Why consumers really shop around for checking accounts

by. Rob Rubin

Switching banks is difficult for most consumers. Why? Completing the switching process requires untangling automated transactions (e.g., ACH’s, online bill pay) and re-establishing those transactions at a new bank or credit union. For many consumers, the process is too time-consuming. Others are concerned they’ll miss an important payment. Consumers that live paycheck-to-paycheck don’t have enough reserves to fund both accounts for as long as it takes to switch everything. The result? Inertia.

That’s why it takes a lot to get people to switch — which is both good and bad. Given how reticent people are to go through the hassle of switching, do you know why people switch from your institution? Three surveys fielded on FindABetterBank since September 2012 has asked respondents why they’re shopping for new checking accounts.

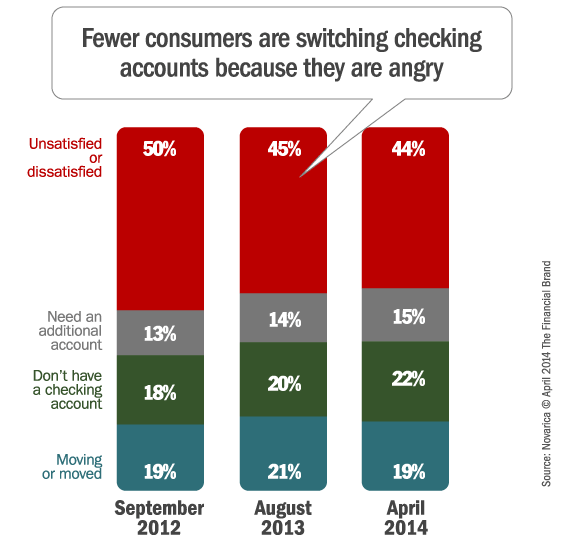

Looking at the data, three trends emerge about the composition of checking account shoppers.

1. The proportion of shoppers who are unhappy with their current bank continues to decline. In September 2012, 25% of respondents said they’re in the market because they’re paying too much in fees, compared to 20% in April 2014. Media attention during the financial crisis caused consumers to obsess over fees. Without the media fanning the flames, fewer respondents are citing high fees as a motivation to switch.

continue reading »