Verity Credit Union’s successful partnership with Zest AI expands credit access to underserved communities

Accessible loans and essential financial products provide the opportunity to bring better lending to all

SEATTLE, WA (March 18, 2024) — Verity Credit Union, an $859 million asset financial institution in Seattle that champions socially responsible banking, announced today the measurable results of its partnership with Zest AI, the leader in AI lending technology. The two organizations came together in 2023 to establish a more inclusive process for reviewing applications for credit cards, personal loans, lines of credit, and auto loans.

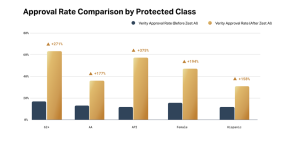

With the help of Zest AI’s technology, Verity achieved notable increases in loan approvals for protected status applicants, who may not typically qualify based on traditional credit scoring methods. This included a 271% rise for individuals age 62+, 177% for African Americans, 375% for Asian Pacific Islanders, 194% for females, and 158% for Hispanic borrowers. Additionally, Verity experienced a significant rise in automated approvals across loan categories. Auto loan approvals have increased by 100%, personal loans by 69%, and credit cards by 84%.

“Our mission is to co-create solutions and advocate for opportunities to grow generational wealth for all,” said CEO of Verity Credit Union, Tonita Webb. “Partnering with Zest AI supports this mission, providing a new way for members to establish credit and improve credit scores while securing financial resources needed to improve their lives, grow businesses, and establish wealth.”

Zest AI’s technology uses hundreds of data points to determine a member’s credit readiness, resulting in more equitable and accurate underwriting decisions compared to traditional credit scores. Verity’s AI models continuously defy expectations, outperforming FICO with over 20% greater accuracy in identifying creditworthy borrowers compared to the national credit score, and identifying delinquent borrowers within the first six months of origination.

“This partnership shows us just how powerful technology can be when combined with the purpose of doing good. We’re excited to see how Verity Credit Union continues to live out their mission, with Zest AI as a tool in their toolkit, and bring economic equity to all their members,” said Zest AI’s CEO, Mike de Vere.

Verity Credit Union serves all of Washington State. The credit union has eight branch locations in Lynnwood, Auburn, and Seattle’s Ballard, Greenwood, Beacon Hill, Northgate, Wallingford, and West Seattle neighborhoods. Verity was recently certified as a Community Development Financial Institution (CDFI), allowing for new opportunities to better serve historically underserved communities across the Greater Puget Sound. It’s known for its customized products that address the needs expressed by the community, including Shariah-compliant loans, bicycle loans, solar loans, no-minimum CD programs, small business programs, and more. For more information, visit www.VerityCU.com. Images can be found HERE.

About Verity Credit Union

Verity Credit Union is one of Washington State’s longest-standing credit unions, putting people, the planet, and prosperity for all above the bottom line. Our mission is to make meaningful, positive, and lasting change by partnering with our members and communities to co-create solutions. As a socially-responsible financial institution, about 95% of our deposits support the local economy and members with loans big and small to improve the well-being of businesses and individuals, especially those who have been historically left out of the financial system. We are one of few financial institutions with a Black woman CEO and leadership team and board that identifies predominantly female, allowing us to embody the change we’re working towards. Together, we can create stronger, healthier, more sustainable communities by making-people centric decisions.

About Zest AI

Zest AI is a tech company on a mission to broaden access to equitable lending. Since 2009, we’ve worked with financial institutions to provide AI-driven credit solutions to their borrowers. Today we work with all types of lenders as a catalyst for economic equity by helping them leverage AI’s potential for good. Learn more at Zest AI and connect with us on LinkedIn.