Building a digital toolkit with Microsoft to improve SME lending in Kenya

Representatives from 16 Kenyan SACCOs participated in the two-day workshop.

Representatives from 16 Kenyan SACCOs participated in the two-day workshop.

In January, World Council of Credit Unions’ (WOCCU) co-hosted a workshop in Kenya with Microsoft’s African Development Center and the Kenya Union of Saving and Credit Cooperatives (KUSCCO). This presented a momentous opportunity for professionals from 16 savings and credit cooperatives societies (SACCOs) to learn how to digitize and expand their small and medium enterprises (SME) lending processes.

The two-day workshop in Mombasa marked the first event WOCCU has conducted with Microsoft’s African Development Center, through its 4Afrika initiative, since the two parties signed a 2021 memorandum of understanding (MoU) to help accelerate SACCO’s digital transformation.

WOCCU’s Technology and Innovation for Financial Inclusion (TIFI) Project, funded by the USAID Cooperative Development Program (CDP), is increasing credit union lending to SMEs through digital solutions and the implementation of the WOCCU TIFI SME Lending Toolkit.

How digitization can improve SME lending

Participants from Microsoft demonstrated how digital transformation in SACCOs can build trust among members and improve loan repayments. For example, digitization can enable a SACCO to get more information about a member or client that will better enable informed decision making. The digitization of loan underwriting tools will also enable better credit scoring and timely decision making, thus enabling a SACCO to manage risks and improve their bottom line.

SACCO attendees articulated some challenges they face in digital transformation, including:

- Technology vendors often lack capacity, so are reluctant to provide system support to SACCOs.

- Technology solutions & licenses can be cost prohibitive for some SACCOs.

- Many SACCOs lack the cybersecurity necessary to safeguard the software.

- Some face limited integration capabilities with third party solutions through Application Programming Interfaces (APIs).

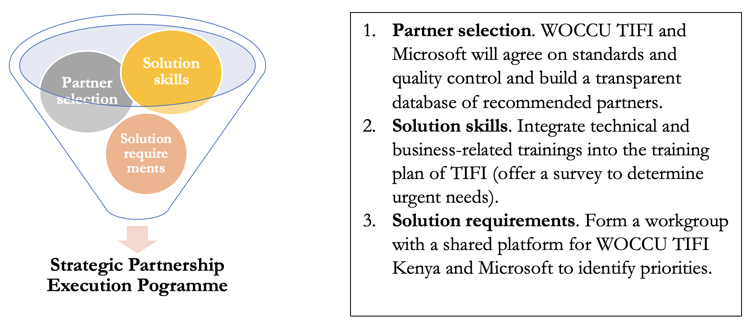

Due to those concerns, WOCCU, KUSCCO and Microsoft are designing a strategic partnership program to address these challenges:

TIFI lending methodology

The workshop also allowed attendees to take a deep dive into the TIFI lending methodology. A TIFI pilot program is currently testing a loan underwriting tool with four SACCOs. The tool is part of a SME lending toolkit designed by TIFI that is meant to:

- Reduce lending risk by credit unions to SMEs, which often do not have formal or documented credit histories and may not be able to provide the same types of documentation and collateral that are required for more traditional loans.

- Streamline and simplify the SME lending process, thereby reducing costs.

- Increase the number and quality of financial products available to SMEs, thereby increasing SME financial inclusion.

While attendees showed a general acceptance and excitement for SACCOs to invest their funds in SME lending, many noted the SME lending methodology marks a shift from their normal way of doing things, which means it must be reinforced through continual training and monitoring. They also voiced the opinion that the continuous refinement of the loan underwriting tool, including its eventual digitization, would be critical to its success.

TIFI is in the process of designing a comprehensive digital strategy, digital business plans and financial models for innovative digital financial solutions. This will comprise a market research and feasibility study on the available digital platforms and marketplace models related to SACCO-SME lending.

That work, along with continuous feedback from SACCOs, through additional workshops with Microsoft, will help WOCCU TIFI develop a demand-driven digital tool SACCOs can use to expand their SME lending portfolios moving forward.

WOCCU TIFI conducts its work with SACCOs in Kenya through a partnership with the Kenya Union of Saving and Credit Cooperatives (KUSCCO). TIFI also works with partner institutions in Burkina Faso, Guatemala and Senegal to expand SME lending. These partner institutions represent and provide technical support to multi-million-member networks of credit unions. You can learn more about the WOCCU TIFI Project here.