Coarse to fine-grain: CECL for loan participations

As the first quarter 2023 deadline for CECL compliance approaches, credit unions must make a number of choices in how to model their portfolios. CECL is a flexible standard that permits many different methods for determining an institution’s Allowance for Credit Losses (ACL). Nonetheless, it is important to choose a method that recognizes the variety in loan products and originators within your participation portfolio and reflects that variety in its expected credit loss estimates. Loan participations increase the diversity within your portfolio, and the resolution of your CECL analysis must be accordingly sharpened.

In this article, we discuss three methods that estimate ACL at differing levels of granularity. We explain why granularity is generally preferable in the context of estimating credit losses for participations, and we additionally inspect several participation portfolios and the ACL estimates produced by the three methods for those portfolios. As we will see, the level of granularity employed can greatly affect the estimated credit losses for a participation portfolio; and, in general, less granular CECL analyses can create the risk of over- or under-reserving for future credit losses.

A Three-Step Progression in Granularity

We will now look at three ACL calculation methods, all of which utilize the Weighted Average Remaining Maturity (WARM) methodology. Ignoring qualitative adjustments, the methods here all produce segment-level ACL figures by multiplying the following three quantities together:

- The outstanding balance of loans belonging to a particular loan segment and originator

- An estimated annual loss rate

- A WARM estimate for the loan segment, measured in years

These segment-level ACL figures are then aggregated into a single portfolio-level figure.

Although all three methods share this basic approach, they differ from one another in the level of granularity they use in calculating estimated loss rates. In order of increasing granularity, we have:

- Portfolio Level – calculates a single estimated loss rate for all loans in the participation portfolio by using the owning institution’s credit losses in that portfolio over the past three years

- Segment Level – calculates an estimated loss rate for each loan segment in the participation portfolio, using the owning institution’s credit losses in its own portfolio over the past three years

- Segment/Originator Level – calculates an estimated loss rate for each loan segment and for each originator in the participation portfolio, using each originator’s reported credit losses in that loan segment over the past three years

As we review these three methods for CECL, in general, credit unions must individually assess the complexity of their loan portfolios when determining which CECL methods would be appropriate.[1]

The Value of Granularity in Credit Loss Estimates

Why is granularity important in these calculations? Why is it preferable to calculate loss rates using data specific to a particular loan product and originator? In the context of these three methods, increased granularity is preferable for two primary reasons.

The first reason is straightforward. Different kinds of loan products exhibit different credit loss outcomes, as do loans originated by different credit unions. Thus, by using data specific to particular loan segments or originators, we achieve more accurate loss estimates.

The second reason relates to the availability of data. Participation owners will often not have three full years of experience with their current participation portfolio, because the composition of their portfolio over the last three years has changed through new purchases made during that period. Their participation portfolio’s last three years of loss history can thus not be justifiably extrapolated into the future.

On a similar note, participation owners often purchase loan types that they themselves originate only rarely, if at all. The participation owner consequently lacks enough of their own experience with a particular loan segment to reliably use that experience as a basis for estimating the future losses of that loan type.

The solution is to calculate future ACL reserves using the credit loss experience of the originators of the participated loans, broken down by loan segment. This approach ensures that expected loss rates are calculated separately for loans with different risk attributes. The data issues discussed above also vanish, since originators almost always sell participations only after many years of originating a particular loan product and developing a robust credit loss history for it.

The Three Methods Applied to Four Participation Portfolios

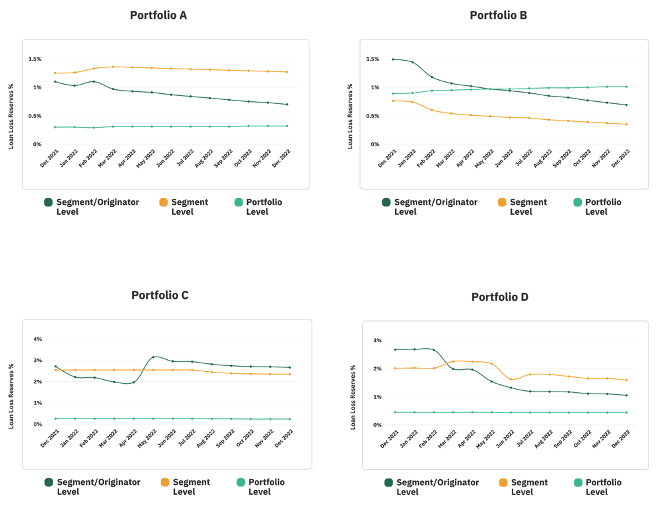

To illustrate how ACL reserves over time – as measured as a percentage of the overall participation portfolio – can be affected by the method employed, let us apply the three different methods to four participation portfolios:

Figure 1: Estimated Expected Credit Losses

As a Percentage of Overall Participation Portfolio

Observe the variety of patterns here. In Portfolios A and B, the less granular Segment-Level analysis generally leads to higher ACL reserves than the more granular Segment/Originator method, while this pattern is reversed in Portfolios C and D. In general, the reserves associated with Segment/Originator-Level loss rates vary more from month to month, reflecting that method’s greater sensitivity to changes in the make-up of a portfolio.

By contrast, the least granular approach—Portfolio-Level analysis—appears indifferent to those changes. A long time can pass before changes in an institution’s participation portfolio are reflected in that institution’s loss history. This lag results in a near constant loss rate over time, and an ACL reserve amount that is basically invariant over time. Moreover, this approach appears to be biased downwards, recommending significantly smaller ACL reserves than the other methods in three out of the four cases.

Discussion

The comparison above makes vivid the advantages of a more granular CECL analysis. The most granular approach–the Segment/Originator-Level approach – is sensitive to month-to-month changes in the portfolio’s composition and produces ACL figures that faithfully reflect the portfolio’s changing risk profile. This approach accordingly decreases the risk of either over- or under-reserving; it also provides timely updates about the operational adjustments required to manage a dynamic participation program.

By contrast, the two less granular approaches produce lagged estimates of credit losses, which fail to reflect recent changes in the participation portfolio and – in the extreme case of the Portfolio-Level analysis – are nearly constant over time.

In sum, the variety and dynamism of an active participation portfolio make the granularity of your CECL calculations crucial. Insufficiently-granular calculations create the risk of over- or under-reserving capital; they also create the potential for unexpected changes in your ACL reserves, if and when lagged or infrequently updated loss estimates finally catch up with the current state of your portfolio. As a best practice, credit unions should utilize CECL methods that account for the variety among their participation partners and among the assets within their participation portfolio. Moreover, this more granular approach is easily available and can be automated — credit unions can run this process internally or use one of the many technology solutions available in the market.

[1] The NCUA has indicated that the Segment Level method will likely suffice for credit unions with relatively simple portfolios – for example, portfolios with unsecured consumer, auto loan or fixed-rate mortgages. See https://www.ncua.gov/regulation-supervision/regulatory-compliance-resources/cecl-resources/simplified-cecl-tool/faqs (“How should participation loans be handled in the Tool?”).