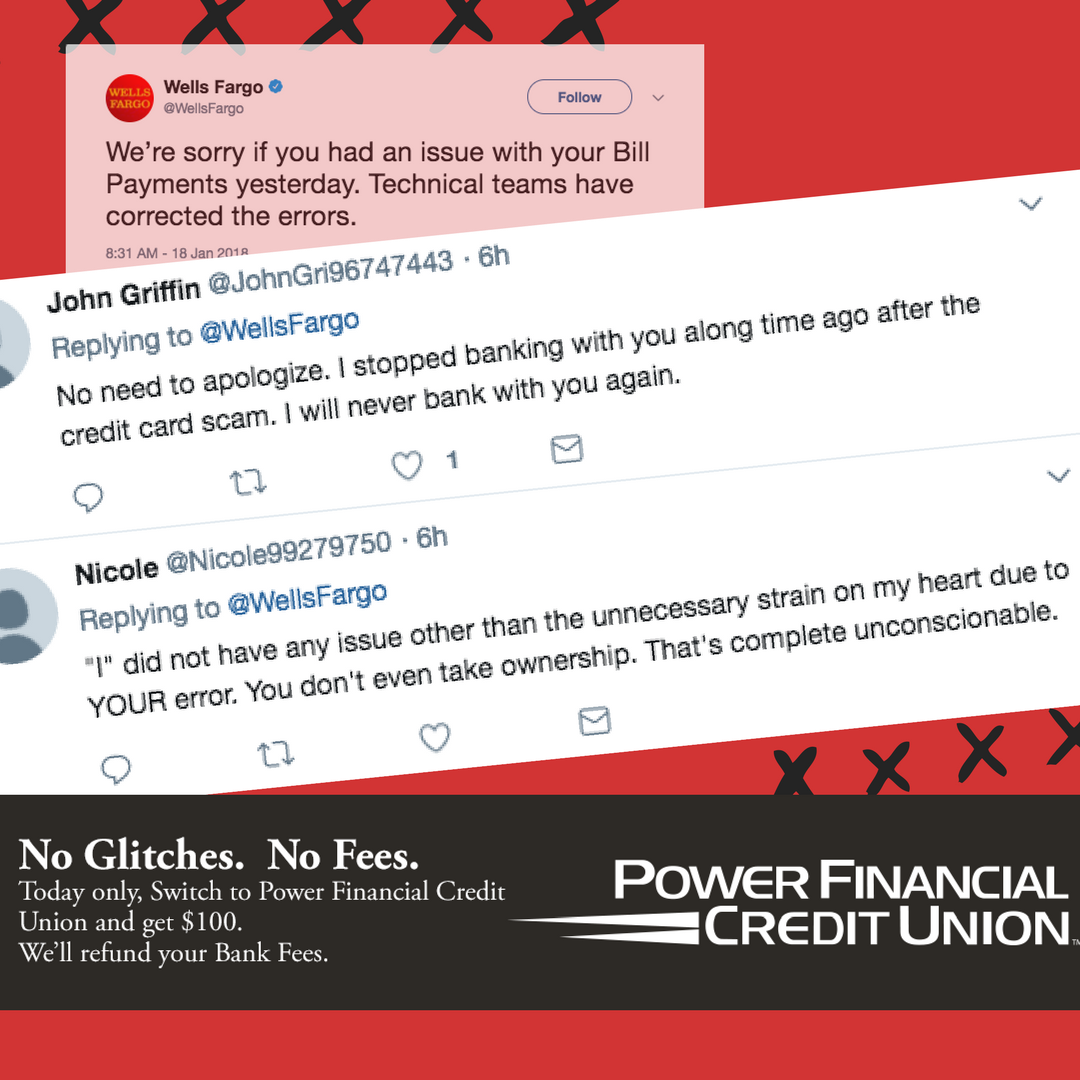

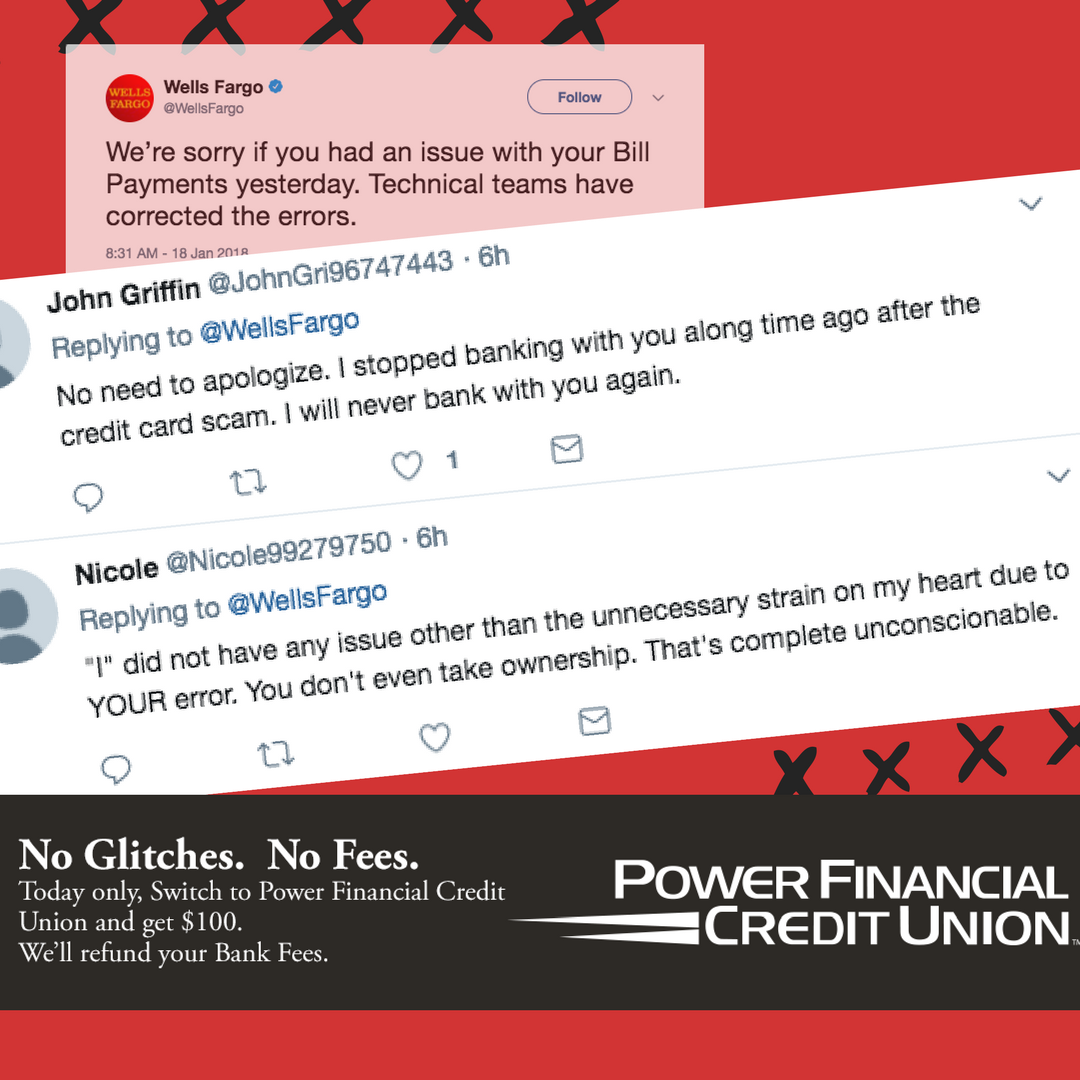

GREENVILLE, SC (January 19, 2018) — Credit unions in California, Florida, New Jersey and South Carolina are throwing some jabs at the third largest bank in the U.S. Targeting the customers of Wells Fargo Bank, the credit unions are offering $100 incentives to the customers impacted by the glitch that drained customer accounts on Wednesday.

Some of the credit unions are even offering to pay off related NSF fees by the bank. According to media reports, the Wells Fargo banking error triggered overdraft fees on many of the checking accounts that were impacted.

Wells Fargo addressed the glitch simply in a tweet, “Some customers may be having an issue with their Bill Pay transactions. Thanks for your patience while we research the issue. We’ll keep you updated.”

“That doesn’t exactly evoke confidence,” noted Bo McDonald, president of Your Marketing Co, the full-service creative marketing agency for the four credit unions that have launched response campaigns. “Our credit unions are much better than that. In the ‘people helping people’ world of credit unions, we want Wells Fargo customers to know that there is a better banking experience.”

In 2016, Wells Fargo fired 5,300 employees for more than 3.5 million phony accounts that were secretly opened to hit sales targets and receive bonuses. In 2017, the bank discovered thousands of customers were also enrolled in online bill pay without their authorization and said it will pay a total of $6.1 million to refund customers for unauthorized bank and credit card accounts.

About Your Marketing Co.

Your Marketing Co. is a full-service strategic planning, branding, and marketing firm serving credit unions that are not content with the status quo. Since 2008, YMC has helped dozens of credit unions grow their potential through strategy, execution, and accountability. And we give a damn!