Confessions of a Gen-Yer: on Banking

I have a confession to make. Though I study Economics at an Ivy League University and work for Andera, I have no idea how to manage my personal finances. That’s right–no clue. I’ve taken advanced Investments courses and can build an efficient portfolio or calculate net present value in my sleep, but I can’t wrap my head around where to keep my money or how to actually collect interest on my savings.

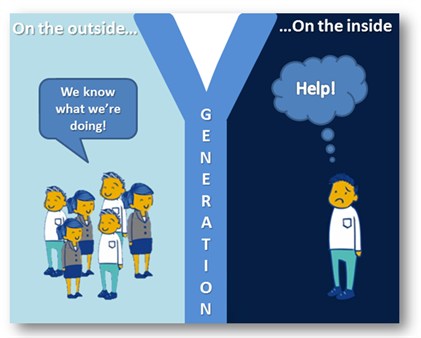

I am not admitting this for the sake of embarrassing myself to the entire internet, though. Rather, I bring this up because I don’t think that I’m alone in this feeling. In fact, I think there is a mass of Gen-Yers like myself who are sitting in the dark about finances without realizing or wanting to admit it. In social psychology there is a concept called pluralistic ignorance, a term that refers to a situation in which a majority of group members privately reject a norm/belief but incorrectly assume that most others accept it, and thus follow along. I’d posit that to some extent, pluralistic ignorance plays a part in the big question mark a lot of my peers have about finances. I didn’t know what a credit union was until I came to Andera, but until I actually sat down and asked my peers if they knew what it was, I thought I was alone in my ignorance. Turns out, they didn’t have a clue either, and had just nodded and smiled whenever I mentioned what I do at Andera.

So let me say this: I don’t know how representative I am of my college-aged peers, but I can say that I am not nearly as educated as I should be about personal finance management. While I agree with the plethora of articles about how financial institutions can reach Gen-Y with social media or get them to use their mobile banking apps, I think there’s another conversation to be had about Gen-Y. No, I don’t want to do all of my banking on my smartphone nor do I care to follow my bank on Facebook. What I want is someone to answer my questions and make personal banking less of a daunting mystery.

continue reading »