Are your members happy?

People often fake it.

We fake our physical ailments, we fake our emotional stability, and we fake our level of happiness. We nod along when asked. We put a smile on our face even if it doesn’t reflect what we’re feeling inside.

We try to will ourselves into a better state of mind. It’s human nature – we constantly seek hits of dopamine to make us feel good and often believe more attainment, pleasure, or money will lead us to be happy. Does it work?

We cannot simply assume people are happy or [financially] healthy because they say so. First off, are we even asking the right questions to get an accurate answer? And even when we are, the findings may surprise us. Our recent Financial Health Pulse 2023 U.S. Trends Report finds 70% of the population is struggling financially and despite being the wealthiest country (with the biggest wealth gap), the United States ranks fifteenth in World Happiness.

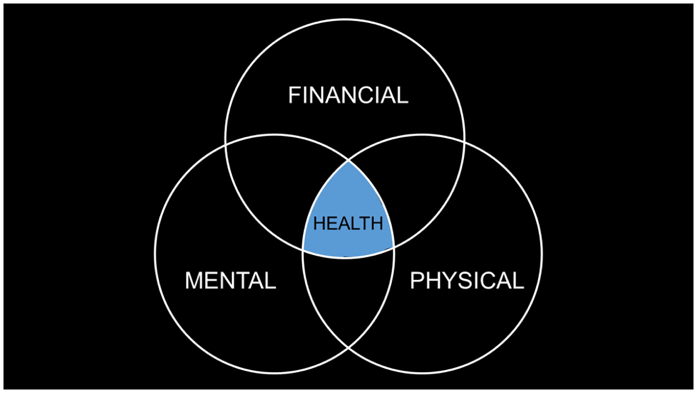

It’s all connected

One year ago, I shared a personal story at EMERGE that highlighted the connective tissue between mental, physical, and financial health. These categories are fused together in our lives. Our overall health and these aspects of life that we all deal with contributes to life, liberty, and the pursuit of…happiness.

Shocks in any of these three categories have a meaningful impact on the other two. And worse, we – people – often deal with shocks alone. But we’re all highly capable of supporting one another here. The collective experiences we each hold can unify us, can create more value, and can help our fellow humans achieve…happiness.

hap·pi·ness ˈha-pē-nəs

: a state of well-being and contentment.

The degree to which people can increase their happiness varies, but we can all use improvement. The key is to improve your quality of experiences and the benefits of doing so are crystal clear.

June Silny outlines how happiness drives overall health, citing the benefits of happiness, including:

- Increased levels of exercise;

- Reduced sickness; and

- Commiting greater levels of volunteerism and charitable giving.

Happiness leads to more successful relationships and good relationships lead to health and happiness. Your credit union is a vital part of this equation.

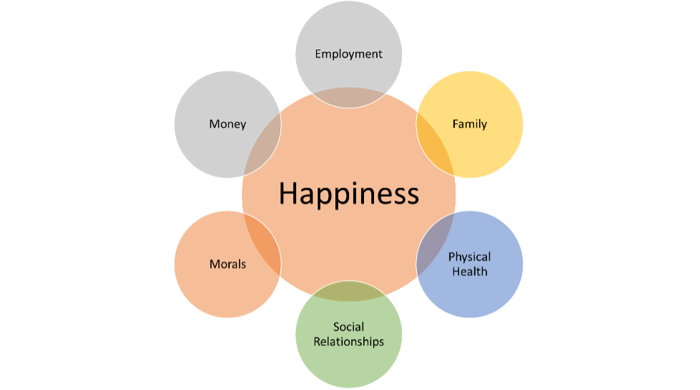

What do people need to be happy?

When members have a good relationship with their credit union, because it supports their financial health – and therefore, their overall health, they have greater levels of satisfaction, loyalty, and are far more likely to purchase additional products. Financial health is a key component of happiness and similar to other studies, our data shows that income matters, to a point.

Whenever I speak with others on this topic, I’m often asked, ‘How much money do people need to be happy?’ It’s a fair question. As financial health practitioners, we know that it’s disproportionately painful to live on modest means. Money – or lack thereof – is the number one driver of stress and is often the reason for misfortunes in one’s life, such as divorce, ill health, addiction, and loneliness.

In 2010 Gallup found that happiness plateaus with an annual income of $75,000. (In 2010 the median household income was $52,000 compared to today’s median of $70,000). In 2021, this basic finding was refuted from Penn’s Wharton School which suggests that all forms of well-being continued with rising incomes.

But the point of agreement between these two bodies of research is that people who equate money with happiness are generally less happy people. In other words, income is a modest determinant of happiness.

Balance in life is key to happiness.

We are all capable of being happy, but imagine if your credit union was in the business of happiness. Credit unions have often found themselves at the forefront of financial health but we’re limiting our value by staying surface level. Go deeper. Your members want a trusted relationship with your credit union and have a desire to share their lived experiences.

Are you in the business of happiness?

As credit unions, you can do so much more to help employees, members, and communities be happy. However, I think we isolate ourselves in a single component of the happiness equation and that fails our purpose as mission-driven organizations.

Happiness is more than just money. As a staple of the communities you serve, credit unions can and should expand offerings to guide members towards a happy and healthy life. Credit unions are uniquely positioned to be more than a financial services provider.

Start by putting financial health in focus

Money alone may not buy happiness, but supporting your member’s financial health helps people get there. Financial Health Network continues to support this movement by working alongside leading credit unions to assess their members’ financial health. The Quick Start Guide published by Filene and the Foundation emphasizes the importance of this step in the process.

Measuring financial health is a vital step to putting Financial Well-Being For All into practice. In partnership with the National Credit Union Foundation, credit unions work with Attune to assess members’ financial health needs and develop strategies to address specific pain points. However, this step to measure is often overlooked by credit union leaders because we assume. Don’t assume people are financially healthy or happy because they say so.

Improving member financial health starts with measurement. Their happiness requires more. Do more.