The new ‘Rs’ in education finance

With school back in session, what are some of the new factors that credit unions must consider when implementing a private student lending program or managing an existing one?

Reading. ‘Riting. ‘Rithmetic. While these well-known “R’s” may be outdated in today’s education world, back in 2011 we showed how they could serve as a helpful tool for credit unions that were evaluating the risk and rewards of private student lending. But just as standards have changed in education, so has the landscape shifted for education lenders.

So what are some of the new “R’s” that credit unions must consider when implementing a private student lending program or managing an existing one?

1. Regulation

As credit unions know all too well, we exist in a highly regulated environment. In late 2013, NCUA shone a regulatory spotlight on private student lending by issuing a supervisory letter to credit unions (LCU2013-15) on this very topic. While the knee-jerk reaction to additional regulatory focus is likely negative, the NCUA did a good job within the letter of providing an overview and background on private student lending, including defining field staff responsibilities and outlining risk management expectations. Credit unions must review and understand these expectations carefully, but can certainly take comfort in the fact that the NCUA has provided much-needed clarity to the exam process. Key takeaways include:

- Know Your Program — Most credit unions offering a private student lending program will rely on a third-party (such as a CUSO) to administer key aspects of the program. That said, it is imperative that credit unions NOT cede control of their program to an external party. They must fully understand the risks and have a plan in place to manage the program moving forward.

- Know Your Portfolio — For obvious reasons, it’s imperative that loans not magically appear on credit union balance sheets and go unchecked. A comprehensive and ongoing portfolio analysis strategy should be implemented in order to monitor performance and adjust program guidelines as needed.

- Know Your Partners — Private student lending is a new asset class for most credit unions and has many unique characteristics, such as school-certification and in-school loan deferment. Like other complex lending programs (credit cards for example), working with a third party to properly administer the program is a smart decision. As is the case with any situation where a credit union works with a third party, it is imperative to perform ongoing due diligence to build a successful program and ensure third party capability.

2. Return On Assets

Delivering superior value to borrowers is the ultimate goal for credit unions in their lending programs, but it’s only possible if value is also being returned to the bottom line. In light of credit and regulatory risk in private student lending, is it really possible for credit unions to achieve a positive ROA in this asset class? In a word, yes.

A recent analysis determined that a credit union that first launched its private student loan program with Student Choice in 2008 and now has nearly $20 million in PSL balances is achieving a Return on Average PSL Asset (ROAA) of 3.41%. This calculation factored in loan yield, cost of funds, loan loss allowance, origination, and servicing costs, as well as other program expenses. Equally as important as the strong repayment performance and positive ROA is the fact that borrowers are receiving fair-value loans with favorable repayment terms from a credit union they can trust … truly, a win-win situation. This scenario is not uncommon, and shows that with proper underwriting and program guidelines, private student loans can perform very well.

In fact, in reviewing undergraduate loans only within this program, comprising $490 million of the most seasoned loans in repayment (as of Q3 2014):

- Less than 1% of loans in repayment were 90 or more days past due

- Annualized charge-off rates stood at only 0.73%, down 10 basis points from one year earlier

- Early to mid-stage delinquencies were stable among all seasoned origination vintages, dating back to loans that were originated during the second-worst recession in our nation’s post-industrial age economy

3. Relationships

At conferences and industry events, credit unions are bombarded by the message that they must build relationships with young adults. Many interesting ideas are thrown about as to how to do this, but what about simply offering a product that we know for a fact is needed by millions of college-age kids every year? Credit unions offering a PSL product have an immediate, powerful opportunity to connect with young adults, not to mention the millions of parents who will serve as co-borrowers.

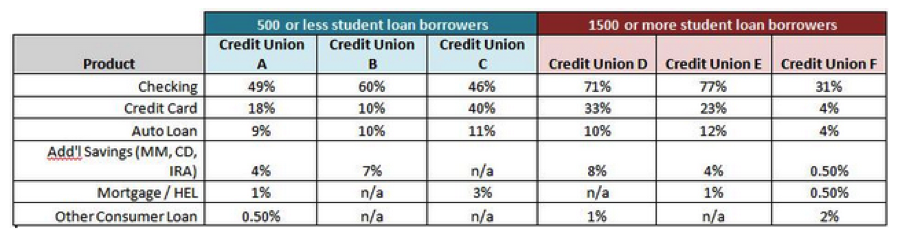

Now that credit unions have multiple years of experience in private student lending, results are starting to appear which show that credit unions can, in fact, build relationships with PSL borrowers. Six credit unions (ranging in assets from $250 million to $5 billion), all offering a private student lending program through the Student Choice platform, recently analyzed their student lending borrowers. The numbers paint a very positive picture.

Average checking account penetration was nearly 56%, while more than 21% had a credit card. Another strong indicator was that more than 9% had an auto loan with the credit union. According to one lender, total deposit balances for their student loan borrowers were more than $4.6 million while total loan balances (outside of their student loans) were approximately $3.7 million.

These are real relationships with members who have a lifetime of financial services needs ahead of them, and a real connection to a credit union that helped them during the most critical stage of their young financial lives.