Unleashing credit union innovation

A quick scroll through the news reveals inflation and a tough job market rivaling against the financial goals of the American people. Yet, credit unions continue to support members and communities with low rates, personal service, and local and national philanthropy – and they are positioned to innovate and grow like never before.

However, many credit unions missed the innovation mark in the last financial crisis. But our current landscape is giving credit unions a second chance, not something that many leaders have during their career. Credit union leaders need to capitalize on the momentum offered by the economy. Here are four ways credit unions can unleash and champion innovation.

4 ways to champion innovation:

- History: Your history is part of your story, but it needs to tie into how you are currently serving your membership, not who you served three decades ago. Currently, 96% of Generation Z and 95% of Millennials bank with a non-credit union. For sustainable growth, credit unions must expand market share among the younger generations. This requires more than digital tools. Credit unions need to elevate their brand image.

A credit union’s name alone can suffocate market share, sending an (unintentional) message that a particular demographic doesn’t qualify for membership.

The largest credit union in Indiana is championing their story with a simple, yet powerful rebrand. Teachers Credit Union once served only teachers and their families in Indiana and Michigan. Their new name, Everwise Credit Union, expands their brand to include all demographics, regardless of career.

The takeaway: Let your history propel you into market share expansion. - Employees: Champion your employees so they can then champion the CU movement. Your people have the power to influence the plot and even conflict of your credit union’s story. Right now, 29% of U.S. employees report being “always burned out” at work. Employees are at more risk than ever of being disengaged or unengaged at their workplace, and you can be sure that this lack of engagement will negatively impact your members.

As you go about strategic planning, don’t forget your people. Invest in their professional development and mental health. Support employees’ repetitive tasks and key functions through AI enabled tools. Strategize for how artificial intelligence can bypass the human element. Collaborating humans and AI will result in stronger, more efficient member service and make your credit union a desired place to work. - Risk: Take calculated, data-backed risks. While there isn’t a perfect formula to know which risks are worth the benefits, data analytics and modeling are a powerful – and vital – tool in your decision-making toolbox. Without advanced data analytics, you will miss out on key growth opportunities (like expanding lending to new credit tiers), struggle to compete with fintechs, and experience higher decision-making insecurity. This will all lead to the dragging of feet in a time when swift action is required.

Data flips risk on its head. Don’t risk delaying members’ needs in the name of caution. If your members are requesting more digital solutions or voicing complaints about poor communication, leverage data and key partnerships to find solutions. Loyalty must be earned, and unsatisfied members might as well be ex-members. Losing members because of lack of data would be a tragedy – and is very preventable. - Opportunity: Take the opportunity to join with other credit union voices. The goal of strategic partnerships is to aggregate the buying power of credit unions, strengthen your position and offerings, and elevate the voice of the CU movement. Credit unions have a superpower: with CUSOs, your credit union can bypass the millions of dollar investments in technology and access the industry tools that are too expensive for credit unions to purchase or build individually. This opportunity paired with the heroic trust and personal service instinctive to the CU industry are highly competitive advantages.

It’s never too late to innovate.

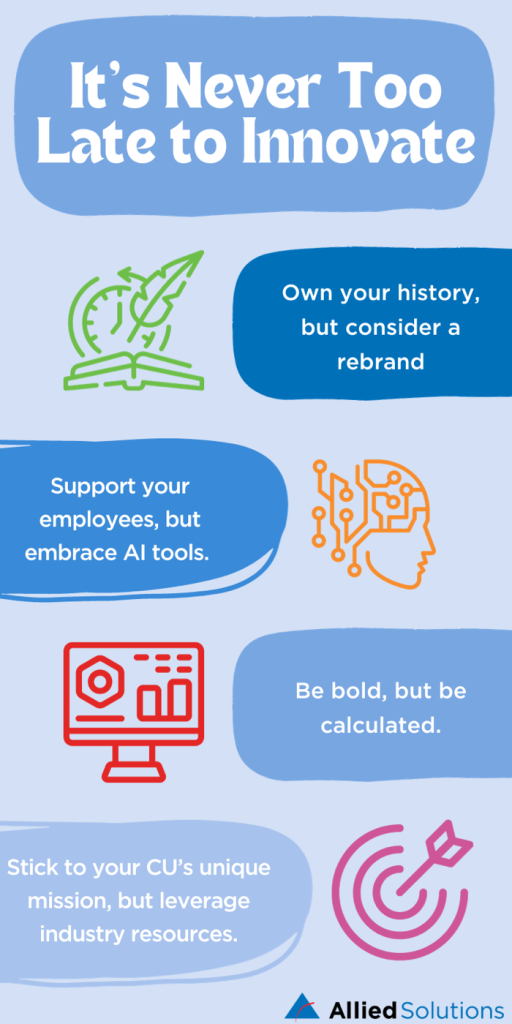

Now is the time for credit unions to embrace this mindset and embrace their story. Own your history, but consider a rebrand. Support your employees, but embrace AI tools. Be bold, but be calculated. Stick to your CU’s unique mission, but leverage industry resources.