The business case for adopting digital automation for small business and consumer loans

The small business and consumer unsecured loan market is enormous—$1.3 trillion by some estimates. However, for community and regional financial institutions under $10 billion in assets, this market is quickly becoming a missed opportunity. Institutions this size have a mere nine percent penetration into the market for small business loans under $100K and only an 11 percent share of the personal loan/credit card market. At credit unions, in particular, loan approval rates are at the lowest mark to-date, dropping to 40.7% in March 2017, according to a recent Biz2Credit Small Business Lending Index™.

These paltry numbers are disappointing, especially when you consider institutions of this size used to stake claim to these loans before ceding them to non-bank, online lenders.

The primary reason for the abdication of this market is the fact that loans of this size are simply too expensive for community institutions to deliver for the return they offer. They are cost centers rather than sources of revenue. However, by replacing manual loan processes with digital technology—which automates the entire lending process and significantly reduces the cost to originate, underwrite and manage these loans—community and regional credit unions can reclaim a significant portion of this ripe loan market.

With digital technology, a true business case for serving members in this space emerges.

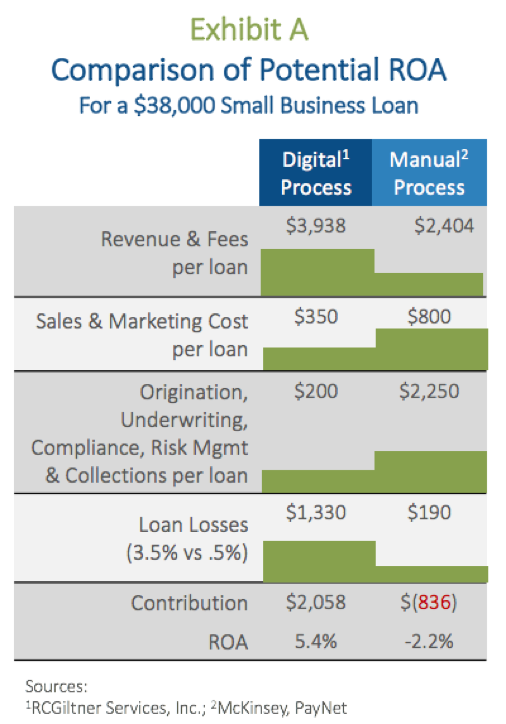

Exhibit A compares potential return on assets for a $38,000 small business loan for both digital and manual processes. Even though the institution may generate $2,000 or more in revenue per loan using a manual process, the cost to sell and market the loan through traditional channels ($800), coupled with the cost of underwriting ($2,250), quickly diminishes any real income. The average cost to process a loan (regardless of size) using traditional, manual processes is approximately $2,500 per loan. Using digital technology, this cost is reduced to an impressive $200 or less.

Loan losses using a manual process are pristine ($190), but even this cannot help make the loan profitable. When comparing the bottom line ROA for each loan process, revenue and fees earned per loan are much higher using the digital alternative.

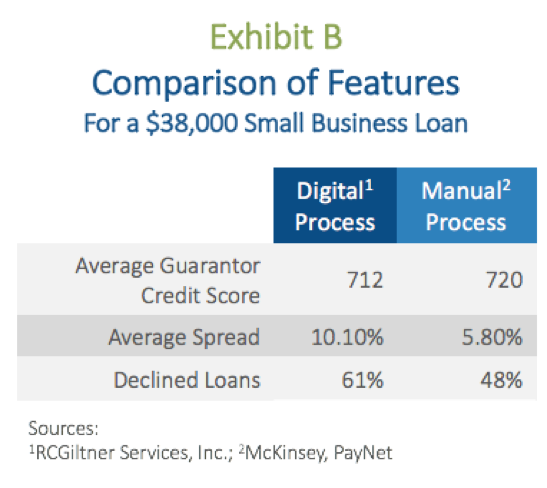

Exhibit B compares typical features of the same $38,000 small business loan. Using digital technology does not change much from an underwriting standpoint: average guarantor credit score is around 700 for both. However, what is gained using digital technology is the ability to charge members for a convenience.

Average spreads of 10 to 15 percent are attractive to consumers, who have statistically demonstrated a willingness to pay this price for the convenience of securing a loan in three minutes or less from the comforts of home or while mobile. Conversely, using a manual underwriting process demands a lower rate, but it also requires a much more cumbersome process.

Exhibit B also illustrates that using digital technology produces an increase in declined loans; however, these percentages are to be expected considering the additional volume of new loans entering the system, many of which are approved quickly and efficiently with little, if any, loan officer involvement. The key is to capitalize on convenience of managing the declinations using digital technology.

Digital automation allows credit unions to charge for a convenience; trims marketing costs by accessing digital channels; and very importantly, reduces the cost to originate and underwrite the loans so dramatically that, even with higher loan losses, these loans are profitable once again.

Digital lending as an industry is on the verge of exploding. By adopting digital technology, credit unions can derive significant efficiencies in the way they deliver loans, drive revenue and, most importantly, provide the experience members want—which makes for a compelling business case indeed.