A closer look at the funding options for credit unions

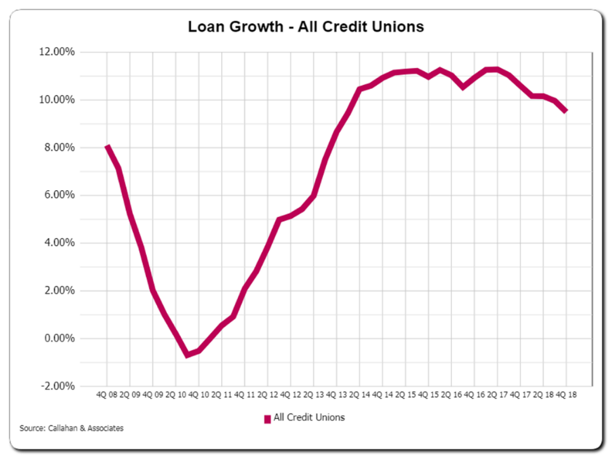

As the chart below illustrates, credit union loan growth has been strong for some time. For example, year-end 2018 data revealed industry loan growth of 9.5% over the previous twelve months. The prolonged loan growth that has accompanied the economy’s expansion has translated into higher net interest income for credit unions, as they have deployed their excess liquidity into higher earning assets.

The expansion of a loan portfolio, however, is typically accompanied by increased stress on funding sources. Average share balances across the credit union industry are generally more than 30% smaller than average loan balances. Consequently, full satisfaction of loan demand typically requires some resort to additional funding sources. Moreover, certain loan types do not provide consistent cash flow and cannot be turned into cash quickly. As a result, the quality of a credit union’s liquidity risk management processes and the robustness of contingency funding plans take on added importance.

It is hardly controversial to assert that liquidity and effective liquidity management are essential to safety and soundness. Recognizing the critical need for credit unions to have a sound policy and process for managing liquidity risk, the NCUA adopted Regulation 741.12, requiring federally insured credit unions to take specific steps to ensure appropriate risk management and access to liquidity.

Liquidity is best viewed from both a strategic and risk perspective. And, the process of liquidity management is dynamic and requires active and ongoing vigilance and monitoring.

At a minimum, a credit union’s program and processes should include the following:

- An appropriately tailored set of strategies, policies, procedures, and limits.

- A comprehensive system of liquidity risk measurement and monitoring.

- A diverse mix of sources of funding, both existing and potential.

- Adequate levels of liquid, marketable securities.

- A comprehensive contingency funding plan that sufficiently addresses adverse liquidity scenarios.

- Internal controls.

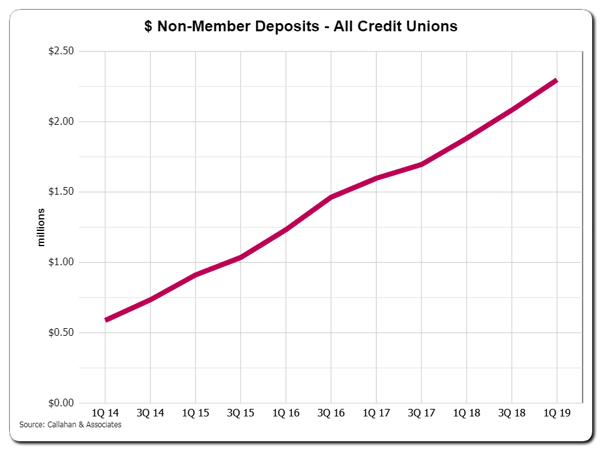

We have also long suggested that our credit union clients employ a variety of funding sources and strategies. And, we have observed that the most robust business plans include many potential sources of funding, including a vibrant non-core wholesale funding strategy to handle opportunities where price, availability and/or maturity issues are important. At Olden Lane, we are engaged daily in an effort to open channels of liquidity traditionally beyond the reach of credit unions. “Once largely thought of as taboo, the use of external funding is now widely accepted throughout the credit union industry. In fact, the NCUA has required all credit unions to seek multiple liquidity sources and document those sources in their liquidity policy.”[1] For instance, the average balance of nonmember deposits, across the industry, increased almost four-fold over the previous five years.

Credit unions can freely access nonmember funding up to the greater of: (i) 20% of total shares or (ii) $3 million. And, several programs exist to satisfy funding needs. In May 2019, the NCUA proposed rule changes to permit additional utilization of nonmember funding in recognition of “credit unions’ growing need for additional sources of funding to serve their members.” The proposed rule change increases the current 20% of total shares limit to 50% of paid-in and unimpaired capital and surplus less any public unit and nonmember shares. The change in standard from “total shares” to “paid-in and unimpaired capital and surplus less any public unit and nonmember shares” provides credit unions with greater ability to accept nonmember deposits because undivided earnings are included in the measurement of a credit union’s paid-in and unimpaired capital and surplus.[2]

Because we are often asked to comment on the differences between the various potential funding sources, we offer this whitepaper. Below, we briefly outline seven of the most common sources of funding available to most credit unions.

Listing Services:

The various listing services can be thought of as a dating service for CD (share certificate) issuers and investors. A listing service “enables banks and credit unions across the country to connect directly with one another, without the intervention of third parties.”[3] As one such service describes its offering, the firm allows issuers to “connect with more than 3,000 institutional subscribers ready to help you generate low-cost funding from nonmember deposits.”[4] The knock on this process has been that it can be labor intensive, as the certificates are all done in increments less than $250,000 and in physical form. In most cases, the issuer signs a term agreement (1-5 years) and pays and annual fee, assessed on volume and total assets. Some of these services have transitioned to ACH in recent years. But, most still use wire transfers to effect payments – typically monthly. None of these deposits are collateralized and they are typically available in durations ranging from 1-5 years. Today, QwickRate and CD Rateline are among the leading service providers in this space.

Public Funds:

Many of the larger public funds are managed with an outsourced chief investment officer. The smaller or independently run municipalities and other public funds typically have very narrow investment policy statements. This has allowed a handful of firms to create an intermediary business. These intermediaries typically take an order from an individual municipality, matching it against credit unions and banks at the $250k level. The broker in between takes a piece of the spread as revenue. In some cases they cobble together orders so they can deliver larger blocks of liquidity to the issuer, but not in every case. None of these deposits are collateralized and the available duration is from 1-5 years.

DTC Share Certificates:

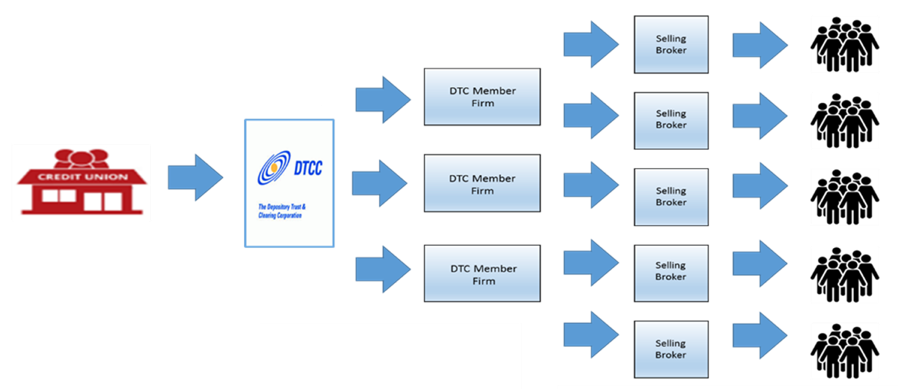

DTC-Eligible Share Certificates are time deposits issued by federally insured low-income designated credit unions and are underwritten by Financial Industry Regulatory Authority (FINRA)-registered broker-dealers. Also known as “brokered deposits,” this type of deposit is offered to investors by issuing institutions looking to raise liquidity and funding through the wholesale and institutional markets. Unlike traditional CDs and Share Certificates, but similar to other securities, DTC-Eligible Share Certificates are issued in book entry form and use the CUSIP system for identification and for trading in the primary and secondary market. Like traditional bank-issued CDs, DTC-Eligible Share Certificates are often a preferred investment alternative for investors concerned about the safety of their principal and the continuity or predictability of cash flows.

DTC-Eligible Share Certificates provide an operational and cost-effective way to raise large amounts of deposits through issuance involving a single certificate. A single Master Certificate (per offering) is held in safekeeping, and all ownership records are maintained (book-entry) with the Depository Trust Company (“DTC”). DTC is the world’s largest securities depository. Owned by its members in the financial industry, DTC is a registered clearing agency with the U.S. Securities and Exchange Commission (SEC), a member of the Federal Reserve System and a limited purpose trust company under New York Banking Law. A CUSIP number is assigned to each offering, and enables an easily-managed start-to-finish process for both purchaser and issuer. The result is an instrument that is insured and supported with a secondary market, a combination that meets the needs of investors who are looking for opportunities to combine government-insured deposits with liquidity.

As the diagram below illustrates, DTC distributes the payment of interest and principal to the relevant large broker-dealers and banks that are DTC participants. These participants then make the downstream payments to their customers, including smaller broker-dealers who participated in the offering.

To set up a program of DTC-Eligible Share Certificates typically requires three documents:

- Brokerage Agreement. This agreement establishes policies and procedures pertaining to the issuance of DTC Eligible Share Certificates. It includes the typical representations that financial institutions make to the underwriter and representations that the underwriter customarily makes to financial institutions in such offerings.

- Letter of Representation for DTC. This short letter contains certain representations that must be made to DTC by the credit union.

- Disclosure Statement. The Disclosure Statement is used primarily for informational purposes only. It contains relevant information about the share certificates similar to an investment prospectus. All purchasers of portions of the DTC Eligible Share Certificate receive this document.

With respect to each specific issuance of DTC-Eligible Share Certificates, issuers also complete (1) a Terms Agreement describing the specific terms of the offerings and (2) a Master Certificate, representing the definitive documentation for the Share Certificates issued through DTC.

Several broker/dealers underwrite DTC-Eligible Share Certificates for credit union clients.

Direct Issuance:

In the true cooperative spirit, this is a credit union-to-credit union model operated by a single company, Primary Financial (“Primary”). Primary, in turn, is owned by 16 corporate credit unions and manages a combined sales force of more than 100. According to its website, Primary has managed SimpliCD (pronounced “simplicity”) as a turnkey certificate of deposit program since in 1996.[5] The company bills its program as “[a] competitive alternative to other funding methods such as Federal Home Loan Bank advances, financial institution borrowing, brokers and subscription rate services.”

The direct issuance of share certificates allows a credit union to leverage an extensive nationwide network of other credit union customers to generate funding. The SimpliCD program, in particular, fashions itself a primary source for liquidity for credit unions by attracting deposits from other credit unions with excess liquidity looking to invest through the program.

Here’s how the program works: A credit union seeking deposits (typically in sizes ranging from $100,000 to $50 million) agrees with Primary’s trading desk on a rate to attract the desired level of deposits. The offering is then published to a nationwide network of credit unions, many of whom are looking to place funds on a daily basis through the program. Primary Financial ordinarily acts as custodian on behalf of the credit union, setting up a single large certificate, allowing the credit union to avoid handling multiple smaller share certificates. Issuers typically complete (1) a signature card, (2) an account opening document and (3) the first monthly interest payment. After that, Primary runs the balance of the transaction.

Perhaps the two biggest limiting factors for this type of program going forward are: (1) its limitation on liquidity solely from the credit union space and (2) the available size of issuance. The settlement process looks and feels very much like the DTC program (see above) and the duration almost mirrors DTC.

Money Market Programs:

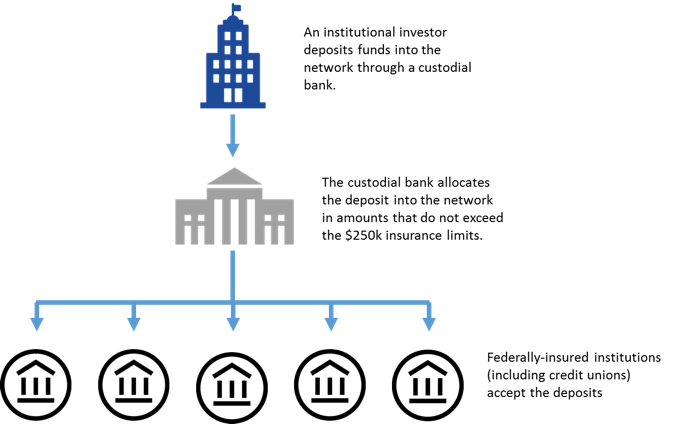

These programs function as conduits for corporate cash that has historically used FDIC insurance as a means to insure overnight. They allow participating financial institutions (including credit unions) easy access to large corporate and public fund deposits seeking federal insurance.

As the diagram below highlights, under these programs, large deposits made by corporate and public fund entities are allocated by a network custodian bank in fully insured increments (below the $250k maximum) to federally insured NCUA insured institutions in the network. Funds requested by the credit union are deposited in a lump sum amount into a money market account in the name of the custodian bank as custodian for persons and entities. Typically, these programs allow funds to be returned at any time, without a fee assessed.

We expect that these programs will grow to be a reliable liquidity source in the coming years, NCUSIF insured product is increasingly viewed on par with FDIC insured product. To date, many corporations and state funds do not yet have approval of NCUA insured products. These programs are all very short in duration. And, pricing will typically beat the FHLB and corporates. Today, firms like StoneCastle, Reich & Tang and Promontory have mature bank-side programs which they continue to tailor to the less mature credit union space.

FHLB Advances:

The Federal Home Loan Bank (FHLB) system, made up of 11 regional cooperative banks governed by Congress, offers secured loans, called advances, to local lenders to help finance housing, jobs and economic growth. The FHLB offers its members – which include a growing number of credit unions nationally – liquidity for the financial institution’s short-term needs and to provide funds for mortgage lending activities. These borrowings are collateralized, based upon an investment portfolio or loan collateral. Pricing and collateral haircuts depend upon the assets pledged and how much value you they have if they are lent out by the FHLB via repurchase agreement.

Each FHLB bank makes its advances based on the security of mortgage loans and other types of eligible collateral pledged by the borrowing credit union. Advances represent the FHLB banks’ largest asset category on a combined basis, representing 66.1% of combined total assets at December 31, 2018. Advances are secured by mortgage loans held in the portfolios of the credit union borrowers and other eligible collateral pledged by the borrowers. Because members may originate loans that are not sold in the secondary mortgage market, FHLB advances can serve as a funding source for a variety of mortgages, including those focused on very low-, low-, and moderate-income households. In addition, FHLB advances can provide interim funding for those members that choose to sell their mortgages.

Each of the 11 FHLB banks develops its advance program to meet the particular needs of its borrowers, consistent with its safe and sound operation. Each FHLB bank offers a wide range of fixed- and variable-rate advance products with different maturities, interest rates, payment characteristics, and optionality, with maturities ranging from one day to 30 years.

Membership in an FHLB bank is voluntary and is generally limited to federally-insured depository institutions, insurance companies engaged in housing finance, and community development financial institutions (CDFIs). Members include commercial banks, savings institutions, insurance companies, credit unions, and CDFIs.

While advances are made to members of all sizes, they can be particularly useful as a source of funding to smaller lenders that may not have access to all of the funding options available to large financial institutions. In this regard, FHLB banks give members access to wholesale funding at competitive prices.

Individual collateral arrangements will vary depending on: (1) borrower credit quality, financial condition, and performance; (2) borrowing capacity; (3) collateral availability; and overall credit exposure to the borrower. Each FHLB bank establishes each borrower’s borrowing capacity by determining the amount it will lend against each collateral type. Each FHLB bank can require additional or substitute collateral during the life of an advance to protect its security interest.

Each FHLB bank generally establishes an overall credit limit for each borrower, capping the amount of credit available to that borrower. This limit has a dual goal: (1) reducing credit exposure to an individual borrower, and (2) encouraging borrowers to diversify funding sources.

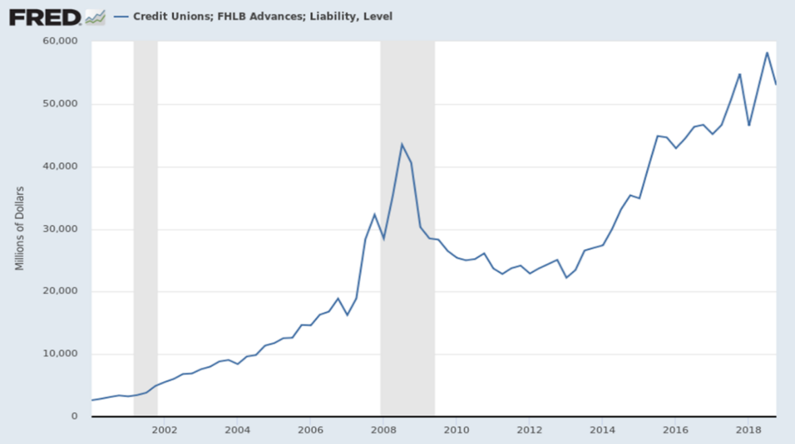

As the chart below illustrates, the FHLB system has seen membership rates among credit unions climb steadily over the past few years. Credit union participation, however, is not as high as many think. As of December 31, 2018, only 27% of eligible credit unions had taken advantage of an FHLB membership. One reason for the gap could be that some credit unions are not yet fully aware of the benefits these cooperative banks can provide.

As of December 31, 2018, credit unions represented 1,489 (21%) of the 6,863 FHLB members. And, credit union participation has been on the rise since the NCUA required credit unions to ramp up access to liquidity for emergency situations. For example, five years ago, credit unions accounted for only 16% of the FHLB’s member institutions.

In terms of active credit union borrowers, as of December 31, 2018, 649 credit unions accounted for $46 billion in advances from the FHLB system. This marks an increase from the 580 credit union borrowers with $54.8 billion of advances as of yearend 2017.

Lines of Credit (Corporates, other CUs, BDs, FHLB)

Credit driven decisions typically dictate the size of a line of credit and its spread over Fed Funds. Many of these providers offer lines of credit as loss leaders to drive other lines of business.

As an alternative to pledged securities, Letters of Credit (LOC) can provide an efficient and acceptable form of collateralization for public unit deposits. Typically, LOCs are highly customizable; furthering their appeal to financial institutions and political subdivisions. The LOC amount can be issued as a fixed or a fluctuating balance and terms can be written to a specific maturity date or incorporate evergreen language. As a form of collateralization, LOCs provide more flexibility and convenience than pledged securities. Perhaps the greatest advantage is the lack of need to monitor market values as the LOC is a direct obligation of the lender, and therefore is not subject to market fluctuations.

By reducing the need to encumber securities, credit unions can free up liquid assets to improve their liquidity ratios and mitigate the need to monitor market value fluctuations. Finally, LOCs are a great option to provide diversification from FHLB advances in a funding mix.

Conclusion

A combination of the programs described above, coupled with a healthy plan to attract member shares and a mix of liquid, marketable securities, should serve a credit union well. At the same time, such a strategy allows for a healthy diversification of funding sources. Today, sound liquidity management requires that a credit union avoid funding source concentration, especially in the current environment of elevated liquidity pressure across the industry. The alternative liquidity sources described above are more susceptible to cost and market volatility. As such, any concentration should be measured and appropriately diversified. At the same time, the ability to access available sources of funding should be exercised, monitored and tested. Maintaining a market presence in respect of the sources described above enhances a credit union’s ability to quickly adapt to different liquidity scenarios and execute contingent funding plans when necessary.

In 2010, the NCUA joined federal bank regulators in issuing a call for diversified funding strategies in an “Interagency Policy Statement of Funding and Liquidity Risk Management.” Again, we suggest that this document should be given renewed consideration in the current environment. Olden Lane urges all credit unions to consult this guidance and heed its tenets:

“An institution should establish a funding strategy that provides effective diversification in the sources and tenor of funding. It should maintain an ongoing presence in its chosen funding markets and strong relationships with funds providers to promote effective diversification of funding sources. An institution should regularly gauge its capacity to raise funds quickly from each source. It should identify the main factors that affect its ability to raise funds and monitor those factors closely to ensure that estimates of fund raising capacity remain valid.”

[1] See Perry Jones, Yes, Your Credit Union CAN Use Public Fund Deposits To Fund Assets, Credit Unions.com (May 14, 2018), available at https://www.creditunions.com/articles/yes-your-credit-union-can-use-public-fund-deposits-to-fund-assets/#ixzz5hQRRtvzi

[2] See Proposed Rule: Public Unit and Nonmember Shares. 84 Fed. Reg. 25018, 25018-25022 (May 30, 2019).

[3] See Deposit Source, https://www.cdrateline.com/public/solutions.aspx.

[4] See CD Marketplace, https://www.qwickrate.com/qrweb/XSP/credit-unions/cd-marketplace.xsp?activemenu=Credit%20Unions&activemenuitem=CD%20Marketplace.

[5] See Issuing Through Primary Financial Really is that Simple, available at https://www.epfc.com/issuing-through-us/credit-union-issuance/issuing-share-certificates.