24% of consumers would choose a local financial institution for their next credit card

Despite the dominance of national banks, credit unions and community banks have quietly strengthened their positions in the consumer credit card market in recent years. The latest report by Elan Credit Card and PYMNTS Intelligence examines where consumers are applying for credit cards, what type of spenders they are, and what features are most persuasive.

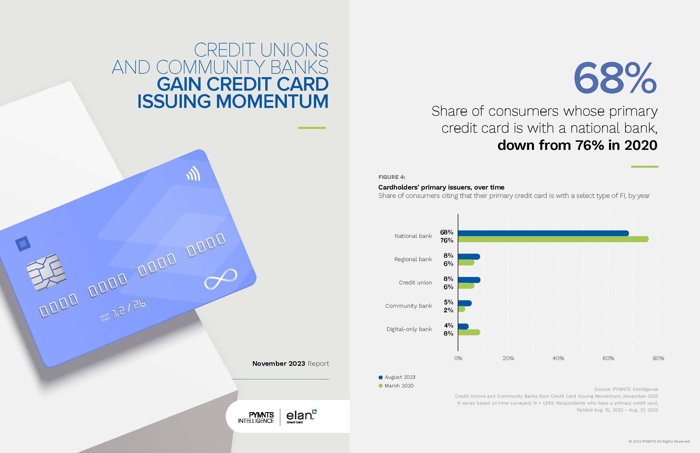

Credit unions increased their share of primary credit cards from 6% in 2020 to 8.3% in 2023. Community banks more than doubled their shares, moving from 2.3% to 5.1% in the same period. Though modest in absolute terms, these shifts represent sizable relative gains. National banks experienced a significant slip from 76% in 2020 to 68% in 2023. Both credit unions and community banks are both poised to continue this upward trend.

Across all consumers surveyed, roughly 15% said they would be most likely to apply for a new credit card from a credit union, reflecting a potential 83% increase versus the share that currently has a primary card from a credit union. For community banks, 8.3% indicated the same, 63% more than those who have their primary card issued by a community bank.

While national banks issue 68% of primary consumer credit cards, 24% of consumers surveyed said they would likely choose a credit union or community bank for their next credit card.

The research also shows that smaller financial institutions can maximize their competitiveness by providing key features that cardholders value, including rewards programs and the ability to split payments.

National banks will continue to dominate the consumer credit card industry, but nevertheless, credit unions and community banks have significantly increased the shares of consumers choosing them for their primary credit cards in recent years. This trend is poised to grow as many consumers prefer credit unions and community banks for their next credit card, including sizable shares of those currently without a primary card.

A partnership with Elan Credit Card can help your credit unions support more members with a credit card program competitive with national issuers. Download the full report to for more data and insights or complete the form below to discuss with the Elan Credit Card team.