Press

Turmoil in payments: New research gives insight into consumer behavior and credit union solutions

MADISON, WI (June 25, 2015) — The National Credit Union Roundtable Advisory Council, a leadership council appointed by the Credit Union National Association board chair, announces the release of Turmoil in Payments: Credit Union Keys to Success. Credit unions are invited to download a complimentary copy of the payments market scan and research conducted by the Filene Research Institute.

Download the report here: https://filene.org/research/report-unlocked/turmoil-in-payments

“The evolution of payments is perhaps the most dynamic topic in financial services today,” says Nader Moghaddam, CEO of Financial Partners Credit Union and chair of the National Credit Union Roundtable Advisory Council. “The Roundtable wanted an up-to-the-minute look at the changing landscape to best meet the needs of existing members and attract new ones.”

To paint a picture of the payments landscape, Filene completed more than two-dozen expert interviews, conducted a survey to gauge credit unions’ challenges around payments and what they’re doing about them, and examined existing literature. The report’s five chapters include:

The Payments Landscape: Traditional economic models are under pressure. Globally, payments represent up to a third of banking revenue and are particularly important in a low-rate environment. But payments don’t always have a clear internal champion, and consumers are used to free and even subsidized payment options, meaning that credit unions must be savvy about their next moves.

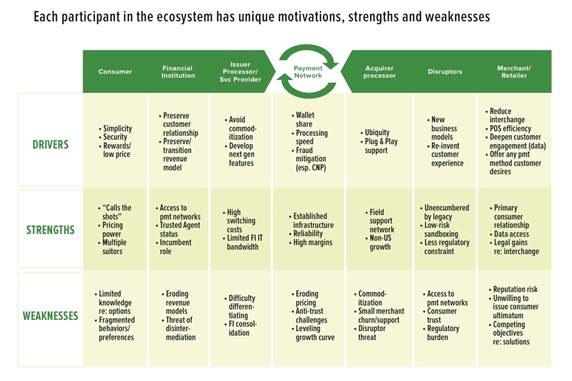

Ecosystem Stakeholders: The payments value chain has a long (and growing) list of players, and each participant has unique motivations. Most of the available revenue in the chain accrues to participants at two divergent poles: those that directly serve payers (individuals or businesses) and payees (usually businesses).

Consumer Priorities: Consumers expect their use of credit, debit, and cash to decline between now and 2020, with the gains flowing to services like PayPal and digital currencies. And consumers, especially younger ones, show willingness to unbundle their banking services, choosing more specific solutions rather than bundled, brand-loyal methods. A successful digital payment or wallet will not only remove payment friction but also offer consumers incentives and information they don’t currently have.

Apple Pay and Digital Wallets: Apple Pay has brought the concept of digital wallets into the mainstream, but it’s still too early to gauge its overall impact. Watch for deep-pocketed hardware and software competitors to emerge. Early returns indicate that mobile payments are primarily displacing credit and debit card swipes rather than migrating (and monetizing) cash and checks. To date, mobile wallets serve more as a form factor than a new core payment method.

Technology Scan: Several technologies, while nascent, are likely to play growing roles in payments, including tokenization, EMV, NFC, beacons, and even cryptocurrencies. Also watch the progress of in-app purchases, expedited/same-day ACH, and the battle between open and closed systems (e.g. Android vs. iOS).

“Payment methods are a credit union’s closest everyday tie to members. If we get them right, we’ll surf the wave of disruption. If we get them wrong, big banks and technology upstarts will quickly siphon transactions, and then members, away,” says Ben Rogers, research director at Filene. “This research explores collaboration opportunities, credit union digital wallets, and leverage points for credit unions to stay on top of that wave.”

About National Credit Union Roundtable Advisory Council

The National Credit Union Roundtable Advisory council is appointed by the board chair of Credit Union National Association. Its purpose is to provide advice to CUNA and leagues in their sponsorship of Roundtable meetings and projects including establishing national meeting invitation guidelines and proposing methods of improving communications among Roundtable participants from the credit unions, state and national organizations.

About Credit Union National Association

With its network of affiliated state credit union leagues, Credit Union National Association (CUNA) serves America’s credit unions, which are owned by more than 100 million consumer members. Credit unions are not-for-profit cooperatives providing affordable financial services to people from all walks of life. For more information about CUNA, visit www.cuna.org or follow @CUNA on Twitter. For more information about credit unions, visit www.aSmarterChoice.org and follow @asmarterchoice on Twitter. Visit the CUNA Press Room for a full listing of media mentions, press releases and resources to stay informed on current events within the credit union industry.

About Filene

Filene Research Institute is an independent, consumer finance think and do tank dedicated to scientific and thoughtful analysis about issues affecting the future of credit unions, retail banking and cooperative finance. Founded over 25 years ago, Filene is a 501(c)(3) nonprofit organization. Nearly 1,000 members make the nonprofit’s research, innovation and impact programs possible. For more information visit www.filene.org