Use the blockchain in lending

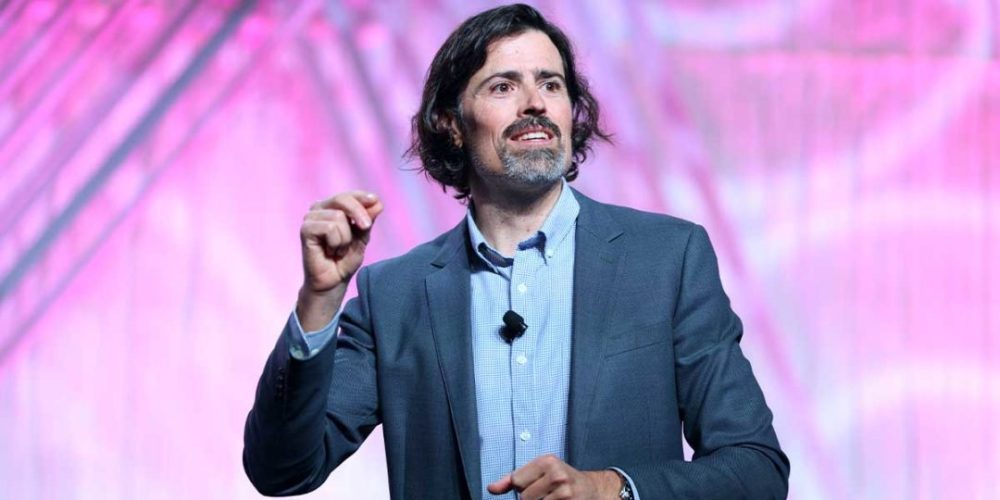

Credit unions need to explore how to use cryptocurrency ecosystem in the credit union, says Lamont Black.

Credit unions should explore how to use blockchain in lending processes, says Lamont Black.

Credit unions should explore how to use blockchain in lending processes, says Lamont Black.

While credit unions are often focused on cryptocurrency as an asset—the purchasing and saving— Lamont Black believes they should be focusing on the platform it’s used on—the blockchain—and how they can use that in lending processes.

“Too many credit unions are focused on the tip of the iceberg,” says Black, an associate professor of finance at DePaul University. “Crypto is not just a number that goes up and down. How do we incorporate the technology and the platform so that members are keeping the transaction fees and the process becomes faster and more seamless?”

Black spoke at the 2022 CUNA Lending Council Conference Friday in San Diego. While he spent time explaining the details of cryptocurrency and blockchain, he focused on two ways the new technologies could be used in lending. He didn’t focus on using cryptocurrency as collateral or payment for loans, but rather how the systems could be used.

“Cryptocurrency is super volatile,” Black says. “How do you take the technology from the crypto ecosystem and map it onto lending processes?”

continue reading »