Are we there yet? A closer look into challenging conditions for credit unions

The credit union industry has faced many challenges in recent years, including a persistent period of high inflation, rising interest rates, compressed income margins, and stagnant demand in the economy. This economic phenomenon has been difficult for many credit unions to navigate. The economy has prompted many questions over the last several years from, “Are we headed into, or in a recession?” “Are we out of pandemic norms or into the new?”. Despite our inquisitive nature, it’s important to remain proactive and take steps forward and reimagine a future with a strategic and growth-focused perspective to identify and seize new opportunities. By emphasizing growth, credit unions can increase revenue, build member loyalty, and drive long-term success.

The top-of-mind focus areas for the credit union industry in 2023 include loan-to-share ratios as liquidity proves to be a challenge, increased loan delinquency, charge-offs, and repossession risk along with a rising interest rate environment, including relative investment duration/commitments.

Under the scope

Federal Reserve Chair Jerome Powell said that if the U.S. job market continues to improve in the coming months or inflation accelerates, the Fed may look to raise interest rates higher than currently projected. Powell made these comments following the release of a government report that showed employers added 517,000 jobs in January and the unemployment rate fell to 3.4%.

While Powell expects a sizeable decline in inflation this year, he cautioned that the central bank is seeing only early development of disinflation and that rates may need to raise further if the labor market and inflation continue to improve.

Credit unions face liquidity challenges when they have insufficient cash reserves to meet their obligations or when their loan-to-share ratios are too high. Increased loan delinquency, charge-off, and repossession risk can also affect credit unions’ financial stability and that of their members. In a rising interest rate environment, credit unions may face challenges in managing their investment duration and commitments, which could affect their net income and liquidity.

Q3 2022 reporting showed several areas indicating key trajectories worthy of notation.

Loan-to-share ratios

Share balances were up 6.3%, pushing the loan-to-share ratio up to 78.3%. Although not an all-time high, there are underlying factors. Cash has fallen 6%, from 13.0% to 7.1% of total assets. With rising interest rates, we see lower mortgage loan originations and a tanking secondary market which means more are being retained on the balance sheet. Credit unions have been keeping up with loan demand, but sudden-onset liquidity concerns may arise if lending activity continues to rise. Credit unions may need to implement new strategies to generate liquidity.

Delinquencies

As we see in Callahan’s Q3 report:

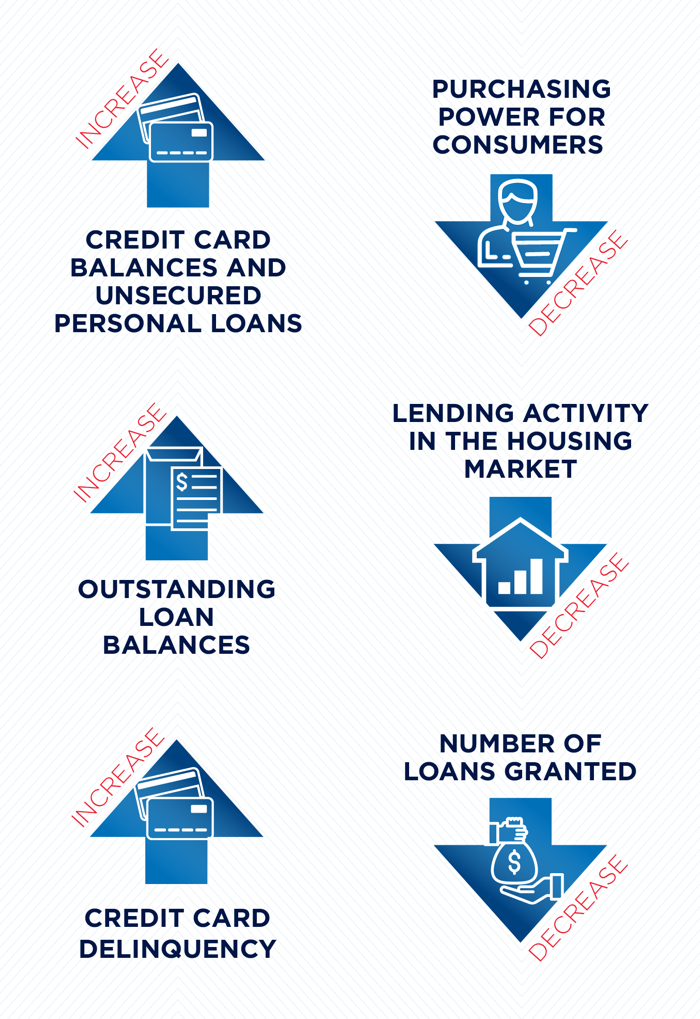

- Inflation outpaced wage growth, leading to a decline in purchasing power for consumers.

- Credit card balances and unsecured personal loans increased due to members seeking cash to alleviate financial tension.

- However, lending activity in the housing market declined due to high prices, interest rates, and low inventories.

- Outstanding loan balances in the industry increased significantly, while the number of loans granted decreased.

- Delinquency ratios varied across loan types, with credit card delinquency increasing.

Here are actionable tips for credit unions to consider as they reimagine the path forward:

Focus on member needs: As the economy changes, so do the needs of credit union members. To best serve these members, credit unions must continuously assess the financial landscape and members’ needs. This should involve making data more meaningful to better understand financial goals, offering new products or services that meet their changing needs, or supplying added resources such as financial counseling or education. The best leveraged member data can answer three primary questions for your credit union:

- How can we improve member servicing?

- How can we apply our understanding of members’ needs?

- How can we anticipate and get ahead of members’ demands?

By doing so, credit unions can better support their members and help them achieve financial stability while improving retention rates.

Invest in talent: Credit unions should prioritize excellent member service by investing in training, staffing, and technology to ensure members have a positive experience. According to Callahan, the credit union industry has increased hiring by 5.1% over the past year, with a focus on employees’ skills in areas such as business intelligence, DEI, member experience, branding, and community engagement. Being an employer of choice is important in a tight labor market, and executives are continually evaluating whether they have the right people for the present and the future.

Grow membership: Credit unions have traditionally attracted members with competitive rates and personalized service. However, the shift towards online channels for interactions has weakened this advantage, and credit unions have been experiencing a decline in overall satisfaction for five consecutive years, as reported by the American Consumer Satisfaction Index. To differentiate yourselves from the competition, look for other ways to stand out, such as focusing on consumer financial wellness through digital delivery. This approach reflects the cooperative model, and many credit unions are well positioned to make this their long-term goal for member acquisition.

Partner advantageously with a purposefully diversified financial services company that can incorporate business and data intelligence to translate your unique business needs into actionable strategies with customized solutions.

Diversify your portfolios and yields by purchasing participations. Understand that diversification should be done sustainably. While adapting to a challenging market for vehicle purchases caused by high prices and supply constraints may seem reactive or short sighted, it may present opportunity for long-term business model evolution. Nonetheless, credit unions must be diligent in monitoring the competitive landscape, keeping an eye on trends, rates, and products, and remain agile to stay competitive in the market.

Manage loan-to-share ratio: Credit unions should not only keep an eye on the loan-to-share ratio, but actively manage it. If the primary sources of liquidity are core deposits (checking and savings accounts) and investments that can be sold quickly without incurring significant losses and those decline, know your options. Modify, increase yields on deposits to make this an attractive option for members. Use alternative sources of liquidity which can be found in borrowing arrangements, such as repurchase agreements and committed lines of credit.

As credit union leaders, you have learned to expect the unexpected in recent years, and despite liquidity swings, credit unions are well-positioned to support members. The credit union industry has a strong capital base and asset quality, solid earnings, and lending capacity. It emphasizes that credit unions perform best in challenging times and should continue to focus on overall growth and member needs to drive long-term success.

Sign up for Allied Solutions’ eNewsletters to grow, protect and evolve your business.