Branch transformation and safety…A great marriage!

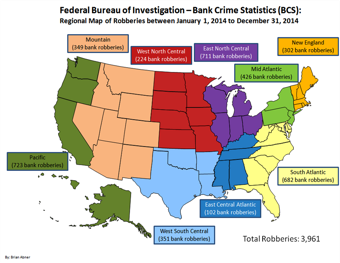

As we think about branch transformation, one of the overlooked benefits in the rush to design-build a customer or member-centric environment is safety. The 2014 Bank Crime Statistics compiled by the FBI recorded 3,879 robberies of financial institutions in the U.S. The breakdown shows 3,430 commercial banks and 312 credit unions robberies are included in the report. The overwhelming majority of the robberies occurred at a branch office. The most common approach used in the robberies was a note or oral command. Nearly 47% of reported robberies involved a firearm or handgun. Needless to say, robberies remain a significant threat for branch operations.

So how can Branch Transformation…the marriage between Design and Technology change the branch environment to hinder potential robberies? Glad you asked! FBI data shows that premeditated robbers research their target by scoping out the institution or branch paying particular attention to where the teller line is and how money exchanges are preformed. For instance, a common robbery scenario involves a note passed to a teller. Per their training, the teller hands over the money and the assailant casually slides out of the bank trying to maintain anonymity.

One key aspect of Branch Transformation involves creating a retail environment that encourages personal interaction between the staff and their customer/member. By engaging the customer as they walk into the branch, conversations take on a completely new meaning. Therefore, many Branch Transformation projects work hand-in-hand with the FBI’s new technique for avoiding robberies called “SafeCatch” tactics. The heart of the tactic is engaging the customer as they walk thru the door thereby taking away the anonymity from a potential robber disarming them with great customer service.

The physical components of Branch Transformation often replace the traditional teller line with a Pod System (in some circles named Dialog Delivery), which encourages staff interaction with customer using a face-to-face posture. An integral part of the system is the cash automation i.e. cash recyclers.

In a robbery scenario, the assailant now sees cash being dispensed, not from a teller drawer, but from a machine, which requires a combination of human and system intervention to dispense currency. Since the cash recyclers are UL Rated as a secure currency container or safe, the staff operating the device needs a pass code in order to interface with the system to dispense cash. This provides the branch staff more flexibility to walk away from the Pod unit to engage the customer/member verses using a teller line and more security.

Robberies and crime are probably here to stay; however, alternative ways of delivering services and technology can greatly reduce a financial institution’s branch from being a target. In yester-year, the teller line’s main purpose was to facilitate a transaction, but with the rapid decline in transaction activity in branches…the teller line is going the way of the dinosaur in favor of alternative approaches to facilitate new interactions with customers.

The latest advancement in branch transformation utilizing interactive teller machines, may finally eliminate the physical opportunity for robberies. However, only time will tell, and history teaches us that robbers have always evolved when desire intersects with ability.

Nevertheless, the goal of all financial institutions is to insure a safe and enjoyable work environment for employees, and the goals for many is an engaging environment for their customers. The good news is with the advancements in technology and design both of these goals can now be a reality.