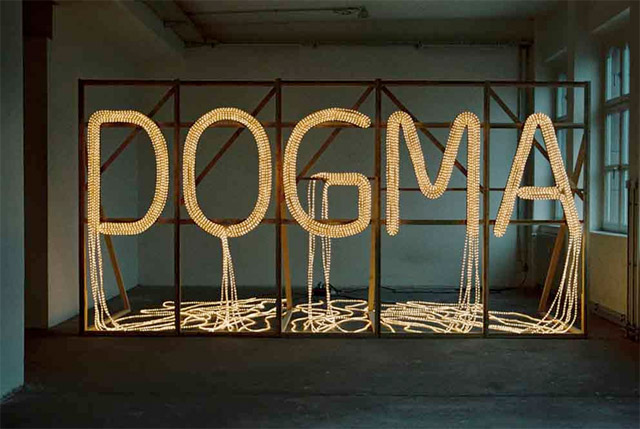

Question and More Questions… Should Credit Union Dogma Die?

by: James Robert Lay, PTP NEW MEDIA & CU*SWAG

Dogma (noun): Something held as an established opinion; especially: a definite authoritative tenet.

As I wrapped up my last article encouraging you “Don’t Join a Credit Union”, I began thinking further about where we have come from as an industry. The world continues to change just as each one of us has evolved personally as well. But what have we done as an industry?

Are we busy continuing to drink our own kool-aid at industry conferences while the rest of the world moves around us? Could it be possible we are clinging to our industry bread dogmatic thoughts and beliefs that are no longer applicable or relevant to general consumers in our communities as a whole? Are we waisting valuable time and dollars trying to beat our industry beliefs into consumer’s heads in a feeble attempt to change their perspective of us?

Take for example the following phrases we cling to year after year making them our industry, and credit union, rallying cry.

We’re the best kept secret: Why? If you are a secret and no one knows about you… can I trust you to take care of my money? Will you be around tomorrow?

Join the credit union: People join clubs, gyms, churches and school organizations. For clubs and gyms, many times a fee is involved. So I have to pay a fee to join your credit union?

Once a member… always a member: Really? Sounds kind of like the mob to me. Do I really want to “join” if I can never get out without having to worry about having my knee caps broken.

You’re a member owner: That’s awesome! But what does that really mean? What do I really own?

You have a voice: Doesn’t everyone these days? If you suck… you can be sure I’ll use it.

You have a vote: What am I voting for? What are the issues? When? Oh wait… I have to go pick my son up from soccer as the vote is after hours.

People helping people: What does this mean? Toms Shoes is really helping people with their “One for One” philosophy. What is your credit union doing?

My hope is that you do not label me a heretic for challenging credit union dogma. My goal is to simply present another perspective from the outside and even piss you off a bit. These are the tough conversations that need to be happening as your credit union plans for 2013.

I truly believe credit unions are and can still be a viable financial solutions provider for consumers looking for an alternative to the traditional profit driven bank. The way we position ourselves through the words we use as an industry must change to connect with the modern day consumer.

At the end of the day it does not matter what we believe as an industry as this will only get us so far. It is by what others outside of our industry, and more importantly our own credit union, the consumer’s perception in our communities which we can not control, that truly defines us.

Will we blindly follow these dogmatic doctrine to the very end, never wavering, just as as a captain stays with his sinking ship? That’s your call.