7 reasons why your website is your most important branch

More people interact with your website than any of your brick and mortar locations, which is why your website is your biggest and most important branch. So, are you giving your credit union website design the attention it deserves?

You’ve sent out mailers. You’ve made attractive brochures. You regularly participate in community service efforts, and maybe you even play a radio ad or two. But if your credit union website is being neglected, then your marketing strategy is missing its star player. In this post, we’ll go over the reasons why your website is so important, backed up by data.

#1 There’s this thing Al Gore invented called the Internet

Forget the Al Gore comment. Instead, consider that more than 2.4 billion people use the internet every day. The internet is one of the most important technological innovations in the history of the world. The current age of humanity is defined by it: the Digital Age.

Furthermore, around 90% of internet users have purchased something or contacted a company online in the last 12 months. Among U.S. adults, about 87% use the internet regularly, and about 73% go online every single day.

Source: XKCD

#2 Millennials especially like the internet

When you look specifically at young adults, the number of those who regularly use the internet jumps all the way up to 98%. As a credit union marketer, you know Millennials are a key demographic because they are the rising generation. You want to catch people at transitory periods, such as having a first child, starting a first adult job, or buying their first home or car. Research has shown that people are most likely to switch financial institutions when they make big life changes. If you want to market to young adults, you need to have a great credit union website design. Millennials prefer fast load times and responsive designs that work on their mobile devices—in fact, 50% of them will abandon content that doesn’t load quickly.

#3 Most people start research online

Data shows that once a potential customer has an idea of what they want, 72% of those customers will look online for answers, focusing especially on educational materials, reviews and testimonials. Furthermore, more than half of consumers say they will go straight to a company’s website to find product information. If half of your potential members are going straight to your website to find out more about you, your website needs to be dressed to impress because people don’t trust credit unions with ugly websites.

Source: Pardot.com

#4 You control the narrative on your website

Social proof has massive influence over where people decide to put their money. And while you can’t decide what people write about you on Google My Business or Yelp, but you can select the testimonials you include on your own website. You also have a chance to use your site to represent your brand exactly how you want it, making it clear who you serve and what sets you apart.

#5 Your website is a place to showcase your other marketing efforts

Your website is a great way to showcase your other marketing efforts and immortalize them. As an example, a great credit union website design has a blog that highlights promotions and cool events you’ve hosted. Your website could also feature a calendar that lets people know when your next free financial education seminar is coming up. Or how about a Community Involvement page that showcases all the good you’ve done? You can even add your favorite brochures as downloadable goodies. On an effective credit union website, past marketing pushes don’t go to waste, but instead keep working for you because the content can live on your website forever.

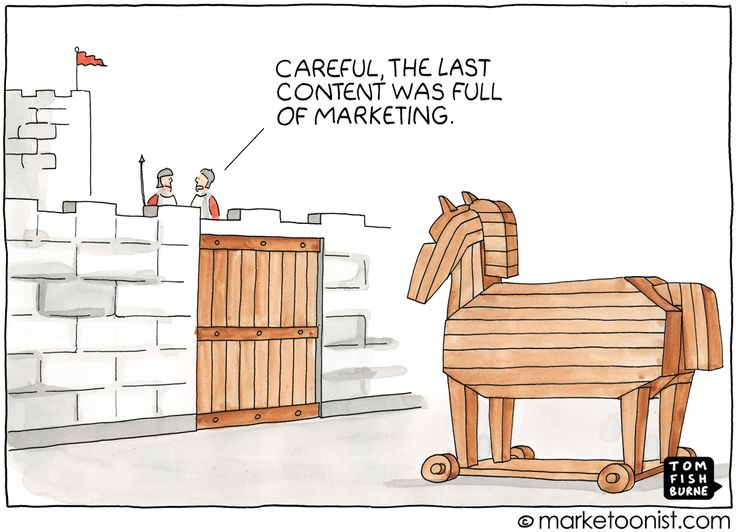

#6 Your website is the backbone of your content marketing strategy

Content marketing is a big winner for many financial institutions. On average, content marketing generates more than three times as many leads as outbound marketing, and costs 62% less. However, if you’re going to get into content marketing as a credit union, you’re going to need an attractive place to host all that content, or to lead visitors back to when you do guest blogging. That’s where your credit union website design comes in.

#7 Even visitors who prefer in-person interactions want to see your website

A big trend right now is the practice of “webrooming” or “reverse showrooming.” It’s the art of researching a business online, and then going to visit it in person before making a buying decision. Reverse showrooming is something 69% of consumers engage in. That means even those who will never sign up for an account or take out a loan online will still peruse your website, and use what they find to judge your credit union. It’s your job to design a fantastic credit union website that peaks their interest enough to get them through your real-life doors.

Interested in improving your credit union website, but not sure where to begin? For help getting started, download our free strategy guide.