Thrive Credit Union expands with help from CUCollaborate

Thrive CU was recently approved to add a local community to its charter, nearly tripling potential membership

WASHINGTON, D.C. (June 28, 2022) — On April 6, 2022, the National Credit Union Administration (NCUA) approved Thrive Credit Union’s addition of a two-county well-defined local community to its field of membership (FOM).

Thrive CU, a federal community credit union based in Muncie, Indiana, in Delaware County, was looking to expand its service area, but uncertain as to the best path forward. Previously, the institution had served people living, working, worshipping or attending school—as well as businesses and other legal entities—in its home county, along with some legacy members. All told, this FOM was made up of just over one hundred thousand people.

Following a successful 2014 rebranding, the credit union began receiving membership requests from neighboring Henry and Madison counties. “The demographics of Delaware, Henry and Madison counties are very similar,” explained Thrive’s President and CEO Brett Rinker. “And with inquiries for membership coming from all three, we wanted to offer all residents the opportunity for membership.”

However, reaching these potential new members was not possible under its now-former FOM restrictions.

The credit union’s headquarters in Muncie, Indiana

To solve this issue, the credit union enlisted the help of CUCollaborate, which specializes in field of membership consulting services specifically for the purpose of helping institutions expand their FOM with their regulator. Working together, the adding of a local community was identified as the best route, with the strategy ultimately leading to a successful application for expansion to the NCUA.

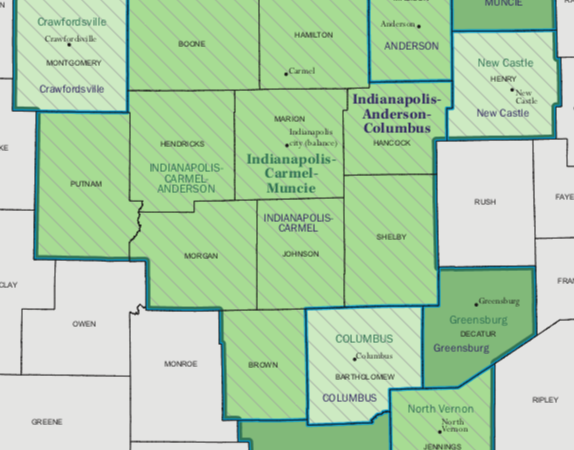

Under a community charter, an institution has the option of adding a local community to an existing FOM, provided it meets certain criteria. The area must first consist of contiguous counties and be “well-defined” in geographic terms. Further, it must adhere to the NCUA regulations of being a recognized single political jurisdiction, or portion thereof, and have a total population no greater than 2.5 million.

In this particular case, CUCollaborate helped Thrive CU prove the area to be added indeed met all these standards, along with the institution’s ability and commitment to serving potential new members immediately.

The move itself sees the addition of a single local community made up of Henry and Madison counties in the state’s central region. The combined area, located entirely within the Indianapolis-Carmel-Muncie, IN CSA, has an estimated population of 292,730 and the potential to increase Thrive CU’s field of membership close to threefold.

U.S. Census Map of the Indianapolis-Carmel-Muncie, IN Core Statistical Area (CSA)

Mr. Rinker underlined both the importance of the expansion as well as his organization’s commitment to the newly added areas, stating: “In addition to building relationships with our members, we have built a reputation of being invested in our community through supporting our non-profit organizations and the small business community regardless of membership status.”

As a CDFI certified credit union, he added, Thrive has “been working on a strategy to ensure we take advantage of the designation for a positive impact in our community. We specifically want to reach the underserved, not only from a banking standpoint, but also through financial literacy.

“The larger field of membership,” he stated, “gives us the ability to leverage our resources to ensure the programs reach as many people as possible.”

CUCollaborate founder and CEO Sam Brownell was naturally pleased by the outcome. “We are thrilled to have played a role in Thrive CU’s expansion,” he said. “Above all, the credit union has now substantially increased its potential field of membership, which will allow it to keep offering its great services, only now on an much larger scale. This progress is vital for any institution aiming to grow and again we are grateful they trusted us to be a part of the process.”

About CUCollaborate

CUCollaborate champions credit union growth through disruptive innovation. The company’s aim is to help credit unions adapt, grow, and succeed long term by offering the innovation, insight, and know-how to help them do it.

CUCollaborate Website: www.cucollaborate.com

CUCollaborate LinkedIn: www.linkedin.com/company/cucollaborate/